- United Kingdom

- /

- Food

- /

- LSE:RE.

Why Investors Shouldn't Be Surprised By R.E.A. Holdings plc's (LON:RE.) 32% Share Price Surge

R.E.A. Holdings plc (LON:RE.) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 14% in the last twelve months.

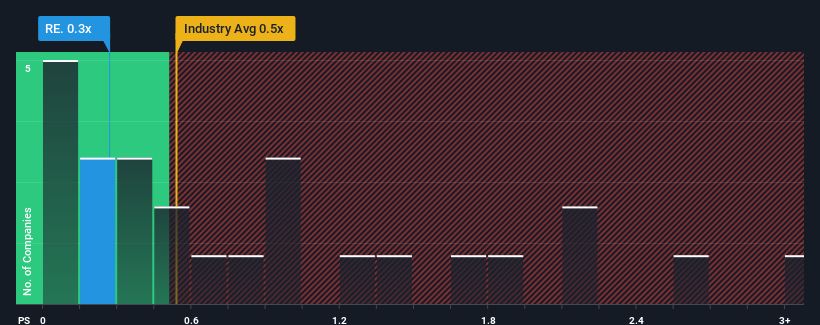

In spite of the firm bounce in price, it's still not a stretch to say that R.E.A. Holdings' price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Food industry in the United Kingdom, where the median P/S ratio is around 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for R.E.A. Holdings

What Does R.E.A. Holdings' P/S Mean For Shareholders?

R.E.A. Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on R.E.A. Holdings.How Is R.E.A. Holdings' Revenue Growth Trending?

R.E.A. Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 27% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 2.6% per annum over the next three years. That's shaping up to be similar to the 4.2% per annum growth forecast for the broader industry.

With this in mind, it makes sense that R.E.A. Holdings' P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does R.E.A. Holdings' P/S Mean For Investors?

Its shares have lifted substantially and now R.E.A. Holdings' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that R.E.A. Holdings maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for R.E.A. Holdings that you should be aware of.

If these risks are making you reconsider your opinion on R.E.A. Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RE.

R.E.A. Holdings

Engages in the cultivation of oil palms in the province of East Kalimantan in Indonesia.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives