- United Kingdom

- /

- Medical Equipment

- /

- LSE:SN.

Smith & Nephew (LSE:SN.) Undervalued Despite Strong Financials and Strategic Alliances for Growth

Reviewed by Simply Wall St

Smith & Nephew (LSE:SN.) is navigating a dynamic period marked by both opportunities and challenges. Recent highlights include a 5.6% revenue growth and innovative product launches, juxtaposed against a high Price-To-Earnings Ratio and concerns over dividend sustainability. In the discussion that follows, we will explore Smith & Nephew's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Click here and access our complete analysis report to understand the dynamics of Smith & Nephew.

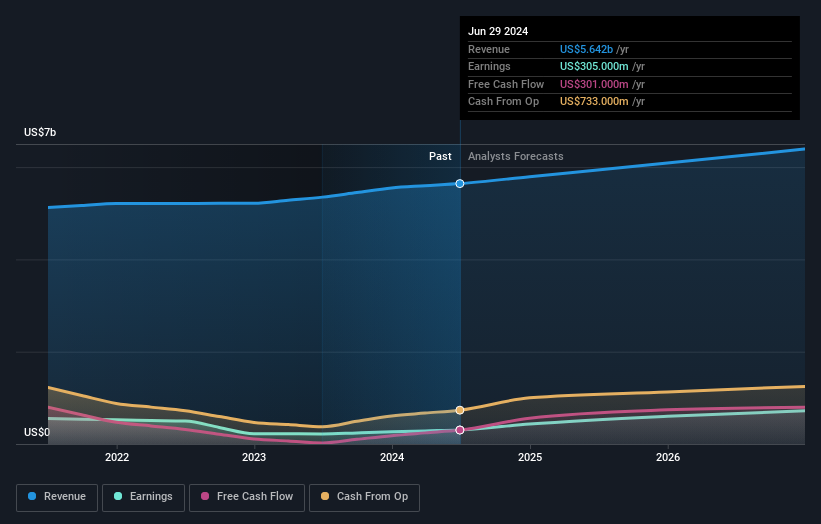

Key Assets Propelling Smith & Nephew Forward

Smith & Nephew has demonstrated strong financial health, with a total shareholder equity of $5.2 billion and a debt-to-equity ratio of 66.7%. The company's EBIT of $735 million and interest coverage ratio of 6.4 indicate operational efficiency. CEO Deepak Nath highlighted a 5.6% revenue growth in the latest quarter, with double-digit profit growth and a 60% trading cash conversion rate, showcasing effective cash management. Additionally, the launch of the CORI robotic system and the CATALYSTEM Primary Hip System underscores the company's commitment to innovation. Trading at £11.63, which is below the estimated fair value of £18.02, Smith & Nephew appears undervalued, presenting a potential investment opportunity.

Internal Limitations Hindering Smith & Nephew's Growth

Smith & Nephew faces several financial challenges. The company's Price-To-Earnings Ratio (44.2x) is significantly higher than the European Medical Equipment industry average (31.1x), indicating it may be overvalued on this metric. Furthermore, the company's Return on Equity (5.9%) is considered low compared to the industry benchmark. CFO John Rogers noted that U.S. Recon lagged behind for the quarter, and ordering patterns were affected by recent implementation changes. Additionally, the company's high payout ratio of 107.1% suggests that its dividend payments are not well covered by earnings, raising concerns about dividend sustainability.

Areas for Expansion and Innovation for Smith & Nephew

Smith & Nephew has several opportunities for growth and innovation. The company plans to launch new products in Europe, including the Advanced Wound Management system, which is expected to see further growth recovery. The collaboration with Healthcare Outcomes Performance Company (HOPCo) aims to enhance solutions for ASC customers through digital health and analytics platforms. Additionally, the company's focus on targeting new technologies and high-growth segments aligns with its strategic goals. These initiatives could significantly enhance Smith & Nephew's market position and capitalize on emerging opportunities in the healthcare sector.

Key Risks and Challenges That Could Impact Smith & Nephew's Success

However, Smith & Nephew faces several external threats that could impact its growth. Input cost inflation, merit increases, and transactional FX pose significant headwinds, as noted by CFO John Rogers. The competitive environment is also intensifying, with new product launches like the Pangea Plating System by competitors. Additionally, the company's high level of debt and large one-off items impacting financial results raise concerns about its financial stability. The dividend yield of 2.43% is not well covered by earnings or free cash flows, further highlighting potential risks. These factors could challenge Smith & Nephew's ability to maintain its market share and achieve long-term growth.

Conclusion

Smith & Nephew's strong financial health, demonstrated by a total shareholder equity of $5.2 billion and a debt-to-equity ratio of 66.7%, coupled with an EBIT of $735 million and an interest coverage ratio of 6.4, showcases its operational efficiency and effective cash management. The company faces challenges such as a high Price-To-Earnings Ratio of 44.2x compared to the industry average and a low Return on Equity of 5.9%, which could signal potential overvaluation on certain metrics and concerns about dividend sustainability. However, the company's strategic initiatives, including new product launches and collaborations, present significant growth opportunities. Trading at £11.63, below its estimated fair value of £18.02, Smith & Nephew appears to offer a compelling investment opportunity, provided it can navigate its internal and external challenges effectively.

Seize The Opportunity

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:SN.

Smith & Nephew

Develops, manufactures, markets, and sells medical devices and services in the United Kingdom, the United States, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives