- United Kingdom

- /

- Media

- /

- LSE:FOUR

3 Top Undervalued Small Caps On UK Exchange With Insider Buying

Reviewed by Simply Wall St

In recent weeks, the United Kingdom's market has been influenced by global economic shifts, particularly the faltering trade data from China, which has impacted major indices like the FTSE 100 and FTSE 250. As investors navigate these challenging conditions, small-cap stocks on UK exchanges present intriguing opportunities due to their potential for growth and resilience in a fluctuating economic landscape. Identifying promising small-cap stocks often involves examining factors such as insider buying activity and valuation metrics that suggest they may be undervalued relative to their intrinsic worth.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Warpaint London | 18.6x | 3.2x | 32.97% | ★★★★★☆ |

| Bytes Technology Group | 20.6x | 5.3x | 18.42% | ★★★★★☆ |

| 4imprint Group | 17.1x | 1.4x | 32.29% | ★★★★★☆ |

| Stelrad Group | 11.7x | 0.6x | 19.20% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 26.80% | ★★★★★☆ |

| Telecom Plus | 17.7x | 0.7x | 27.19% | ★★★★☆☆ |

| Gamma Communications | 23.1x | 2.4x | 33.62% | ★★★★☆☆ |

| CVS Group | 28.2x | 1.1x | 38.91% | ★★★★☆☆ |

| Franchise Brands | 40.6x | 2.1x | 21.96% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 45.80% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

CVS Group (AIM:CVSG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CVS Group operates primarily in the veterinary services industry, encompassing veterinary practices, laboratories, crematoria, and an online retail business, with a market capitalization of approximately £1.5 billion.

Operations: The primary revenue stream comes from Veterinary Practices, contributing £577.50 million, followed by Online Retail Business at £50 million and Laboratories at £31.60 million. The gross profit margin has shown fluctuations, recently recorded at 43.13% as of December 2023. Central Administration impacts overall financial performance with a negative contribution of -£23.80 million to the revenue segments.

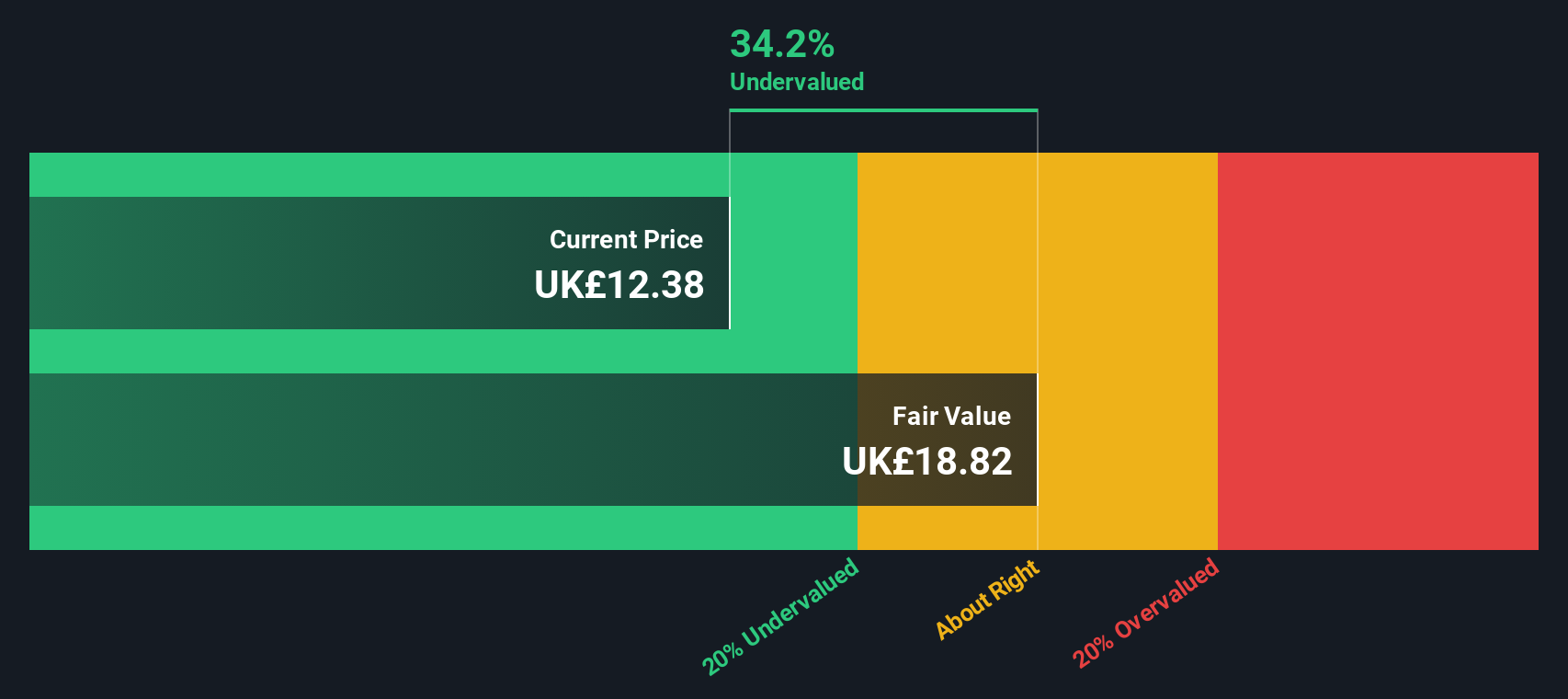

PE: 28.2x

CVS Group, a smaller company in the UK, has recently seen insider confidence with share purchases over the past year. Despite a drop in profit margins from 8.2% to 4%, earnings are projected to grow by 15.03% annually, hinting at potential future gains. However, it's burdened with high debt and relies entirely on external borrowing for funding. This financial structure presents risks but also opportunities if growth forecasts materialize positively in the coming years.

- Unlock comprehensive insights into our analysis of CVS Group stock in this valuation report.

Understand CVS Group's track record by examining our Past report.

4imprint Group (LSE:FOUR)

Simply Wall St Value Rating: ★★★★★☆

Overview: 4imprint Group is a company specializing in the direct marketing of promotional products, with significant operations in North America and the UK & Ireland, and a market capitalization of approximately £1.14 billion.

Operations: The company generates significant revenue primarily from North America, contributing $1.33 billion, with a smaller portion from the UK & Ireland at $25 million. Over recent periods, the gross profit margin has shown an upward trend, reaching 29.77% as of June 2024. Operating expenses include notable allocations towards sales and marketing efforts, which have been increasing alongside revenue growth.

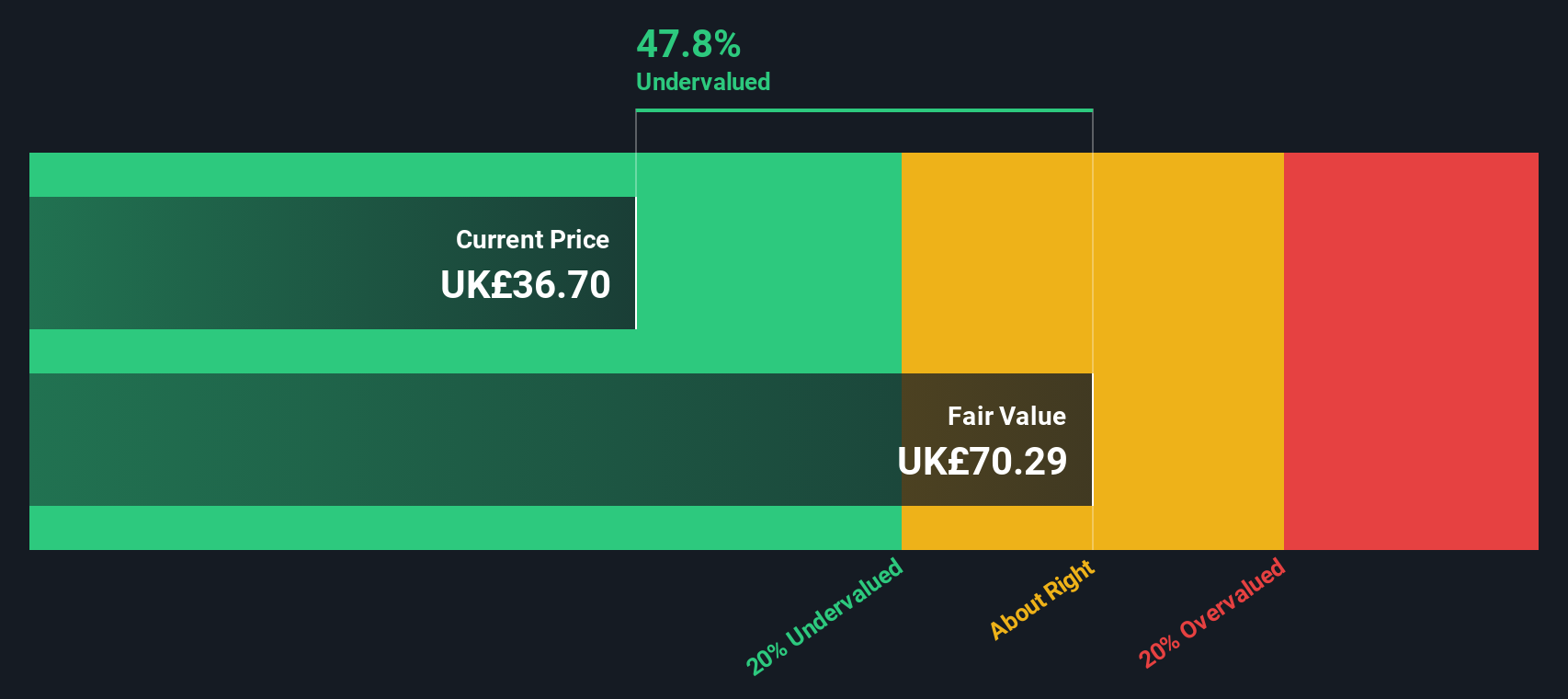

PE: 17.1x

4imprint Group, a UK-based company, shows potential as an undervalued investment despite relying solely on external borrowing for funding. Their revenue is projected to grow by 4.34% annually, indicating steady business momentum. Insider confidence is evident with recent share purchases in the past year, suggesting belief in future prospects. The upcoming fiscal year 2024 sales statement on January 21, 2025, will provide further insights into their performance trajectory and market positioning amidst industry challenges.

- Click here and access our complete valuation analysis report to understand the dynamics of 4imprint Group.

Assess 4imprint Group's past performance with our detailed historical performance reports.

Safestore Holdings (LSE:SAFE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Safestore Holdings is a leading provider of self-storage accommodation and related services, with a market capitalization of approximately £2.65 billion.

Operations: The company generates revenue primarily through the provision of self-storage accommodation and related services, with recent figures showing a revenue of £223.4 million. Over time, there has been a notable trend in its net income margin, which reached 1.67% as of October 2024. Operating expenses have decreased to £16.1 million by the same period, contributing to the financial outcome observed.

PE: 3.5x

Safestore Holdings, a UK-based storage company, showcases insider confidence with CEO Frederic Vecchioli acquiring 65,000 shares valued at £408,492 in early 2025. Despite a slight dip in annual revenue to £223.4 million from the previous year, net income surged to £372.3 million. The company's reliance on external borrowing poses higher risk but its forecasted 6.52% revenue growth offers potential upside. A modest dividend increase further highlights investor appeal amidst expected earnings decline over the next three years.

- Navigate through the intricacies of Safestore Holdings with our comprehensive valuation report here.

Where To Now?

- Click here to access our complete index of 35 Undervalued UK Small Caps With Insider Buying.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FOUR

4imprint Group

Operates as a direct marketer of promotional products in North America, the United Kingdom, and Ireland.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives