- United Kingdom

- /

- Construction

- /

- AIM:NEXS

Spotlight On UK Penny Stocks: 3 Picks With Market Caps Over £7M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, highlighting the interconnectedness of global economies. Despite such broader market fluctuations, certain investment opportunities remain compelling. Penny stocks, often associated with smaller or newer companies, can still offer growth potential when underpinned by strong financials. This article explores three penny stocks that may present hidden value and long-term promise for investors seeking to navigate these uncertain times.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.75 | £302.95M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.73 | £425.14M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.02 | £300.36M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.92 | £146.62M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.39 | £423.18M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.786 | £66.72M | ★★★★★★ |

| Croma Security Solutions Group (AIM:CSSG) | £0.855 | £11.74M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.385 | £176.38M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.22 | £158.38M | ★★★★★☆ |

Click here to see the full list of 440 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Intercede Group (AIM:IGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intercede Group plc is a cybersecurity company that develops and supplies identity and credential management software for digital trust across the UK, Europe, the US, and internationally, with a market cap of £90.32 million.

Operations: The company generates revenue of £21.51 million from its Software & Programming segment.

Market Cap: £90.32M

Intercede Group plc, with a market cap of £90.32 million and revenue of £21.51 million, has demonstrated strong financial performance recently. The company's earnings grew by 271.1% over the past year, significantly outpacing the software industry average. Its high-quality earnings and outstanding return on equity of 40.9% reflect robust profitability, while being debt-free enhances its financial stability. Short-term assets comfortably cover both short and long-term liabilities, indicating sound liquidity management. However, despite these strengths, forecasts suggest a potential decline in earnings over the next three years which investors should consider when evaluating this penny stock opportunity.

- Click here to discover the nuances of Intercede Group with our detailed analytical financial health report.

- Evaluate Intercede Group's prospects by accessing our earnings growth report.

Nexus Infrastructure (AIM:NEXS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nexus Infrastructure plc, with a market cap of £14.45 million, operates through its subsidiaries to develop and deliver infrastructure solutions.

Operations: The company generates revenue from its Tamdown segment, which amounts to £56.71 million.

Market Cap: £14.45M

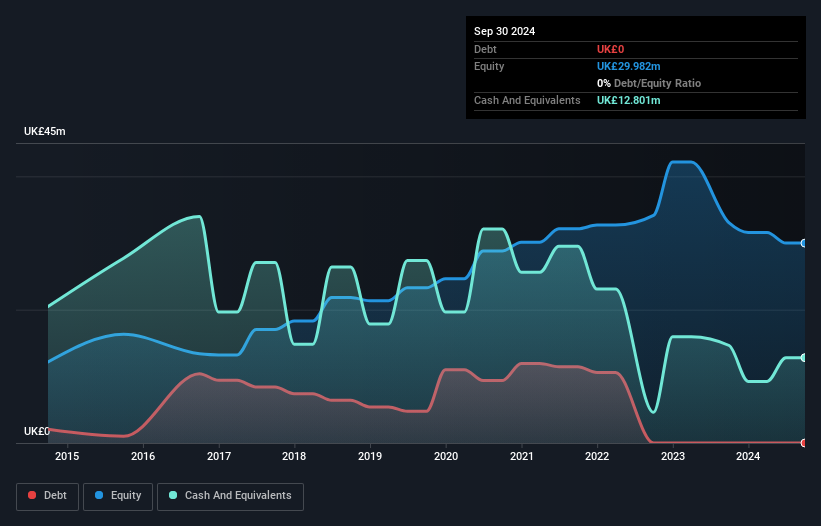

Nexus Infrastructure plc, with a market cap of £14.45 million, faces challenges as it remains unprofitable and reported a net loss of £2.76 million for the year ending September 2024, compared to a significant profit the previous year. Despite declining revenues from its Tamdown segment (£56.71 million), the company maintains strong liquidity with short-term assets exceeding liabilities and is debt-free, which supports financial stability. Recent announcements include potential M&A activities aimed at growth and diversification, alongside a proposed final dividend of 2 pence per share subject to shareholder approval, reflecting ongoing efforts to enhance shareholder value amidst current financial pressures.

- Dive into the specifics of Nexus Infrastructure here with our thorough balance sheet health report.

- Assess Nexus Infrastructure's previous results with our detailed historical performance reports.

Totally (AIM:TLY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Totally plc, with a market cap of £7.86 million, operates in the United Kingdom and Ireland providing healthcare services through its subsidiaries.

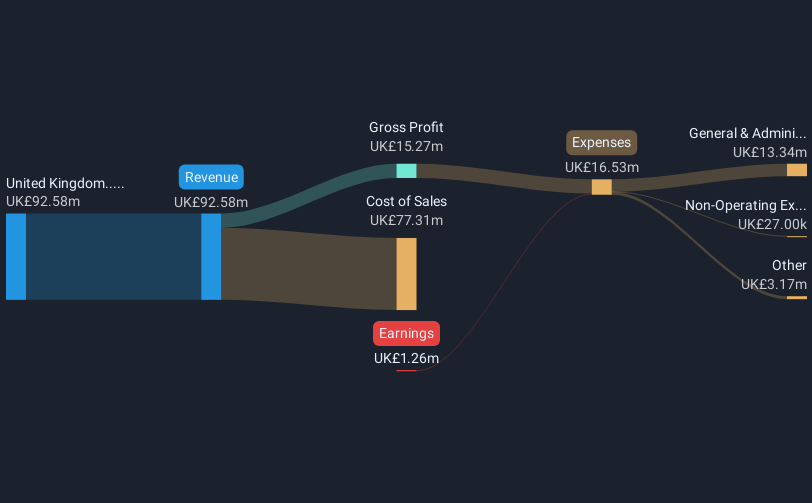

Operations: The company generates revenue of £92.58 million from its operations in the United Kingdom.

Market Cap: £7.86M

Totally plc, with a market cap of £7.86 million, faces financial challenges as it remains unprofitable with a negative return on equity and short-term liabilities exceeding assets. Despite these hurdles, the company has secured significant contract renewals for urgent care services in the UK, potentially bolstering future revenue streams. Recent leadership changes include Wendy Lawrence stepping down as CEO, with Professor Prasad Godbole appointed interim CEO. The board anticipates stable financial performance for FY25 and FY26 despite losing a key NHS 111 contract worth £13 million annually due to strategic shifts by NHS England.

- Click here and access our complete financial health analysis report to understand the dynamics of Totally.

- Learn about Totally's future growth trajectory here.

Summing It All Up

- Click here to access our complete index of 440 UK Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexus Infrastructure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NEXS

Nexus Infrastructure

Through its subsidiaries, develops and delivers infrastructure solutions.

Flawless balance sheet and good value.

Market Insights

Community Narratives