- United Kingdom

- /

- Medical Equipment

- /

- AIM:IHC

Not Many Are Piling Into Inspiration Healthcare Group plc (LON:IHC) Stock Yet As It Plummets 28%

Unfortunately for some shareholders, the Inspiration Healthcare Group plc (LON:IHC) share price has dived 28% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 64% loss during that time.

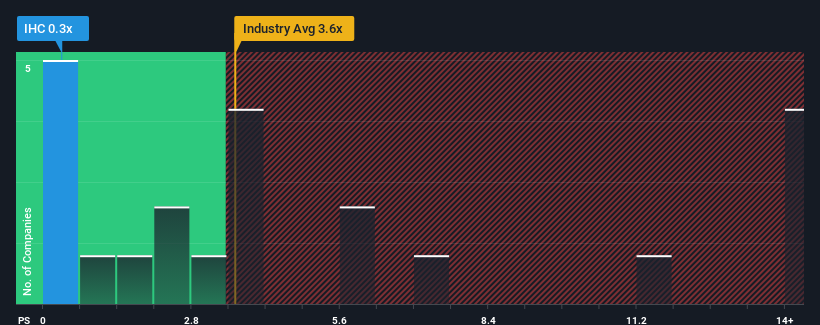

After such a large drop in price, Inspiration Healthcare Group may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Medical Equipment industry in the United Kingdom have P/S ratios greater than 3.6x and even P/S higher than 9x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Inspiration Healthcare Group

What Does Inspiration Healthcare Group's P/S Mean For Shareholders?

Inspiration Healthcare Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Inspiration Healthcare Group.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Inspiration Healthcare Group's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.7%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 9.8% each year as estimated by the one analyst watching the company. That's shaping up to be similar to the 8.6% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Inspiration Healthcare Group's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Inspiration Healthcare Group's P/S looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Inspiration Healthcare Group currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 3 warning signs for Inspiration Healthcare Group (2 are concerning!) that we have uncovered.

If you're unsure about the strength of Inspiration Healthcare Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IHC

Inspiration Healthcare Group

Designs, manufactures, and sells medical technology products worldwide.

Slight risk and fair value.

Market Insights

Community Narratives