- United Kingdom

- /

- Food

- /

- LSE:RE.

Shareholders May Be More Conservative With R.E.A. Holdings plc's (LON:RE.) CEO Compensation For Now

The underwhelming share price performance of R.E.A. Holdings plc (LON:RE.) in the past three years would have disappointed many shareholders. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 10 June 2021. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for R.E.A. Holdings

Comparing R.E.A. Holdings plc's CEO Compensation With the industry

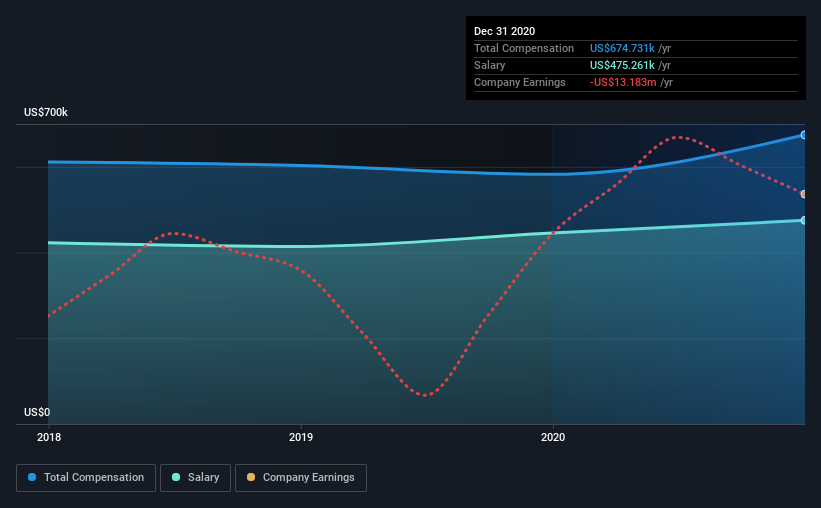

At the time of writing, our data shows that R.E.A. Holdings plc has a market capitalization of UK£22m, and reported total annual CEO compensation of US$675k for the year to December 2020. That's a notable increase of 16% on last year. We note that the salary portion, which stands at US$475.3k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below UK£141m, reported a median total CEO compensation of US$345k. Accordingly, our analysis reveals that R.E.A. Holdings plc pays Carol Gysin north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$475k | US$446k | 70% |

| Other | US$199k | US$137k | 30% |

| Total Compensation | US$675k | US$582k | 100% |

On an industry level, roughly 70% of total compensation represents salary and 30% is other remuneration. R.E.A. Holdings is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at R.E.A. Holdings plc's Growth Numbers

R.E.A. Holdings plc has seen its earnings per share (EPS) increase by 27% a year over the past three years. Its revenue is up 11% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has R.E.A. Holdings plc Been A Good Investment?

Few R.E.A. Holdings plc shareholders would feel satisfied with the return of -85% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for R.E.A. Holdings that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade R.E.A. Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:RE.

R.E.A. Holdings

Engages in the cultivation of oil palms in the province of East Kalimantan in Indonesia.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives