- United Kingdom

- /

- Food

- /

- LSE:RE.

Investors Appear Satisfied With R.E.A. Holdings plc's (LON:RE.) Prospects As Shares Rocket 28%

R.E.A. Holdings plc (LON:RE.) shares have continued their recent momentum with a 28% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 42% in the last year.

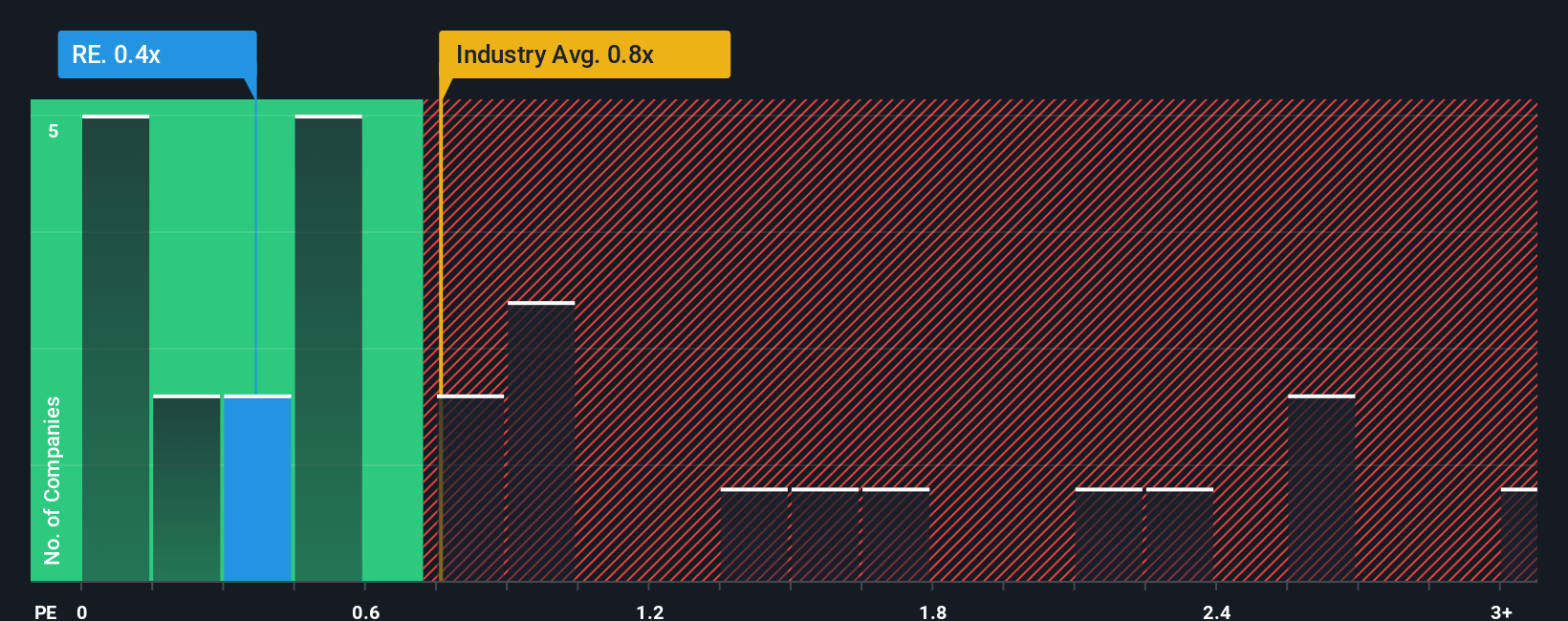

Even after such a large jump in price, there still wouldn't be many who think R.E.A. Holdings' price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in the United Kingdom's Food industry is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for R.E.A. Holdings

What Does R.E.A. Holdings' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, R.E.A. Holdings has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on R.E.A. Holdings will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For R.E.A. Holdings?

R.E.A. Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.3% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 6.3% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 4.5% during the coming year according to the sole analyst following the company. With the industry predicted to deliver 2.9% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that R.E.A. Holdings' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On R.E.A. Holdings' P/S

Its shares have lifted substantially and now R.E.A. Holdings' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A R.E.A. Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Food industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 2 warning signs for R.E.A. Holdings (1 is a bit concerning!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RE.

R.E.A. Holdings

Engages in the cultivation of oil palms in the province of East Kalimantan in Indonesia.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives