- United Kingdom

- /

- Medical Equipment

- /

- AIM:EKF

EKF Diagnostics Holdings plc Just Missed EPS By 22%: Here's What Analysts Think Will Happen Next

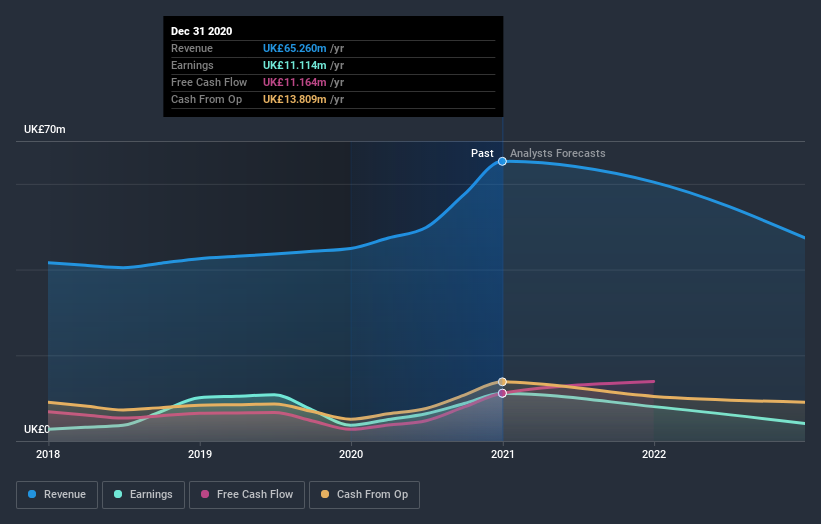

Shareholders will be ecstatic, with their stake up 22% over the past week following EKF Diagnostics Holdings plc's (LON:EKF) latest full-year results. It looks like a pretty bad result, all things considered. Although revenues of UK£65m were in line with analyst predictions, statutory earnings fell badly short, missing estimates by 22% to hit UK£0.024 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for EKF Diagnostics Holdings

Taking into account the latest results, the current consensus, from the dual analysts covering EKF Diagnostics Holdings, is for revenues of UK£60.4m in 2021, which would reflect a noticeable 7.4% reduction in EKF Diagnostics Holdings' sales over the past 12 months. Statutory earnings per share are expected to plummet 29% to UK£0.017 in the same period. In the lead-up to this report, the analysts had been modelling revenues of UK£54.4m and earnings per share (EPS) of UK£0.015 in 2021. So we can see there's been a pretty clear increase in sentiment following the latest results, with both revenues and earnings per share receiving a decent lift in the latest estimates.

With these upgrades, we're not surprised to see that the analysts have lifted their price target 27% to UK£0.65per share.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 7.4% by the end of 2021. This indicates a significant reduction from annual growth of 11% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 10% annually for the foreseeable future. It's pretty clear that EKF Diagnostics Holdings' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around EKF Diagnostics Holdings' earnings potential next year. Fortunately, they also upgraded their revenue estimates, although our data indicates sales are expected to perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At least one analyst has provided forecasts out to 2022, which can be seen for free on our platform here.

Plus, you should also learn about the 1 warning sign we've spotted with EKF Diagnostics Holdings .

If you decide to trade EKF Diagnostics Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EKF Diagnostics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:EKF

EKF Diagnostics Holdings

Engages in the design, development, manufacture, and sale of diagnostic instruments, reagents, and other ancillary products in the Americas, Europe, the Middle East, Asia, Africa, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026