- United Kingdom

- /

- Healthcare Services

- /

- LSE:SPI

We Discuss Why Spire Healthcare Group plc's (LON:SPI) CEO Compensation May Be Closely Reviewed

Spire Healthcare Group plc (LON:SPI) has not performed well recently and CEO Justin Ash will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 13 May 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Spire Healthcare Group

Comparing Spire Healthcare Group plc's CEO Compensation With the industry

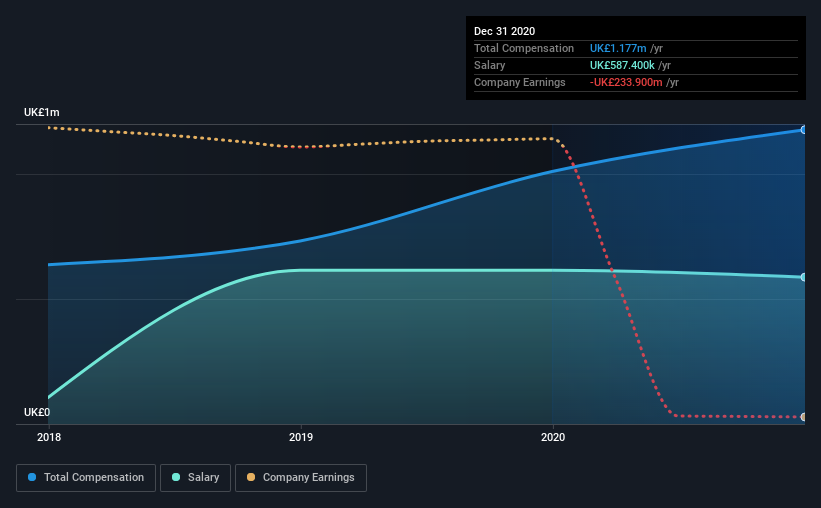

Our data indicates that Spire Healthcare Group plc has a market capitalization of UK£812m, and total annual CEO compensation was reported as UK£1.2m for the year to December 2020. Notably, that's an increase of 17% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at UK£587k.

On comparing similar companies from the same industry with market caps ranging from UK£288m to UK£1.2b, we found that the median CEO total compensation was UK£486k. Accordingly, our analysis reveals that Spire Healthcare Group plc pays Justin Ash north of the industry median. Furthermore, Justin Ash directly owns UK£799k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£587k | UK£615k | 50% |

| Other | UK£590k | UK£395k | 50% |

| Total Compensation | UK£1.2m | UK£1.0m | 100% |

On an industry level, roughly 74% of total compensation represents salary and 26% is other remuneration. Spire Healthcare Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Spire Healthcare Group plc's Growth Numbers

Spire Healthcare Group plc has reduced its earnings per share by 131% a year over the last three years. It saw its revenue drop 6.2% over the last year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Spire Healthcare Group plc Been A Good Investment?

Since shareholders would have lost about 6.3% over three years, some Spire Healthcare Group plc investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Spire Healthcare Group that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Spire Healthcare Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:SPI

Spire Healthcare Group

Owns and operates private hospitals and clinics in the United Kingdom.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026