- United Kingdom

- /

- Healthtech

- /

- AIM:IUG

The Market Lifts Intelligent Ultrasound Group plc (LON:IUG) Shares 42% But It Can Do More

Intelligent Ultrasound Group plc (LON:IUG) shareholders would be excited to see that the share price has had a great month, posting a 42% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 26%.

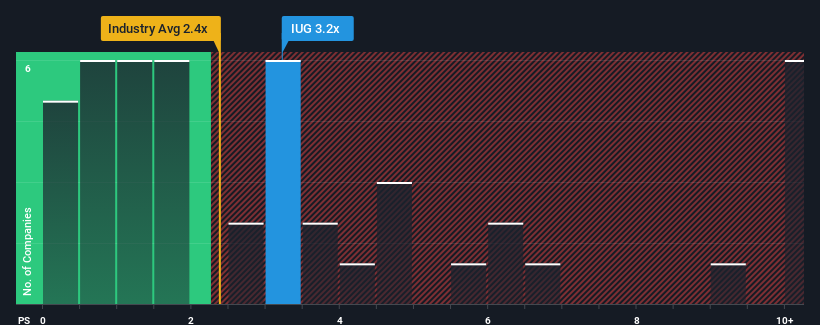

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Intelligent Ultrasound Group's P/S ratio of 3.2x, since the median price-to-sales (or "P/S") ratio for the Healthcare Services industry in the United Kingdom is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Intelligent Ultrasound Group

How Intelligent Ultrasound Group Has Been Performing

Recent times have been advantageous for Intelligent Ultrasound Group as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Intelligent Ultrasound Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Intelligent Ultrasound Group would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. Pleasingly, revenue has also lifted 116% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 40% as estimated by the lone analyst watching the company. With the industry only predicted to deliver 13%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Intelligent Ultrasound Group's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Intelligent Ultrasound Group's P/S Mean For Investors?

Intelligent Ultrasound Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Intelligent Ultrasound Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 3 warning signs for Intelligent Ultrasound Group (2 are potentially serious!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IUG

Intelligent Ultrasound Group

Through its subsidiaries, develops, markets, and distributes medical training simulators in the United Kingdom, North America, and internationally.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives