- United Kingdom

- /

- Healthtech

- /

- AIM:COG

There's Reason For Concern Over Cambridge Cognition Holdings Plc's (LON:COG) Massive 35% Price Jump

Cambridge Cognition Holdings Plc (LON:COG) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

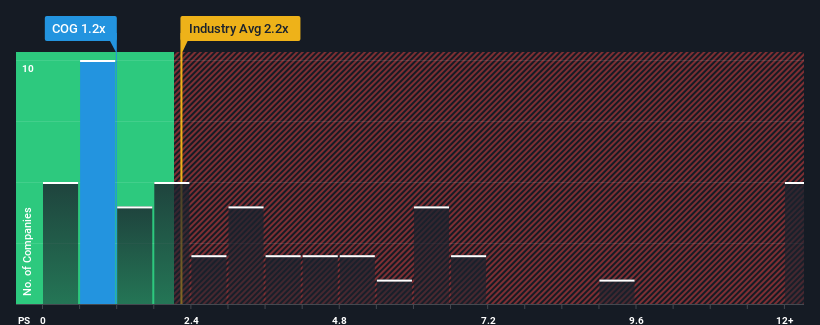

Although its price has surged higher, it's still not a stretch to say that Cambridge Cognition Holdings' price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Healthcare Services industry in the United Kingdom, where the median P/S ratio is around 1.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Cambridge Cognition Holdings

How Cambridge Cognition Holdings Has Been Performing

Cambridge Cognition Holdings could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cambridge Cognition Holdings.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Cambridge Cognition Holdings' is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 59% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to slump, contracting by 14% during the coming year according to the dual analysts following the company. That's not great when the rest of the industry is expected to grow by 7.4%.

With this information, we find it concerning that Cambridge Cognition Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Cambridge Cognition Holdings' P/S?

Its shares have lifted substantially and now Cambridge Cognition Holdings' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

While Cambridge Cognition Holdings' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Cambridge Cognition Holdings (1 can't be ignored!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:COG

Cambridge Cognition Holdings

Develops and markets digital solutions for the assessment of brain health in the United States, United Kingdom, the European Union, and internationally.

Undervalued with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.