- United Kingdom

- /

- Medical Equipment

- /

- AIM:CNSL

Announcing: Omega Diagnostics Group (LON:ODX) Stock Soared An Exciting 301% In The Last Year

While Omega Diagnostics Group PLC (LON:ODX) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 20% in the last quarter. But that isn't a problem when you consider how the share price has soared over the last year. In fact, it is up 301% in that time. Arguably, the recent fall is to be expected after such a strong rise. Of course, winners often do keep winning, so there may be more gains to come (if the business fundamentals stack up).

Check out our latest analysis for Omega Diagnostics Group

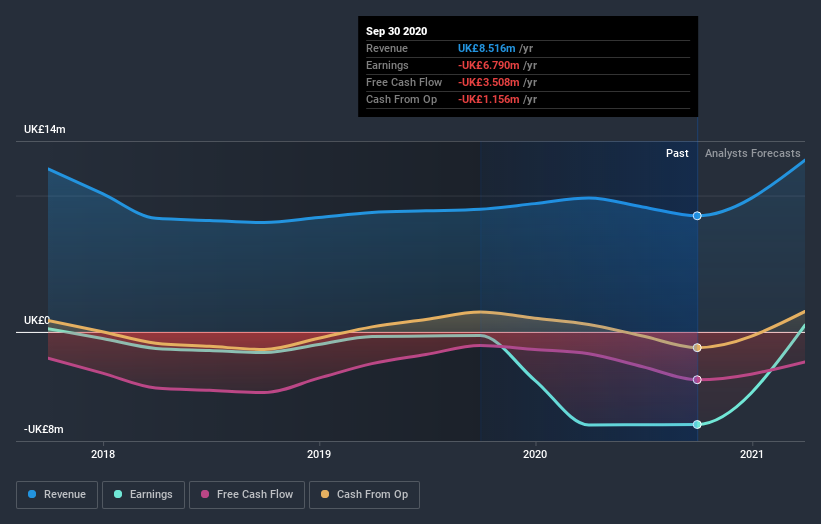

Because Omega Diagnostics Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Omega Diagnostics Group actually shrunk its revenue over the last year, with a reduction of 5.4%. This is in stark contrast to the splendorous stock price, which has rocketed 301% since this time a year ago. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. To us, a gain like this looks like speculation, but there might be historical trends to back it up.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Omega Diagnostics Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Omega Diagnostics Group shareholders have received a total shareholder return of 301% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 30% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Omega Diagnostics Group (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade Omega Diagnostics Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:CNSL

Cambridge Nutritional Sciences

Develops, manufactures, and distributes medical diagnostics products for the food sensitivity testing market.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives