- United Kingdom

- /

- Basic Materials

- /

- LSE:IBST

Discover 3 UK Stocks Estimated To Be Up To 48.7% Below Their Intrinsic Value

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced headwinds, with the FTSE 100 index closing lower amid concerns over weak trade data from China, highlighting the global interconnectedness that affects London’s blue-chip stocks. In such a challenging environment, identifying undervalued stocks—those trading below their intrinsic value—can offer potential opportunities for investors looking to navigate these uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victorian Plumbing Group (AIM:VIC) | £0.69 | £1.28 | 46.2% |

| ProCook Group (LSE:PROC) | £0.305 | £0.56 | 45.7% |

| Pan African Resources (LSE:PAF) | £0.954 | £1.82 | 47.7% |

| PageGroup (LSE:PAGE) | £2.41 | £4.53 | 46.8% |

| Nichols (AIM:NICL) | £10.10 | £18.53 | 45.5% |

| Ibstock (LSE:IBST) | £1.354 | £2.64 | 48.7% |

| Fintel (AIM:FNTL) | £2.08 | £3.80 | 45.2% |

| Fevertree Drinks (AIM:FEVR) | £8.08 | £16.10 | 49.8% |

| Airtel Africa (LSE:AAF) | £3.148 | £5.84 | 46.1% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.17 | £4.16 | 47.8% |

Let's dive into some prime choices out of the screener.

NIOX Group (AIM:NIOX)

Overview: NIOX Group Plc specializes in designing, developing, and commercializing medical devices for asthma diagnosis, monitoring, and management globally, with a market cap of £296.69 million.

Operations: The company generates revenue primarily from its NIOX® segment, amounting to £46 million.

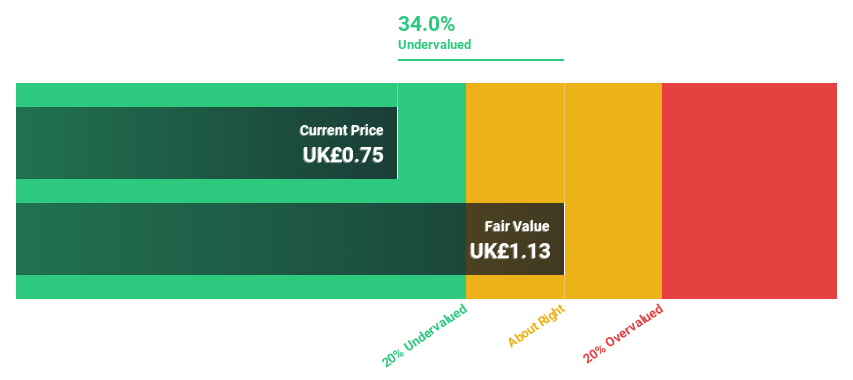

Estimated Discount To Fair Value: 31.4%

NIOX Group, trading at £0.71, is undervalued based on discounted cash flow analysis with a fair value estimate of £1.04. Despite a decline in profit margins from 28.2% to 10.7%, its earnings are forecasted to grow significantly at 34.15% annually over the next three years, outpacing the UK market's growth rate of 14.4%. Recent earnings reports show increased sales and net income, supporting this positive growth outlook amidst its undervaluation status.

- Our expertly prepared growth report on NIOX Group implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in NIOX Group's balance sheet health report.

Ibstock (LSE:IBST)

Overview: Ibstock plc operates in the United Kingdom, manufacturing and selling clay and concrete building products for the residential construction sector, with a market cap of £534.40 million.

Operations: Ibstock's revenue is derived from its clay segment, which generated £262.88 million, and its concrete segment, contributing £118.59 million.

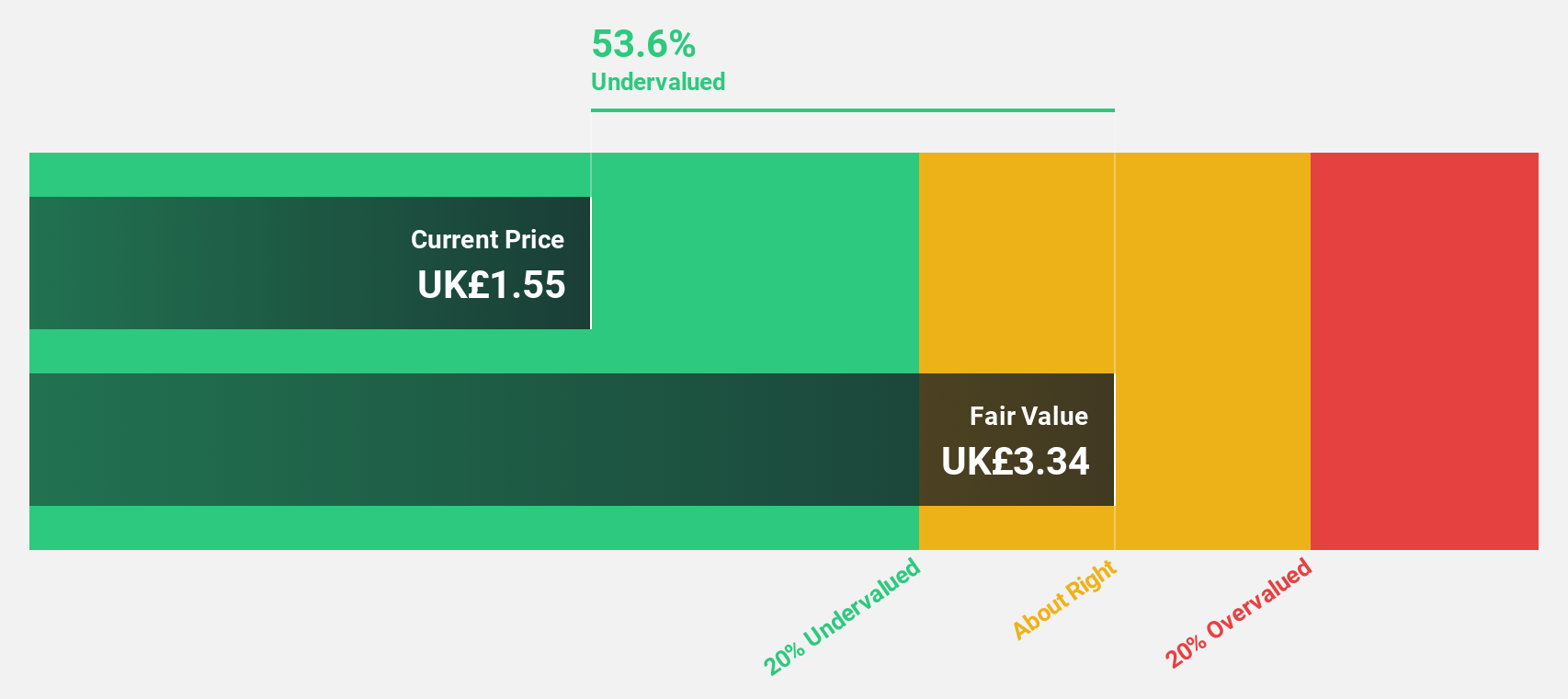

Estimated Discount To Fair Value: 48.7%

Ibstock, trading at £1.35, is significantly undervalued with a fair value estimate of £2.64 based on discounted cash flow analysis. Its earnings are forecast to grow substantially at 37.9% annually over the next three years, surpassing the UK market's 14.4% growth rate despite slower revenue growth of 6.3%. The recent renewal of a £125 million revolving credit facility at improved terms supports its strategic initiatives amidst executive changes and high-quality earnings impacted by large one-off items.

- Insights from our recent growth report point to a promising forecast for Ibstock's business outlook.

- Click here to discover the nuances of Ibstock with our detailed financial health report.

S&U (LSE:SUS)

Overview: S&U plc operates in the United Kingdom, offering motor, property bridging, and specialist finance services, with a market cap of £227.83 million.

Operations: The company's revenue is primarily derived from motor finance (£70.07 million) and property bridging finance (£15.82 million) services in the United Kingdom.

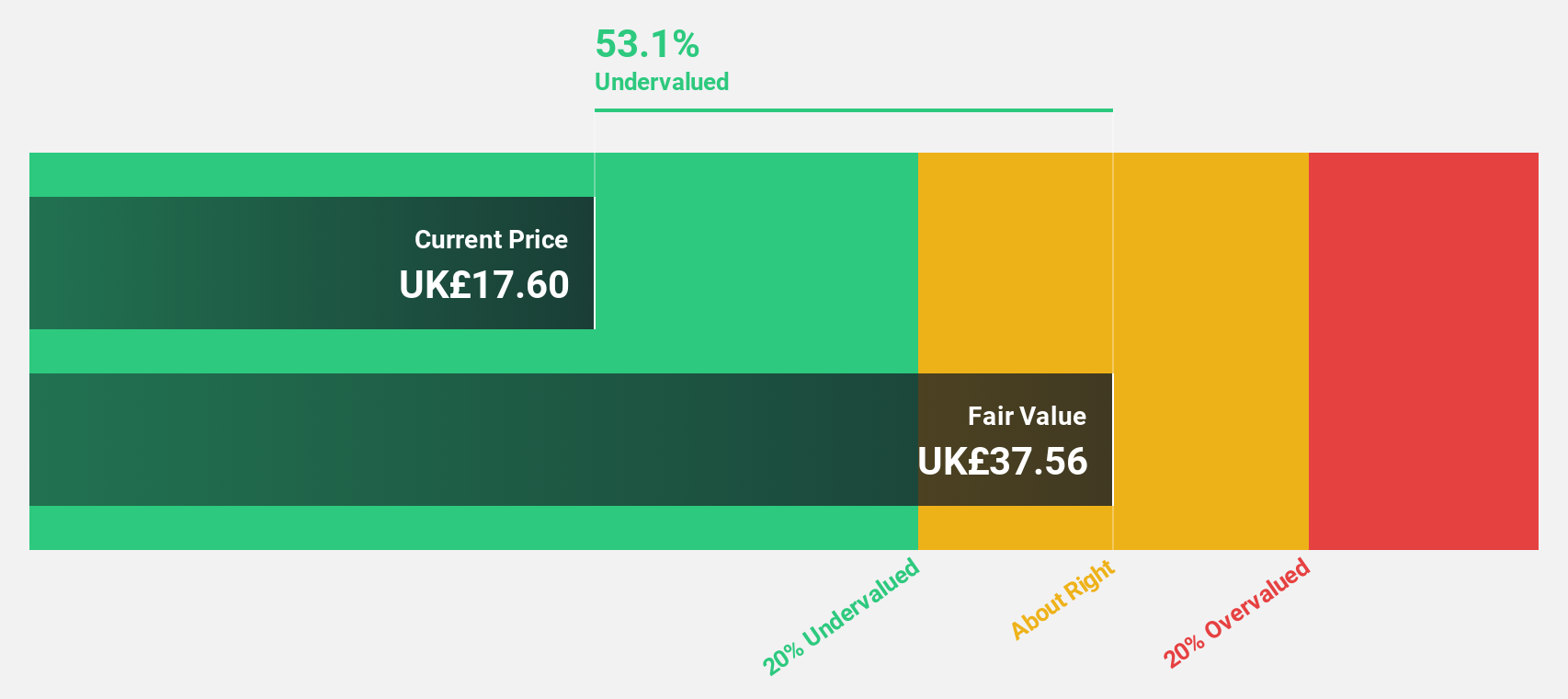

Estimated Discount To Fair Value: 29.0%

S&U is trading at £18.75, notably undervalued with an estimated fair value of £26.4 according to discounted cash flow analysis. Earnings are projected to grow at 17.7% annually, outpacing the UK market's growth rate, with revenue expected to increase by 23.3% per year. Despite a high debt level and unstable dividend history, recent earnings results showed an increase in net income to £11.6 million for the half-year ended August 2025 from £9.56 million a year prior.

- In light of our recent growth report, it seems possible that S&U's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of S&U.

Make It Happen

- Reveal the 53 hidden gems among our Undervalued UK Stocks Based On Cash Flows screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IBST

Ibstock

Manufactures and sells clay and concrete building products and solutions to customers in the residential construction sector in the United Kingdom.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success