- United Kingdom

- /

- Personal Products

- /

- AIM:BAR

The Market Lifts Brand Architekts Group plc (LON:BAR) Shares 81% But It Can Do More

Brand Architekts Group plc (LON:BAR) shares have had a really impressive month, gaining 81% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 77% in the last year.

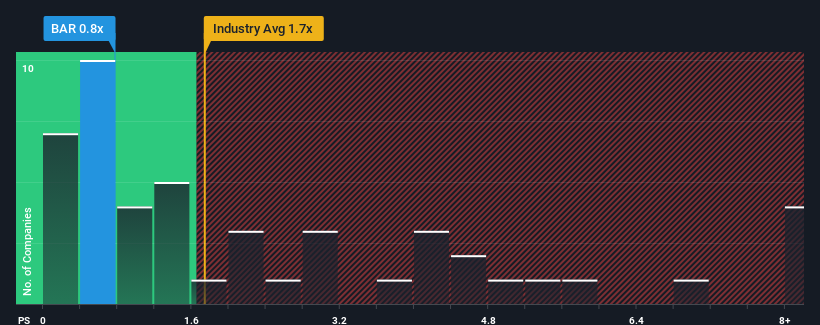

In spite of the firm bounce in price, Brand Architekts Group's price-to-sales (or "P/S") ratio of 0.8x might still make it look like a buy right now compared to the Personal Products industry in the United Kingdom, where around half of the companies have P/S ratios above 2.7x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Brand Architekts Group

How Brand Architekts Group Has Been Performing

With revenue that's retreating more than the industry's average of late, Brand Architekts Group has been very sluggish. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Brand Architekts Group.How Is Brand Architekts Group's Revenue Growth Trending?

In order to justify its P/S ratio, Brand Architekts Group would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.3% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 8.4% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 2.4%, which is noticeably less attractive.

In light of this, it's peculiar that Brand Architekts Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Brand Architekts Group's P/S?

The latest share price surge wasn't enough to lift Brand Architekts Group's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Brand Architekts Group currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Brand Architekts Group (2 are a bit concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Brand Architekts Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Brand Architekts Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:BAR

Brand Architekts Group

Operates in the beauty sector in the United Kingdom, other European Union countries, and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives