- United Kingdom

- /

- Medical Equipment

- /

- AIM:IHC

Further Upside For Inspiration Healthcare Group plc (LON:IHC) Shares Could Introduce Price Risks After 28% Bounce

Inspiration Healthcare Group plc (LON:IHC) shareholders have had their patience rewarded with a 28% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.3% over the last year.

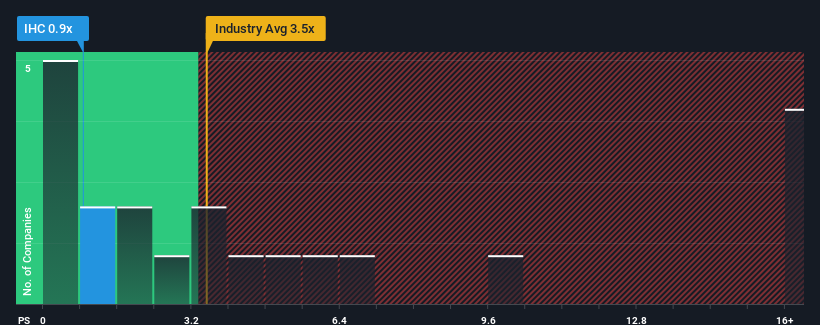

In spite of the firm bounce in price, Inspiration Healthcare Group may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Medical Equipment industry in the United Kingdom have P/S ratios greater than 3.5x and even P/S higher than 7x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Inspiration Healthcare Group

What Does Inspiration Healthcare Group's P/S Mean For Shareholders?

There hasn't been much to differentiate Inspiration Healthcare Group's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Inspiration Healthcare Group will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Inspiration Healthcare Group.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Inspiration Healthcare Group's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 72% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 8.5%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Inspiration Healthcare Group's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Inspiration Healthcare Group's P/S

Inspiration Healthcare Group's recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Inspiration Healthcare Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Inspiration Healthcare Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IHC

Inspiration Healthcare Group

Designs, manufactures, and sells medical technology products worldwide.

Good value slight.

Market Insights

Community Narratives