- United Kingdom

- /

- Healthcare Services

- /

- AIM:KOO

Slammed 31% Kooth plc (LON:KOO) Screens Well Here But There Might Be A Catch

Kooth plc (LON:KOO) shares have had a horrible month, losing 31% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 21% share price drop.

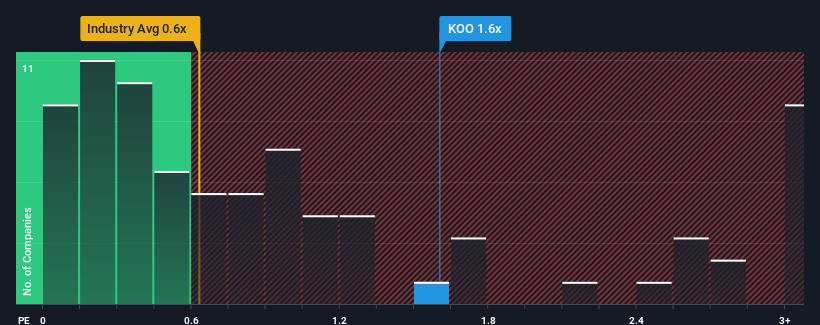

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Kooth's P/S ratio of 1.6x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in the United Kingdom is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Kooth

What Does Kooth's Recent Performance Look Like?

Recent times have been advantageous for Kooth as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Kooth's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Kooth?

Kooth's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 138% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 259% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 24% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 11%, which is noticeably less attractive.

In light of this, it's curious that Kooth's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Kooth's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Kooth looks to be in line with the rest of the Healthcare industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Kooth's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 1 warning sign for Kooth that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kooth might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:KOO

Kooth

Provides digital mental health services to children, young people, and adults in the United Kingdom.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives