- United Kingdom

- /

- Healthcare Services

- /

- AIM:CVSG

Exploring 3 Undervalued Small Caps In Global With Insider Action

Reviewed by Simply Wall St

In recent weeks, global markets have experienced notable movements, with major U.S. stock indexes reaching all-time highs, driven in part by the Federal Reserve's decision to cut interest rates for a third consecutive meeting. The small-cap Russell 2000 Index outperformed its larger peers, reflecting its sensitivity to interest rate changes and highlighting the potential opportunities within smaller companies during such economic shifts. In this context of fluctuating market dynamics and monetary policy adjustments, identifying stocks that exhibit strong fundamentals and strategic insider actions can be particularly appealing for investors seeking value in the small-cap space.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.3x | 0.9x | 25.83% | ★★★★★★ |

| Norcros | 13.5x | 0.7x | 42.15% | ★★★★★☆ |

| A.G. BARR | 14.6x | 1.7x | 47.73% | ★★★★☆☆ |

| PSC | 9.6x | 0.4x | 21.44% | ★★★★☆☆ |

| Chinasoft International | 20.5x | 0.6x | -1147.45% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 45.23% | ★★★★☆☆ |

| Kendrion | 29.3x | 0.7x | 41.99% | ★★★☆☆☆ |

| Amaero | NA | 65.0x | 31.36% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.3x | 0.4x | -410.57% | ★★★☆☆☆ |

| Betr Entertainment | NA | 1.5x | 10.37% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

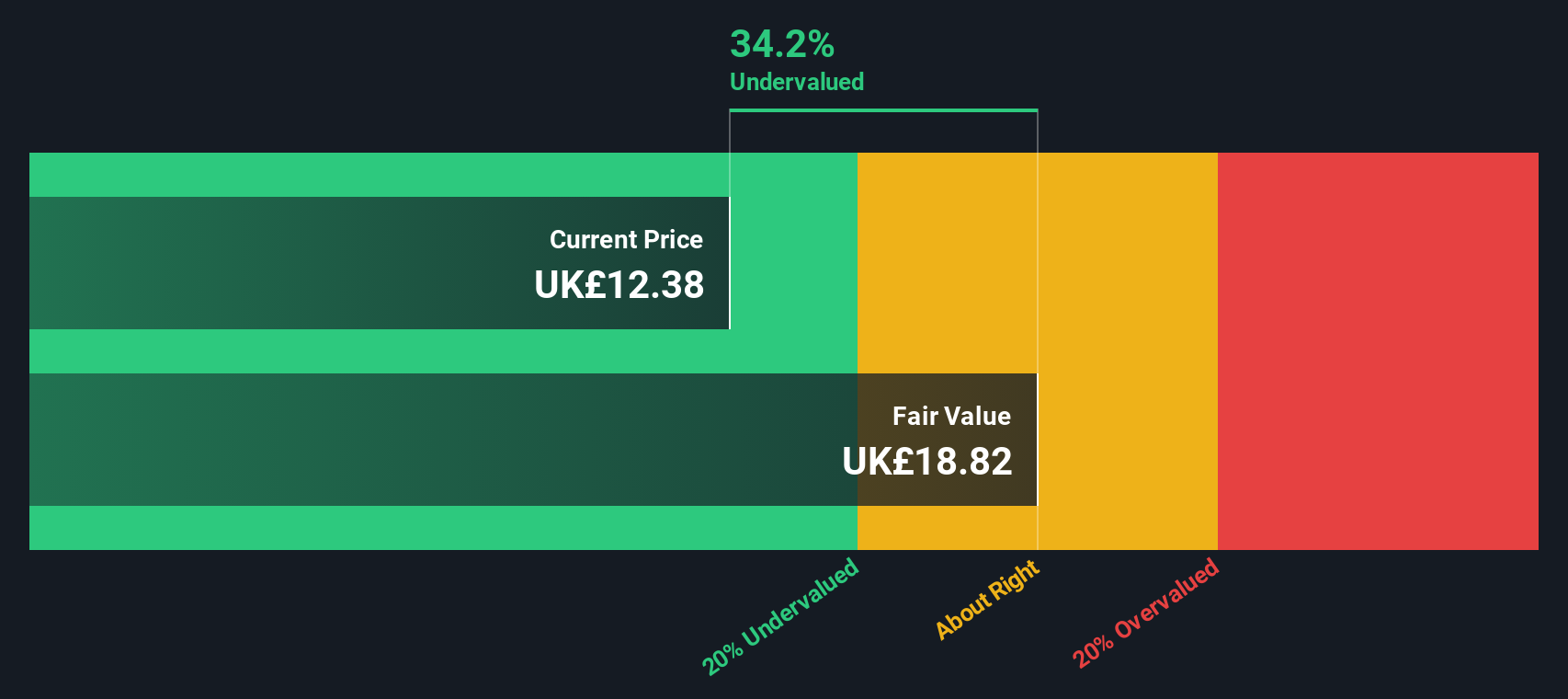

CVS Group (AIM:CVSG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: CVS Group operates primarily in the veterinary services industry, offering laboratory services, veterinary practices, and an online retail business, with a market capitalization of approximately £1.44 billion.

Operations: CVS Group generates revenue primarily from its Veterinary Practices (£616.1 million) and Online Retail Business (£45.9 million), with a smaller contribution from Laboratories (£31.4 million). The company has experienced fluctuations in its net income margin, peaking at 8.17% for the period ending June 30, 2023, before decreasing to 2.81% by December 18, 2025. Operating expenses are significant and have varied over time, impacting profitability alongside non-operating expenses such as interest costs or other financial charges.

PE: 47.4x

CVS Group, a smaller company with potential for growth, has announced a share repurchase program of up to £20 million to optimize capital allocation. Despite earnings not fully covering interest payments, the company's earnings are forecasted to grow 18.41% annually. Recent financial results showed sales rising to £673.2 million from £638.7 million in the previous year, with net income significantly increasing from £6.2 million to £52.8 million, indicating improving profitability amidst its higher-risk funding structure reliant on external borrowing.

- Click here and access our complete valuation analysis report to understand the dynamics of CVS Group.

Assess CVS Group's past performance with our detailed historical performance reports.

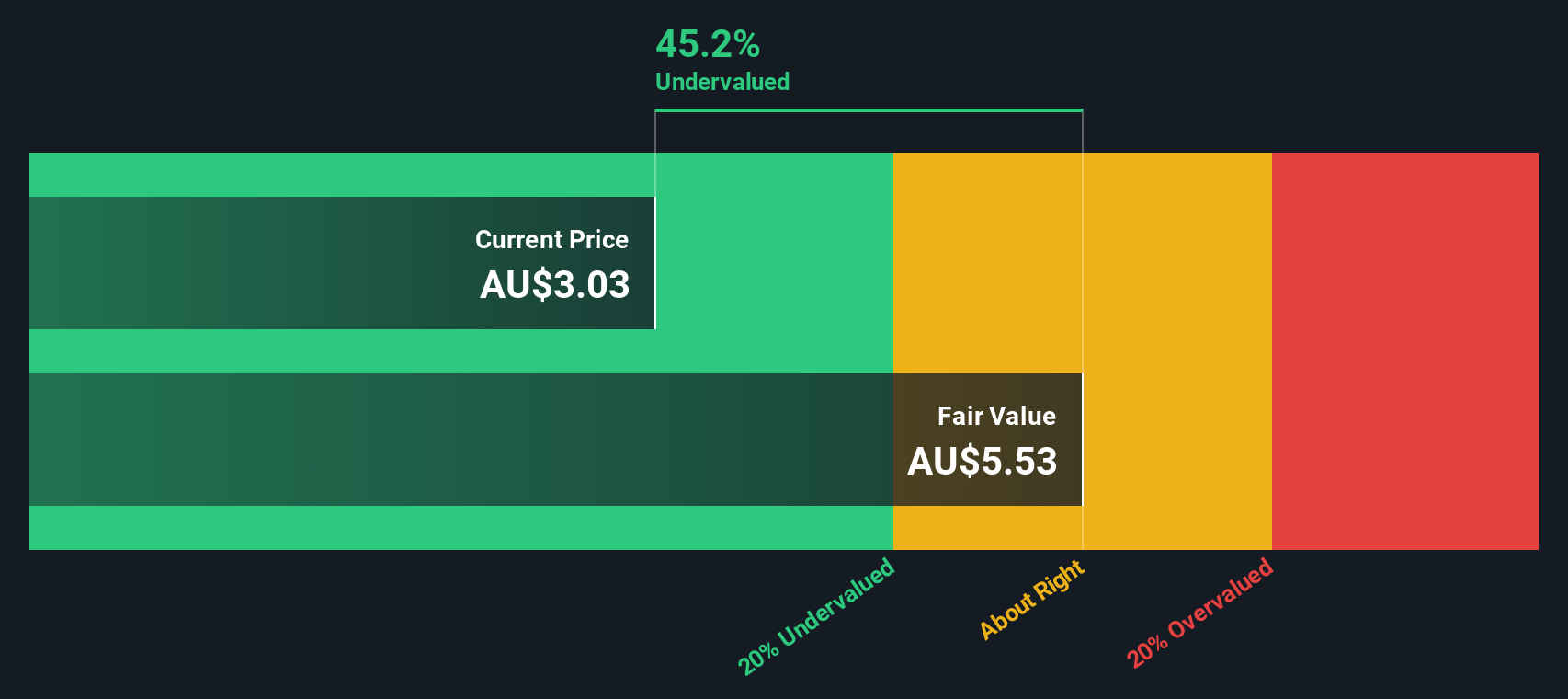

DigiCo Infrastructure REIT (ASX:DGT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: DigiCo Infrastructure REIT is a diversified owner, operator, and developer of data centres with a market capitalization of A$1.75 billion.

Operations: Revenue is primarily derived from data centre operations, totaling A$171 million. The gross profit margin stands at 59.39%. Operating expenses are A$93.45 million, with significant non-operating expenses of A$109.95 million impacting net income, which is reported as a loss of A$101.85 million.

PE: -14.9x

DigiCo Infrastructure REIT, a smaller player in its sector, is currently trading below intrinsic value. Earnings are projected to grow by 30% annually, suggesting potential for significant returns. Insider confidence is evident with recent share purchases in the past six months. However, reliance on external borrowing poses risks due to lack of customer deposits. Recent board changes and a confirmed A$0.06 dividend for December highlight active management and shareholder engagement as the company positions itself for future growth.

- Take a closer look at DigiCo Infrastructure REIT's potential here in our valuation report.

Understand DigiCo Infrastructure REIT's track record by examining our Past report.

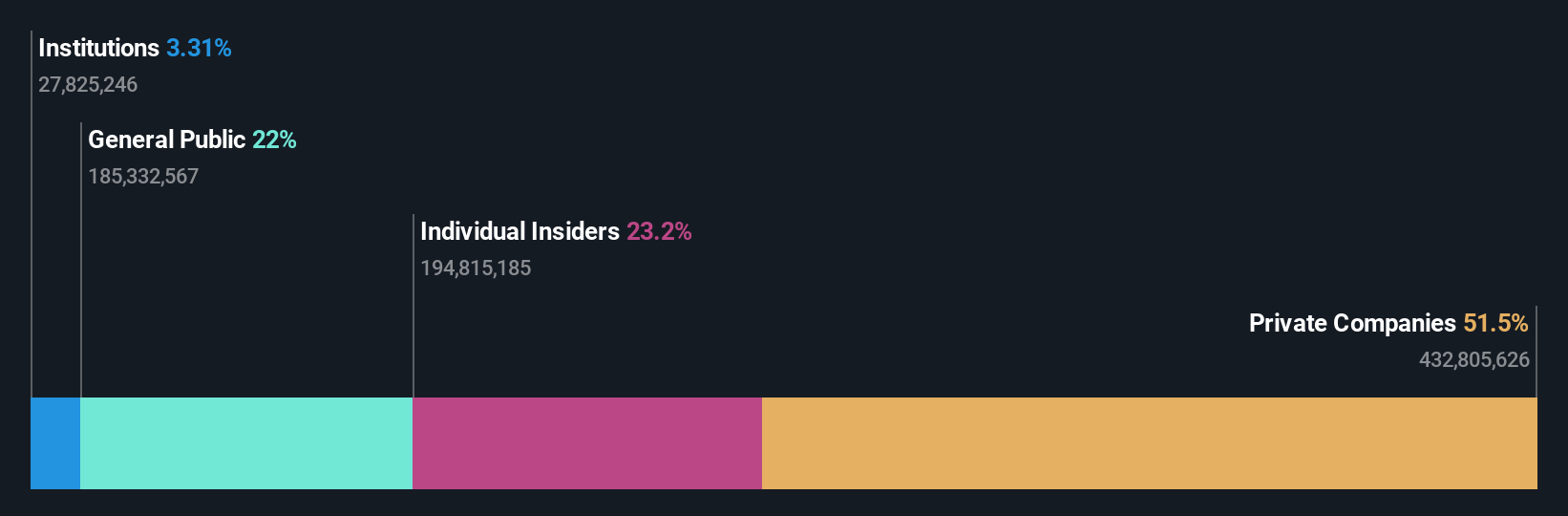

Centurion (SGX:OU8)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Centurion is a company primarily engaged in providing accommodation services, focusing on workers and student housing, with a market capitalization of S$0.57 billion.

Operations: The company primarily generates revenue from Workers Accommodation at SGD 304.98 million and Student Accommodation at SGD 52.07 million. Over recent periods, the net profit margin has shown a significant upward trend, reaching as high as 101.51% in the latest reporting period ending December 2024. Operating expenses have been consistently managed with General & Administrative Expenses being a major component, while non-operating income has positively impacted net income figures in several quarters.

PE: 3.6x

Centurion's recent acquisition of a London property for £41 million (approximately S$71 million) marks its strategic entry into the city, enhancing its UK portfolio with a 225-bed Purpose-Built Student Accommodation. This expansion aligns with Centurion's focus on high-demand student hubs and follows their successful REIT listing. Although facing forecasted earnings declines and high debt reliance, insider confidence remains evident with substantial share purchases in the past year. The company's strategic moves suggest potential growth amid market demand-supply imbalances.

- Unlock comprehensive insights into our analysis of Centurion stock in this valuation report.

Evaluate Centurion's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Dive into all 142 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CVSG

CVS Group

Engages in veterinary, online pharmacy, and retail businesses in the United Kingdom and Australia.

Fair value with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion