- United Kingdom

- /

- Healthcare Services

- /

- AIM:PHSC

Shareholders Will Probably Not Have Any Issues With PHSC plc's (LON:PHSC) CEO Compensation

Performance at PHSC plc (LON:PHSC) has been rather uninspiring recently and shareholders may be wondering how CEO Stephen King plans to fix this. At the next AGM coming up on 29 September 2022, they can influence managerial decision making through voting on resolutions, including executive remuneration. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for PHSC

Comparing PHSC plc's CEO Compensation With The Industry

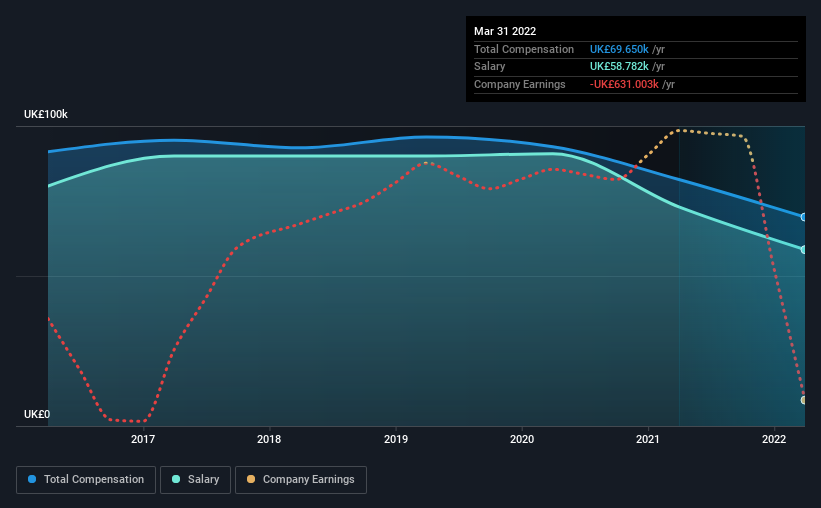

Our data indicates that PHSC plc has a market capitalization of UK£2.4m, and total annual CEO compensation was reported as UK£70k for the year to March 2022. That's a notable decrease of 15% on last year. We note that the salary portion, which stands at UK£58.8k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below UK£178m, reported a median total CEO compensation of UK£232k. This suggests that Stephen King is paid below the industry median. What's more, Stephen King holds UK£512k worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | UK£59k | UK£73k | 84% |

| Other | UK£11k | UK£9.1k | 16% |

| Total Compensation | UK£70k | UK£82k | 100% |

Talking in terms of the industry, salary represented approximately 52% of total compensation out of all the companies we analyzed, while other remuneration made up 48% of the pie. PHSC pays out 84% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at PHSC plc's Growth Numbers

Over the last three years, PHSC plc has shrunk its earnings per share by 83% per year. In the last year, its revenue is up 8.5%.

Overall this is not a very positive result for shareholders. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has PHSC plc Been A Good Investment?

We think that the total shareholder return of 114%, over three years, would leave most PHSC plc shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean these strong returns may not continue. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 3 warning signs (and 1 which doesn't sit too well with us) in PHSC we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:PHSC

PHSC

Through its subsidiaries, engages in health, safety, hygiene, and environmental consultancy services and security solutions to the public and private sectors in the United Kingdom.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion