- United Kingdom

- /

- Personal Products

- /

- AIM:SIS

Science in Sport plc (LON:SIS) Stock Catapults 26% Though Its Price And Business Still Lag The Industry

Science in Sport plc (LON:SIS) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 64% in the last year.

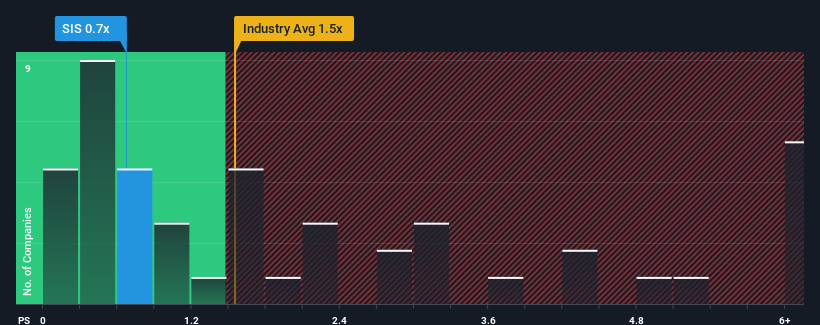

Even after such a large jump in price, Science in Sport may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Personal Products industry in the United Kingdom have P/S ratios greater than 2.2x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Science in Sport

What Does Science in Sport's P/S Mean For Shareholders?

Science in Sport's negative revenue growth of late has neither been better nor worse than most other companies. It might be that many expect the company's revenue performance to degrade further, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Science in Sport will help you uncover what's on the horizon.How Is Science in Sport's Revenue Growth Trending?

Science in Sport's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.7%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 24% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 1.3% per annum as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 3.3% each year, which is noticeably more attractive.

With this information, we can see why Science in Sport is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Science in Sport's P/S

Despite Science in Sport's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Science in Sport's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Science in Sport (at least 1 which is significant), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Science in Sport, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SIS

Science in Sport

Develops, manufactures, and markets sports nutrition products for professional athletes, sports and fitness enthusiasts, and the active lifestyle community in the United Kingdom, rest of Europe, the United States, and internationally.

Adequate balance sheet low.