- United Kingdom

- /

- Tobacco

- /

- LSE:IMB

Imperial Brands (LSE:IMB) Sees Strong Revenue Growth Amid Market Challenges and Strategic NGP Expansion

Imperial Brands (LSE:IMB) is currently navigating a complex landscape marked by robust financial performance and significant external pressures. Recent news highlights a notable 2.8% growth in net revenue and a strong pricing strategy, but also underscores challenges such as high inflation and regulatory changes. In the discussion that follows, we will delve into the core strengths, weaknesses, opportunities, and threats facing Imperial Brands, providing a comprehensive analysis of its strategic positioning and future prospects.

Click here to discover the nuances of Imperial Brands with our detailed analytical report.

Strengths: Core Advantages Driving Sustained Success for Imperial Brands

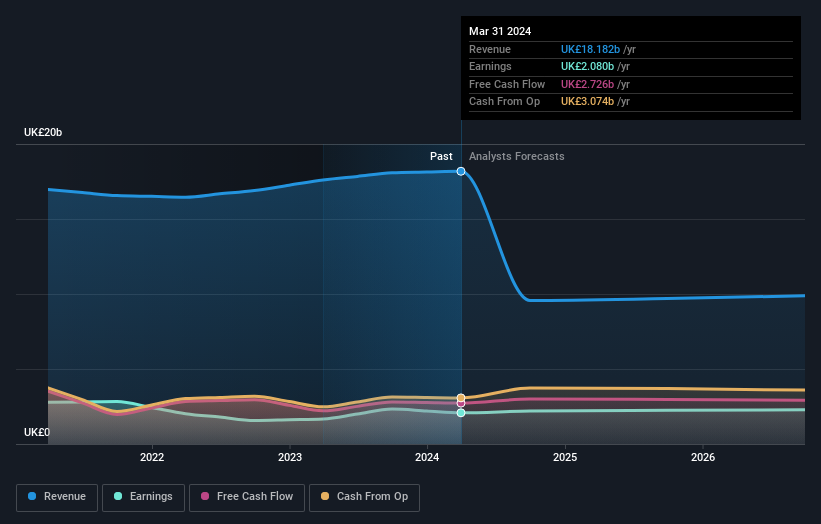

Imperial Brands has demonstrated robust financial health, marked by a 2.8% growth in net revenue, the strongest organic growth reported in over a decade, according to CEO Stefan Bomhard in the latest earnings call. This growth is further bolstered by a strong pricing strategy that has driven a 9% increase in price mix within the tobacco segment. Additionally, the company has seen significant market share gains across various markets over the past two years. IMB's next-generation products (NGP) have also shown impressive performance, with a 17% increase in revenue and improved gross margins, as highlighted by CFO Lukas Paravicini. IMB's strong cash conversion rate of 97% and a successful share buyback program, which retired 9% of its share capital, underscore its financial stability. The company's Price-To-Earnings Ratio (9.1x) is significantly lower than both the peer average (18.9x) and the Global Tobacco industry average (11.4x), indicating it is trading below its estimated fair value of £61.89. To dive deeper into how IMB's valuation metrics are shaping its market position, check out our detailed Valuation Report for IMB.

Weaknesses: Critical Issues Affecting Imperial Brands's Performance and Areas for Growth

Despite its strengths, IMB faces several challenges. The company operates in a market characterized by external pressures such as high inflation, supply chain disruptions, and evolving regulations, as noted by Bomhard. Volume declines in Europe, IMB's largest region, have been significant, although strong pricing has somewhat mitigated this impact. The company's group market share declined by 80 basis points in the first half, as pointed out by UBS analyst Mirza Faham Baig. Additionally, IMB's high level of debt skews its outstanding Return on Equity (43.35%), raising concerns about financial leverage. The company's revenue is expected to decline by 16.4% per year over the next three years, which is a stark contrast to the UK market's expected growth of 14.2% per year.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

IMB is making strategic moves to transform its business and capitalize on emerging opportunities. The company is focusing on becoming more consumer-centric and driving efficiency, as highlighted in the last earnings call. Expansion in the next-generation products (NGP) segment, particularly in Europe—the world's largest NGP region—presents a significant growth opportunity. Innovative product launches, such as the blu bar in the disposable vaping category, are also expected to enhance IMB's market position. The U.S. market also offers potential, especially in the mass-market cigar segment, which IMB aims to benefit from. These strategic initiatives could help IMB leverage its strengths and mitigate some of the financial challenges it faces. To understand how these initiatives could build on previous efforts, visit the IMB’s Past Performance Report.

Threats: Key Risks and Challenges That Could Impact Imperial Brands's Success

IMB operates in a highly competitive industry prone to disruptive changes, as acknowledged by Bomhard. Economic pressures, including inflation and a squeeze on consumer wallets, pose significant risks. Regulatory changes and shifting consumer preferences add another layer of complexity, potentially impacting IMB's market position. The company is also facing an elevated level of market size decline, which could further strain its financial performance. The volatility and unreliability of IMB's dividend payments over the past decade, combined with its high debt levels, also raise concerns about its long-term financial stability. These external factors could threaten IMB's growth and market share, necessitating careful strategic planning and execution.

Conclusion

In conclusion, Imperial Brands stands out as an attractive investment opportunity due to its strong financial health, highlighted by a robust cash conversion rate and an impressive share buyback program. While the company faces challenges such as high inflation, supply chain issues, and regulatory shifts, its strategic emphasis on next-generation products and market expansion—especially in Europe and the U.S.—presents significant growth potential. Additionally, IMB's Price-To-Earnings Ratio of 9.1x, well below the peer average of 18.9x and the Global Tobacco industry average of 11.4x, suggests that the stock is undervalued relative to its estimated fair value of £61.89. This positioning underscores IMB's potential for future performance, making it a compelling choice for investors seeking value within the tobacco sector.

Already own IMB? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:IMB

Imperial Brands

Manufactures, imports, markets, and sells tobacco and tobacco-related products in Europe, the Americas, Africa, the Asia, Australasia, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives