- United Kingdom

- /

- Pharma

- /

- LSE:HLN

Haleon (LSE:HLN) Eyes Bolt-On M&A and New Product Launches to Drive Growth Despite High Valuation Concerns

Reviewed by Simply Wall St

Click here and access our complete analysis report to understand the dynamics of Haleon.

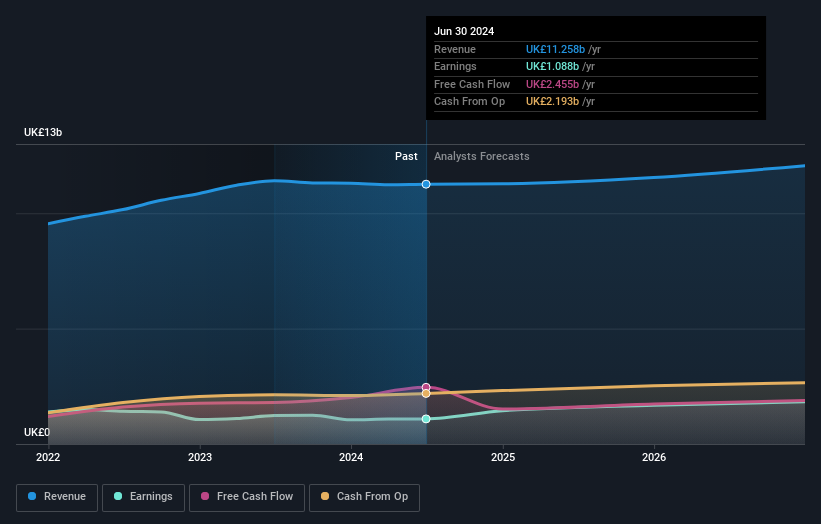

Strengths: Core Advantages Driving Sustained Success for Haleon

Haleon has demonstrated robust financial health, marked by a consistent track record of strong performance. CEO Brian McNamara emphasized the company's strategic advantages and the successful execution of its strategy, which has led to a 4.1% organic sales growth in Q2 2024, with a notable increase in price and volume/mix. Additionally, the company's nine power brands have shown impressive growth, up 5.6%, contributing to an 11% rise in organic profit for the first half of the year. The adjusted operating margin improved to 22.7%, reflecting efficient cost management. Furthermore, Haleon has maintained strong cash flow generation, with GBP 0.8 billion in free cash flow, and reduced net debt to GBP 8.4 billion, achieving a leverage ratio of 2.9x. Despite these strengths, the company’s valuation appears high, with a Price-To-Earnings Ratio of 32.8x, compared to the peer average of 26.2x and the industry average of 21x, indicating it is trading above the estimated fair value of £3.36.

Weaknesses: Critical Issues Affecting Haleon's Performance and Areas for Growth

Haleon faces several financial challenges, particularly in its over-the-counter pain relief category, which saw a 4.4% organic sales decline in the first half of 2024, as noted by CEO Brian McNamara. The company also experienced a 1.3% drop in organic revenue, with a 4.5% decline in volume/mix offsetting positive pricing. Operating profit declined by 8% organically due to reduced revenue and increased advertising and promotional spending. Additionally, Haleon's Return on Equity is forecasted to be low at 9.7% in three years, and its earnings growth of 12.5% per year is expected to lag behind the UK market average of 14.2%. These factors, combined with its high valuation, underscore the need for improved financial performance and cost management.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Haleon is well-positioned to capitalize on several growth opportunities. The company is confident about meeting its medium-term guidance, with plans to expand its new product range in Italy to additional markets later this year. CEO Brian McNamara highlighted the upcoming launch of reformulated cough and cold medicines, which are expected to drive future revenue growth. The consumer health industry’s favorable long-term fundamentals, including population growth and a rising middle class, present significant opportunities for Haleon. Furthermore, the company is actively seeking bolt-on M&A opportunities to strengthen its market position and enhance shareholder returns. These strategic initiatives could help Haleon achieve its forecasted 4-6% organic revenue growth and high single-digit organic profit growth.

Threats: Key Risks and Challenges That Could Impact Haleon's Success

Haleon faces several external threats that could impact its growth and market share. The U.S. FDA Advisory Committee's recommendation to remove oral PE from its approved list of ingredients for cough and cold medicines poses a regulatory risk. Additionally, the market is still experiencing volume declines, although Haleon has gained both value and volume share. CFO Tobias Hestler noted that the company expects a reversal in revenue decline in the second half of the year. However, the impact of divestments and foreign exchange movements, which resulted in a 25.9% operating profit margin, remains a concern. High levels of debt also pose a financial risk, potentially affecting the company's ability to invest in growth opportunities and maintain its competitive edge.

Conclusion

Haleon's demonstrated financial health and strategic execution have driven strong organic sales growth and improved operating margins, underscoring its ability to manage costs effectively and generate substantial free cash flow. However, the company faces significant challenges, including declining sales in the over-the-counter pain relief category and lower forecasted earnings growth compared to the UK market average. Despite promising opportunities in product expansion and M&A activities, external threats such as regulatory risks and high debt levels pose potential hurdles. Importantly, Haleon's high Price-To-Earnings Ratio of 32.8x, compared to peer and industry averages, suggests that the market may be pricing in these growth prospects, but it also highlights the need for the company to deliver on its strategic initiatives to justify its premium valuation and sustain future performance.

Turning Ideas Into Actions

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Haleon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:HLN

Haleon

Engages in the research, development, manufacture, and sale of various consumer healthcare products in North America, Europe, the Middle East, Africa, Latin America, and the Asia Pacific.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives