- United Kingdom

- /

- Medical Equipment

- /

- AIM:DEMG

Here's Why Deltex Medical Group plc's (LON:DEMG) CEO Compensation Is The Least Of Shareholders Concerns

Key Insights

- Deltex Medical Group to hold its Annual General Meeting on 8th of May

- CEO Andy Mears' total compensation includes salary of UK£175.0k

- Total compensation is 35% below industry average

- Over the past three years, Deltex Medical Group's EPS grew by 3.9% and over the past three years, the total loss to shareholders 93%

Shareholders may be wondering what CEO Andy Mears plans to do to improve the less than great performance at Deltex Medical Group plc (LON:DEMG) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 8th of May. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

View our latest analysis for Deltex Medical Group

How Does Total Compensation For Andy Mears Compare With Other Companies In The Industry?

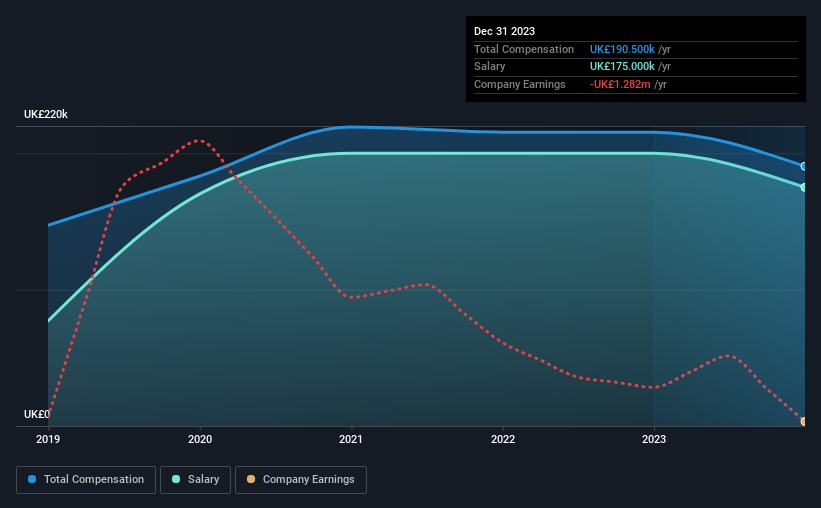

At the time of writing, our data shows that Deltex Medical Group plc has a market capitalization of UK£2.4m, and reported total annual CEO compensation of UK£191k for the year to December 2023. Notably, that's a decrease of 12% over the year before. Notably, the salary which is UK£175.0k, represents most of the total compensation being paid.

For comparison, other companies in the British Medical Equipment industry with market capitalizations below UK£160m, reported a median total CEO compensation of UK£291k. Accordingly, Deltex Medical Group pays its CEO under the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | UK£175k | UK£200k | 92% |

| Other | UK£16k | UK£16k | 8% |

| Total Compensation | UK£191k | UK£216k | 100% |

Talking in terms of the industry, salary represented approximately 67% of total compensation out of all the companies we analyzed, while other remuneration made up 33% of the pie. Deltex Medical Group is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Deltex Medical Group plc's Growth

Deltex Medical Group plc has seen its earnings per share (EPS) increase by 3.9% a year over the past three years. It saw its revenue drop 28% over the last year.

We would prefer it if there was revenue growth, but the modest EPS growth gives us some relief. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Deltex Medical Group plc Been A Good Investment?

Few Deltex Medical Group plc shareholders would feel satisfied with the return of -93% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The loss to shareholders over the past three years is certainly concerning. The disappointing performance may have something to do with the flat earnings growth. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 6 warning signs for Deltex Medical Group (4 are a bit unpleasant!) that you should be aware of before investing here.

Switching gears from Deltex Medical Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you're looking to trade Deltex Medical Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:DEMG

Deltex Medical Group

Manufactures, markets, and sells oesophageal doppler haemodynamic monitoring systems under the TrueVue name in the United Kingdom, the United States, and internationally.

Moderate and slightly overvalued.

Market Insights

Community Narratives