- United Kingdom

- /

- Healthcare Services

- /

- LSE:MGP

Medica Group Plc's (LON:MGP) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?

With its stock down 5.9% over the past month, it is easy to disregard Medica Group (LON:MGP). However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. Specifically, we decided to study Medica Group's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Medica Group

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Medica Group is:

13% = UK£4.8m ÷ UK£37m (Based on the trailing twelve months to June 2020).

The 'return' refers to a company's earnings over the last year. That means that for every £1 worth of shareholders' equity, the company generated £0.13 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Medica Group's Earnings Growth And 13% ROE

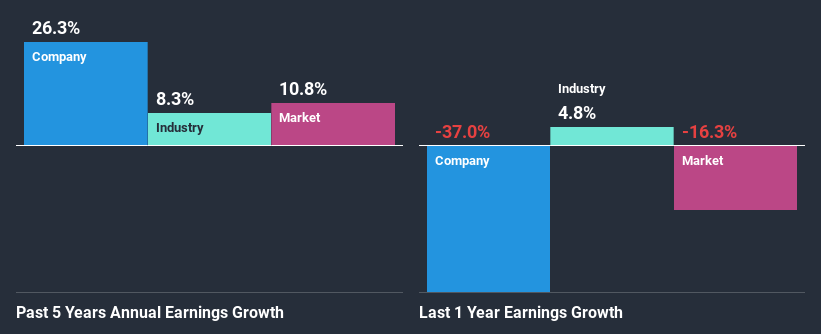

At first glance, Medica Group seems to have a decent ROE. Further, the company's ROE compares quite favorably to the industry average of 9.4%. This certainly adds some context to Medica Group's exceptional 26% net income growth seen over the past five years. We believe that there might also be other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

Next, on comparing with the industry net income growth, we found that Medica Group's growth is quite high when compared to the industry average growth of 8.3% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for MGP? You can find out in our latest intrinsic value infographic research report.

Is Medica Group Efficiently Re-investing Its Profits?

Medica Group's three-year median payout ratio is a pretty moderate 32%, meaning the company retains 68% of its income. So it seems that Medica Group is reinvesting efficiently in a way that it sees impressive growth in its earnings (discussed above) and pays a dividend that's well covered.

Besides, Medica Group has been paying dividends over a period of three years. This shows that the company is committed to sharing profits with its shareholders. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 30% of its profits over the next three years. Still, forecasts suggest that Medica Group's future ROE will rise to 18% even though the the company's payout ratio is not expected to change by much.

Summary

Overall, we are quite pleased with Medica Group's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

When trading Medica Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:MGP

Medica Group

Medica Group Plc, together with its subsidiaries, provides teleradiology reporting services to NHS and private healthcare providers in the United Kingdom, Ireland, and the United States.

Flawless balance sheet and good value.

Market Insights

Community Narratives