- United Kingdom

- /

- Insurance

- /

- LSE:JUST

UK Stocks Trading Below Estimated Value In May 2025

Reviewed by Simply Wall St

Amidst ongoing concerns about China's economic recovery and its ripple effects on global markets, the FTSE 100 and FTSE 250 indices in the United Kingdom have faced downward pressure, reflecting broader uncertainties. In such a volatile environment, identifying stocks that are trading below their estimated value can offer potential opportunities for investors looking to navigate through market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Aptitude Software Group (LSE:APTD) | £2.79 | £5.13 | 45.6% |

| Victrex (LSE:VCT) | £7.98 | £15.44 | 48.3% |

| SDI Group (AIM:SDI) | £0.71 | £1.36 | 48% |

| Informa (LSE:INF) | £7.96 | £14.50 | 45.1% |

| Just Group (LSE:JUST) | £1.486 | £2.95 | 49.7% |

| Duke Capital (AIM:DUKE) | £0.2875 | £0.53 | 45.4% |

| Huddled Group (AIM:HUD) | £0.0305 | £0.06 | 49.1% |

| Entain (LSE:ENT) | £7.466 | £13.75 | 45.7% |

| Vistry Group (LSE:VTY) | £6.24 | £11.39 | 45.2% |

| Deliveroo (LSE:ROO) | £1.754 | £3.04 | 42.4% |

We're going to check out a few of the best picks from our screener tool.

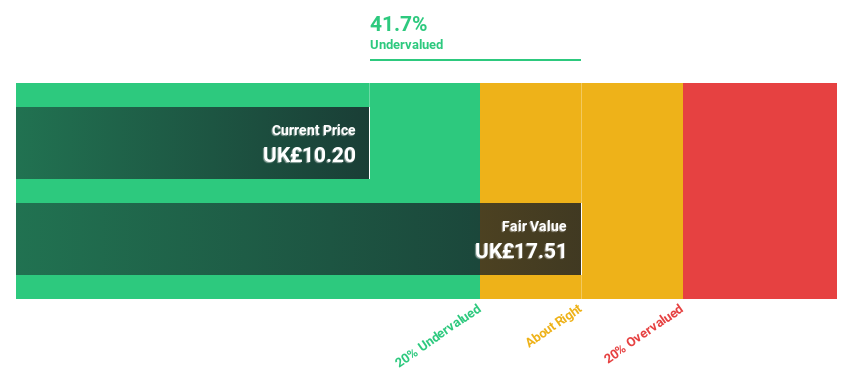

CVS Group (AIM:CVSG)

Overview: CVS Group plc operates in veterinary services, pet crematoria, online pharmacy, and retail sectors, with a market cap of £886.71 million.

Operations: The company's revenue is primarily derived from its veterinary practices (£600.50 million), online retail business (£48.50 million), laboratories (£30.90 million), and crematoria services (£12.20 million).

Estimated Discount To Fair Value: 32.5%

CVS Group appears undervalued, trading 32.5% below its estimated fair value of £18.32, with a current price of £12.36. Despite lower profit margins compared to last year, the company's earnings are projected to grow significantly at 24.3% annually over the next three years, outpacing the UK market average growth rate of 14.5%. However, interest payments are not well covered by earnings, which may pose financial risks despite strong revenue forecasts and analyst optimism about future price increases.

- Our growth report here indicates CVS Group may be poised for an improving outlook.

- Click here to discover the nuances of CVS Group with our detailed financial health report.

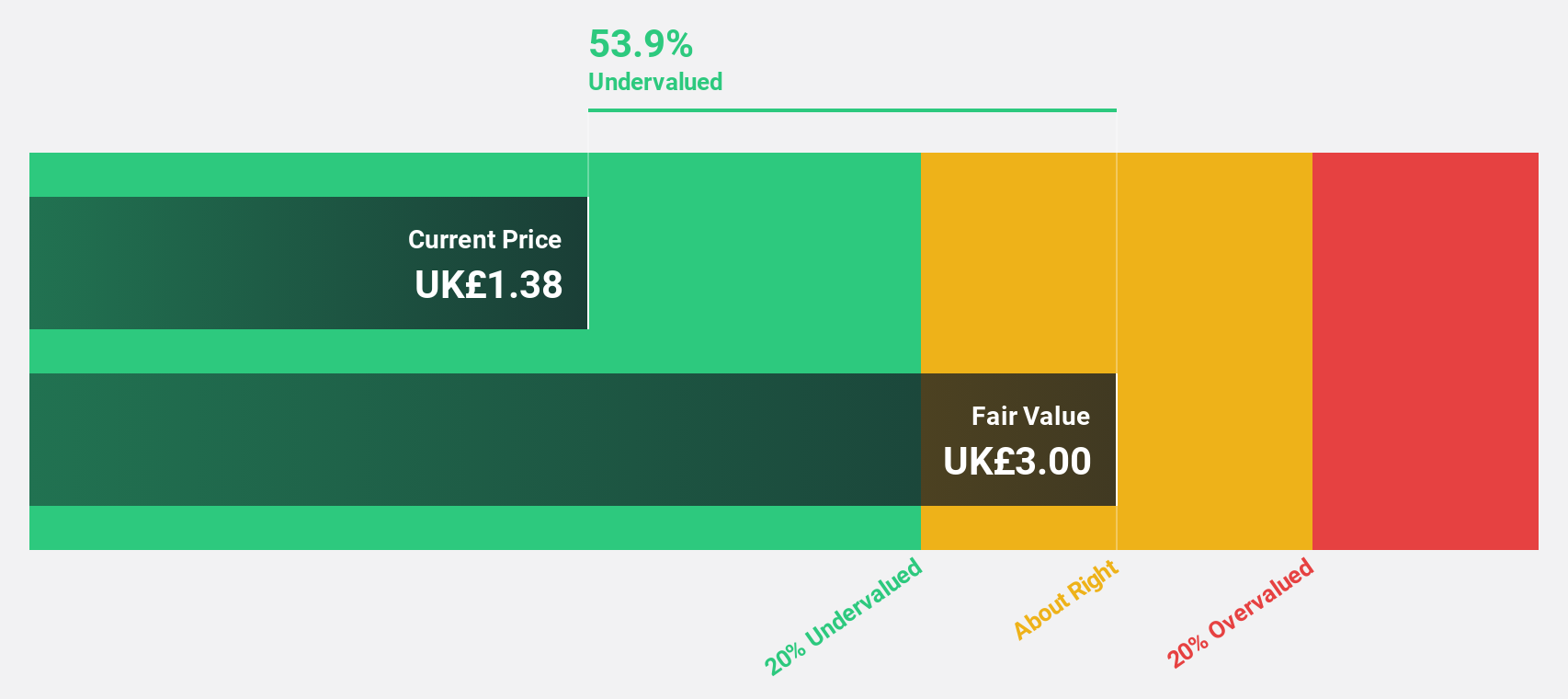

Just Group (LSE:JUST)

Overview: Just Group plc offers a range of retirement income products and services to individuals, homeowners, and corporate clients in the United Kingdom, with a market cap of £1.54 billion.

Operations: Just Group's revenue primarily stems from its diverse offerings in retirement income solutions tailored for individuals, homeowners, and corporate clients across the UK.

Estimated Discount To Fair Value: 49.7%

Just Group is trading at £1.49, significantly below its estimated fair value of £2.95, indicating potential undervaluation based on cash flows. Despite a drop in profit margins to 3.2% from 6.3% last year and net income falling to £80 million, earnings are forecasted to grow at 19.7% annually, surpassing the UK market average of 14.5%. Recent dividend approval highlights ongoing shareholder returns amidst robust revenue growth projections of 29% per year.

- According our earnings growth report, there's an indication that Just Group might be ready to expand.

- Click to explore a detailed breakdown of our findings in Just Group's balance sheet health report.

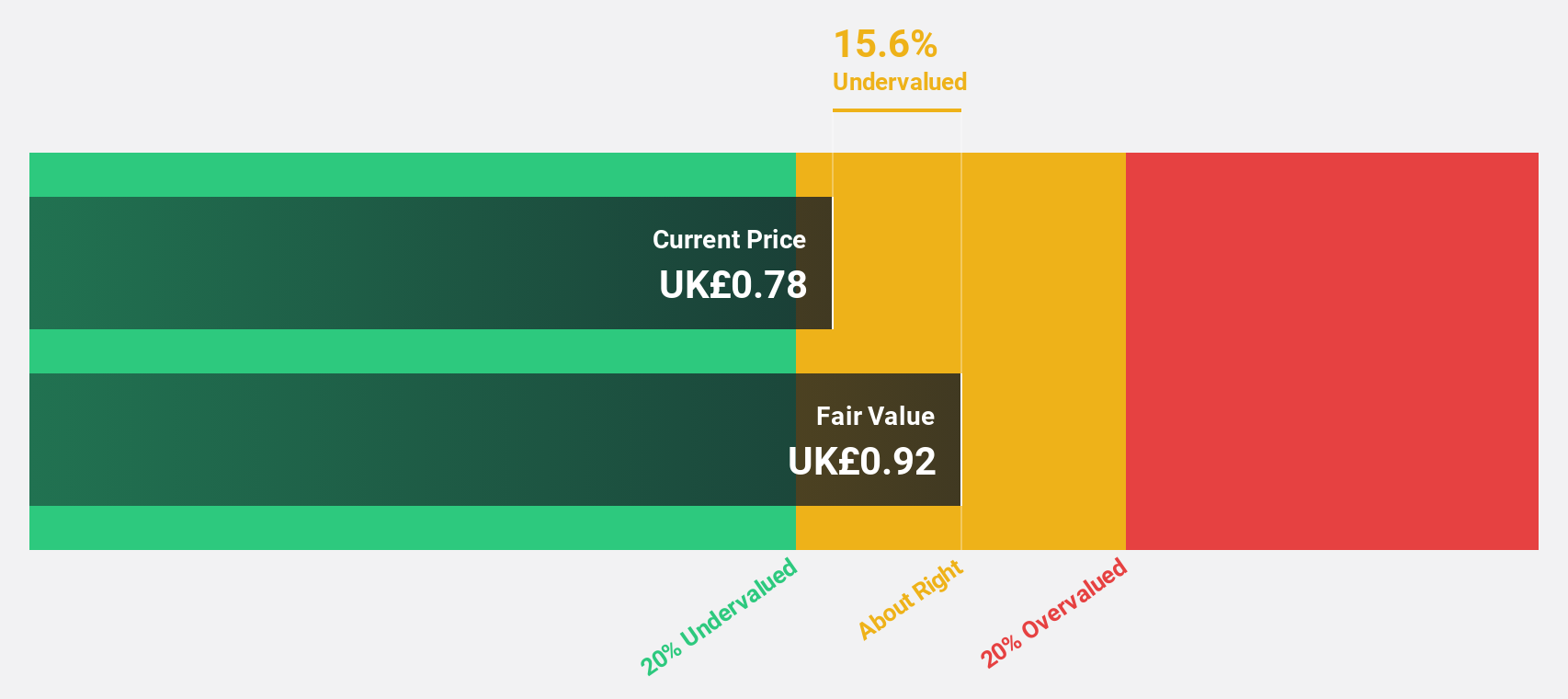

W.A.G payment solutions (LSE:WPS)

Overview: W.A.G payment solutions plc operates an integrated payments and mobility platform targeting the commercial road transportation industry in Europe, with a market cap of £452.68 million.

Operations: The company generates revenue primarily from its Payment Solutions segment, which accounts for €2.11 billion, and its Mobility Solutions segment, contributing €125.57 million.

Estimated Discount To Fair Value: 24.3%

W.A.G payment solutions is trading at £0.66, below its estimated fair value of £0.87, highlighting potential undervaluation based on cash flows. Despite a forecasted revenue decline of 71.6% annually over the next three years, earnings are expected to grow significantly at 34.7% per year, outpacing the UK market average growth rate. Recent guidance suggests low-teen net revenue growth for 2025, and a special dividend of 3 pence per share has been proposed pending shareholder approval.

- Our comprehensive growth report raises the possibility that W.A.G payment solutions is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of W.A.G payment solutions.

Next Steps

- Explore the 53 names from our Undervalued UK Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:JUST

Just Group

Provides various retirement income products and services to individual, homeowners, and corporate clients in the United Kingdom.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives