- United Kingdom

- /

- Healthcare Services

- /

- LSE:SPI

Here's Why We Think Spire Healthcare Group (LON:SPI) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Spire Healthcare Group (LON:SPI). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Spire Healthcare Group with the means to add long-term value to shareholders.

See our latest analysis for Spire Healthcare Group

Spire Healthcare Group's Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Spire Healthcare Group to have grown EPS from UK£0.017 to UK£0.053 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future.

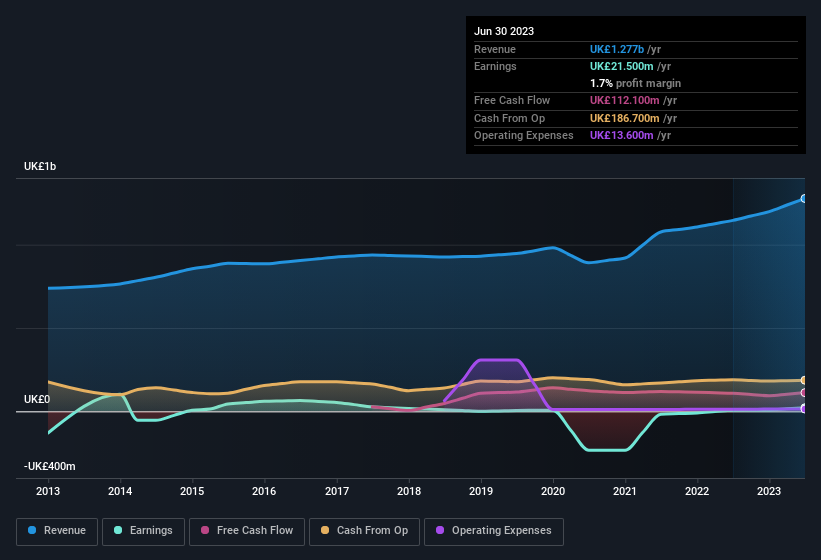

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Spire Healthcare Group maintained stable EBIT margins over the last year, all while growing revenue 11% to UK£1.3b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Spire Healthcare Group's forecast profits?

Are Spire Healthcare Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Spire Healthcare Group shareholders is that no insiders reported selling shares in the last year. Add in the fact that Justinian Ash, the CEO & Executive Director of the company, paid UK£25k for shares at around UK£2.26 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Spire Healthcare Group.

Should You Add Spire Healthcare Group To Your Watchlist?

Spire Healthcare Group's earnings per share growth have been climbing higher at an appreciable rate. Growth-minded people will be intrigued by the incredible movement in EPS growth. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put Spire Healthcare Group on your watchlist. What about risks? Every company has them, and we've spotted 1 warning sign for Spire Healthcare Group you should know about.

The good news is that Spire Healthcare Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SPI

Spire Healthcare Group

Owns and operates private hospitals and clinics in the United Kingdom.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives