- United Kingdom

- /

- Healthtech

- /

- AIM:IUG

Intelligent Ultrasound Group (LON:IUG) Share Prices Have Dropped 70% In The Last Five Years

Generally speaking long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. To wit, the Intelligent Ultrasound Group plc (LON:IUG) share price managed to fall 70% over five long years. That is extremely sub-optimal, to say the least. On the other hand the share price has bounced 9.1% over the last week.

Check out our latest analysis for Intelligent Ultrasound Group

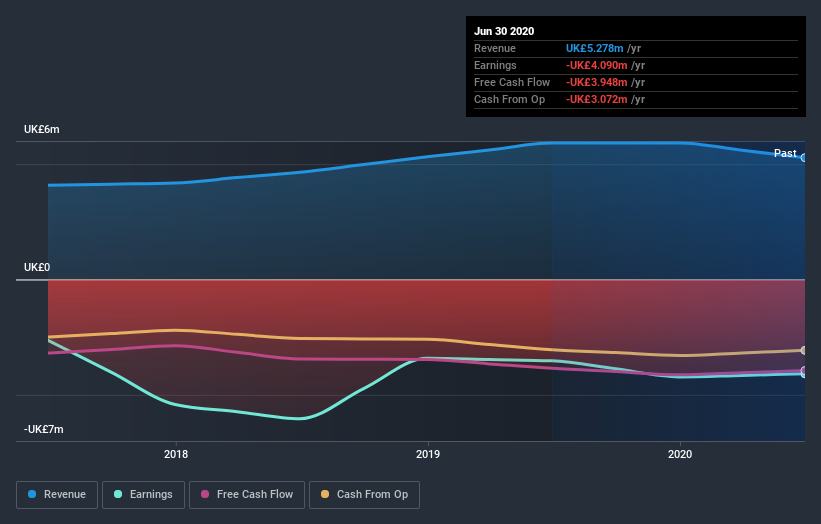

Because Intelligent Ultrasound Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Intelligent Ultrasound Group saw its revenue increase by 21% per year. That's better than most loss-making companies. In contrast, the share price is has averaged a loss of 11% per year - that's quite disappointing. It's safe to say investor expectations are more grounded now. If you think the company can keep up its revenue growth, you'd have to consider the possibility that there's an opportunity here.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Intelligent Ultrasound Group's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Intelligent Ultrasound Group has rewarded shareholders with a total shareholder return of 43% in the last twelve months. That certainly beats the loss of about 11% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Intelligent Ultrasound Group (at least 1 which is significant) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading Intelligent Ultrasound Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:IUG

Intelligent Ultrasound Group

Through its subsidiaries, develops, markets, and distributes medical training simulators in the United Kingdom, North America, and internationally.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives