- United Kingdom

- /

- Medical Equipment

- /

- AIM:MHC

3 Promising Penny Stocks On UK Exchange With Under £200M Market Cap

Reviewed by Simply Wall St

The United Kingdom's stock market has been facing challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, impacting companies tied to global economic trends. Amid these broader market fluctuations, investors might find potential in lesser-known opportunities. Penny stocks, although an older term, still represent a viable investment area where smaller or newer companies can offer unique growth prospects when supported by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.22 | £836.42M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.20 | £417.71M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.92 | £74.76M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.97 | £73.46M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.20 | £102.41M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.39 | £177.02M | ★★★★★☆ |

| Tristel (AIM:TSTL) | £4.275 | £203.88M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.418 | $242.99M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £3.34 | £427.4M | ★★★★★★ |

Click here to see the full list of 464 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

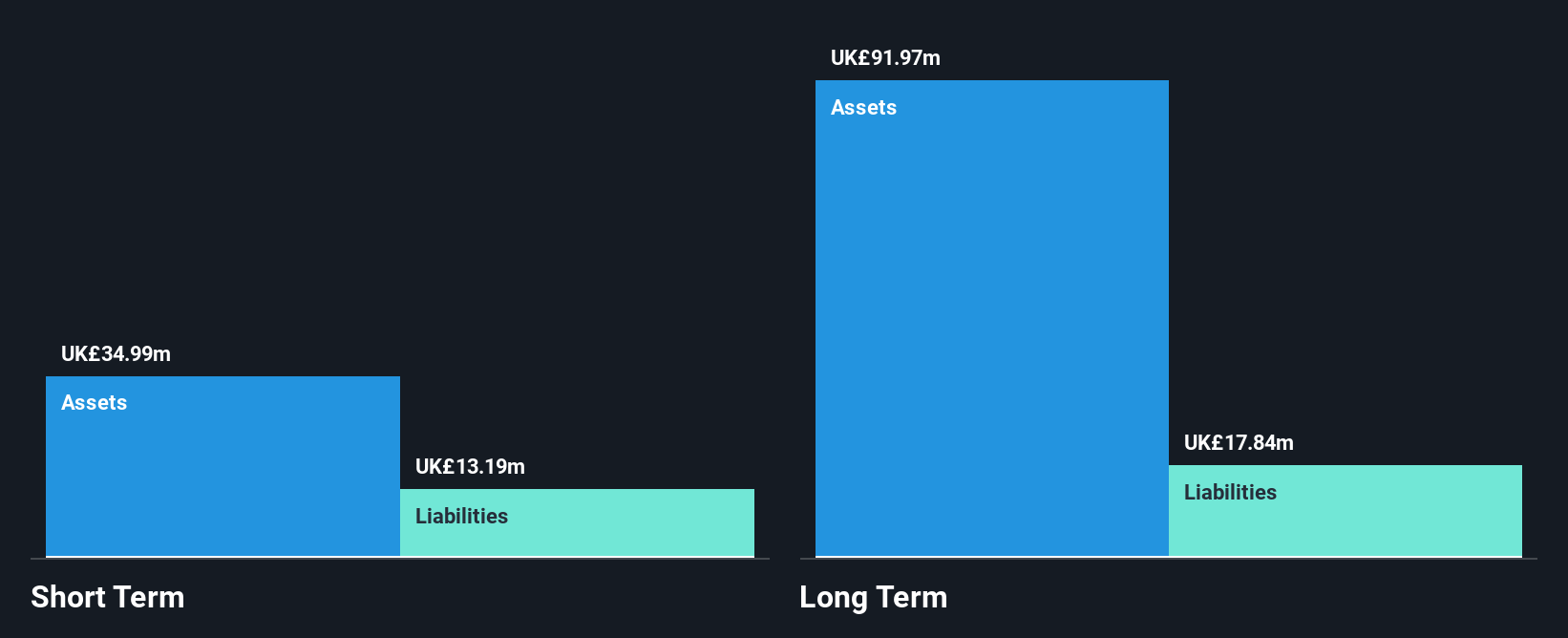

Michelmersh Brick Holdings (AIM:MBH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Michelmersh Brick Holdings plc, with a market cap of £97.22 million, manufactures and sells bricks and brick prefabricated products in the United Kingdom and Europe.

Operations: The company generates £70.69 million in revenue from its Building Products segment.

Market Cap: £97.22M

Michelmersh Brick Holdings plc, with a market cap of £97.22 million, presents a mixed picture for penny stock investors. The company is debt-free and has high-quality earnings; however, recent performance shows challenges with sales dropping to £35.39 million for H1 2024 from the previous year's £42.04 million, and net income decreasing to £3.12 million from £4.68 million. Despite these setbacks, the stock trades at 24% below its estimated fair value and analysts agree on potential price appreciation of nearly 48%. The company's board is experienced but its return on equity remains low at 8.9%.

- Get an in-depth perspective on Michelmersh Brick Holdings' performance by reading our balance sheet health report here.

- Examine Michelmersh Brick Holdings' earnings growth report to understand how analysts expect it to perform.

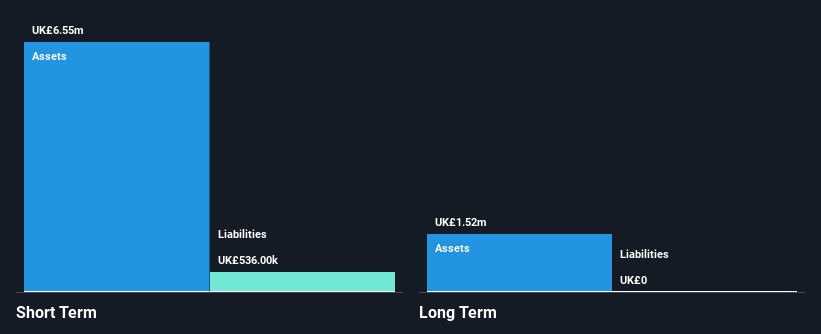

MyHealthChecked (AIM:MHC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MyHealthChecked PLC develops, distributes, and commercializes at-home healthcare and wellness tests in the United Kingdom with a market cap of £6.24 million.

Operations: The company's revenue is primarily generated from the provision of diagnostic healthcare products, amounting to £9.39 million.

Market Cap: £6.24M

MyHealthChecked PLC, with a market cap of £6.24 million, offers an intriguing prospect within the penny stock arena despite its unprofitable status. The company reported H1 2024 sales of £0.881 million, a decline from the previous year's £2.46 million, alongside an increased net loss of £1.2 million compared to last year's £0.319 million loss. Positively, MyHealthChecked is debt-free and has a strong cash runway exceeding three years due to positive free cash flow growth. While share price volatility remains high, its seasoned management team and board provide stability amidst financial challenges.

- Unlock comprehensive insights into our analysis of MyHealthChecked stock in this financial health report.

- Examine MyHealthChecked's past performance report to understand how it has performed in prior years.

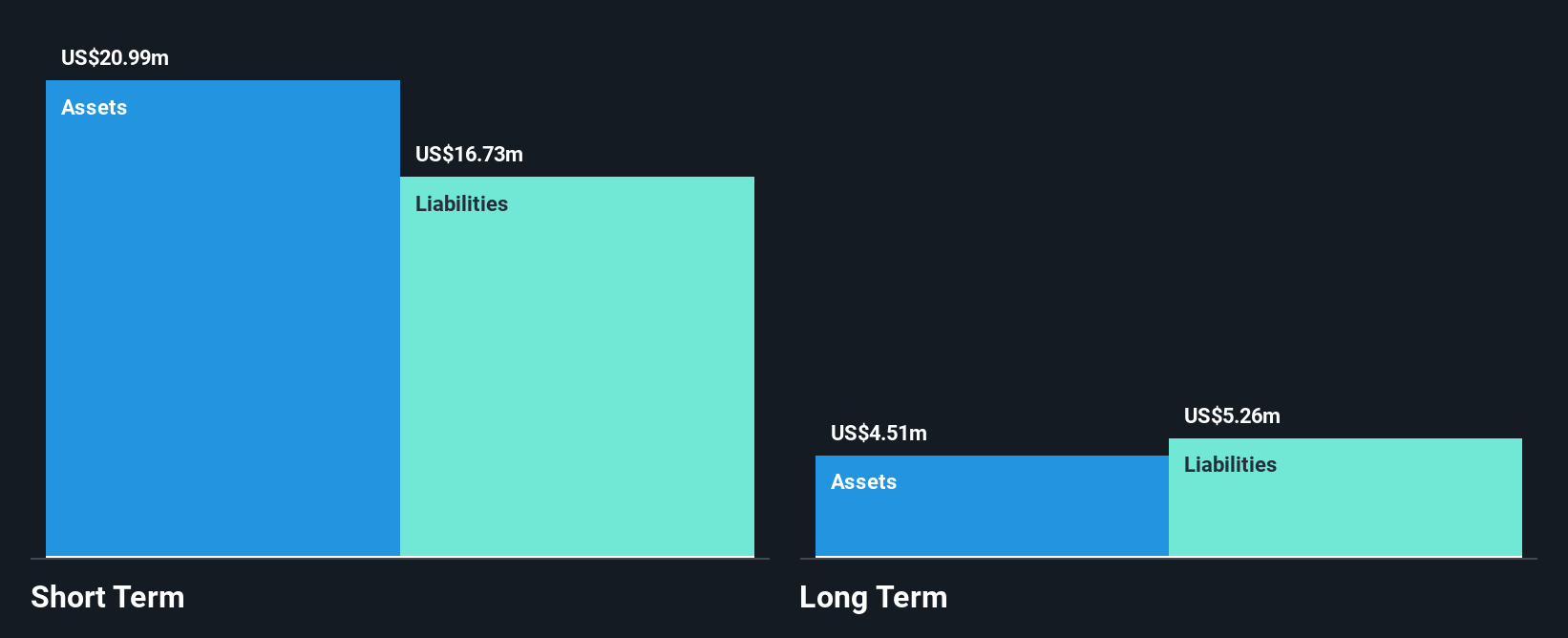

Windward (AIM:WNWD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Windward Ltd. is a predictive intelligence company operating in Israel and internationally, with a market capitalization of £109.02 million.

Operations: The company's revenue is derived from its Software & Programming segment, totaling $33.09 million.

Market Cap: £109.02M

Windward Ltd., with a market capitalization of £109.02 million, operates in the predictive intelligence sector and is currently unprofitable, though it forecasts a 17.13% annual revenue growth. Recent product launches like Advanced Intelligence and Early Detection highlight its focus on AI-driven solutions for maritime security challenges, offering significant potential for stakeholder engagement across commercial and governmental sectors. Despite being debt-free with a sufficient cash runway exceeding three years, Windward faces challenges such as shareholder dilution and an inexperienced board with an average tenure of 2.9 years, impacting investor confidence in its long-term profitability prospects.

- Take a closer look at Windward's potential here in our financial health report.

- Explore Windward's analyst forecasts in our growth report.

Make It Happen

- Click through to start exploring the rest of the 461 UK Penny Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MHC

MyHealthChecked

Develops, distributes, and commercializes at-home healthcare and wellness tests in the United Kingdom.

Flawless balance sheet and slightly overvalued.