- United Kingdom

- /

- Beverage

- /

- LSE:DGE

Diageo LSE:DGE eyes growth with Baileys Cinnamon Churros launch amid board changes and market volatility

Reviewed by Simply Wall St

Diageo (LSE:DGE) is navigating a complex environment characterized by both growth and hurdles. Recent developments include a strategic push into key markets and innovative product launches, contrasted with a 0.6% decline in group organic net sales and inflationary pressures. In the discussion that follows, we will explore Diageo's financial health, operational challenges, strategic growth opportunities, and external threats to provide a comprehensive overview of the company's current business situation.

Click to explore a detailed breakdown of our findings on Diageo.

Competitive Advantages That Elevate Diageo

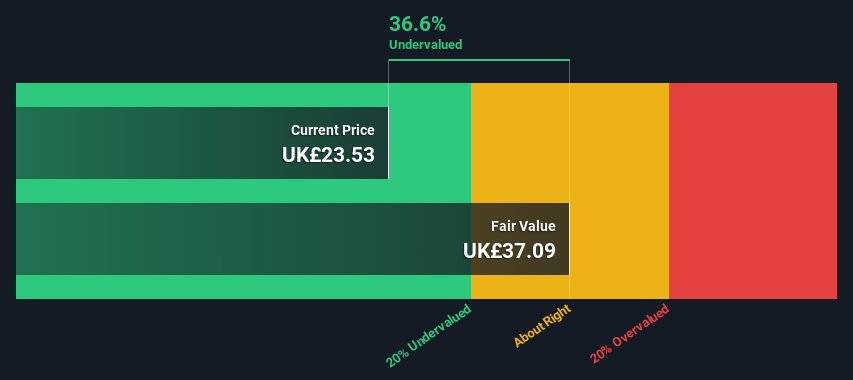

Diageo has demonstrated resilience through strategic growth in regions like Africa, Asia Pacific, and Europe, where organic net sales increased by 1.8%. This expansion is complemented by market share gains in over 75% of its net sales value, particularly in the U.S. The company's focus on premiumization continues to drive growth, as highlighted by Lavanya Chandrashekar, CFO, in the latest earnings call. Furthermore, Diageo's productivity savings of nearly $700 million and free cash flow generation of $2.6 billion underscore its strong operational efficiency. Despite trading at £25.88, significantly below its estimated fair value of £48.37, its Price-To-Earnings Ratio of 19.4x remains higher than both peer and industry averages, suggesting a premium valuation.

Challenges Constraining Diageo's Potential

The company faces several challenges, including a 0.6% drop in group organic net sales, primarily due to weaker performance in Latin America and the Caribbean (LAC). The cautious consumer environment and persistent margin pressures from salary inflation in emerging markets further constrain profitability. Additionally, Diageo's high debt-to-equity ratio of 181.3% indicates financial leverage that could be risky, especially since its debt is not well covered by operating cash flow. The recent earnings call also highlighted inventory management issues, particularly in the Tequila and Scotch segments, where competitive activity and down trading have impacted market share.

Potential Strategies for Leveraging Growth and Competitive Advantage

Looking forward, Diageo is poised to capitalize on its expansion into key markets and its innovation pipeline, including new product launches like the Baileys Cinnamon Churros Irish Cream Liqueur. Strategic investments, such as the construction of a second brewery for Guinness in Ireland, are set to bolster production capacity and market presence. Strengthening consumer insights to identify growth opportunities will further enhance Diageo's competitive edge. The appointment of Manik Hiru Jhangiani as a director could also bring fresh perspectives to the board, aligning with the company's strategic goals.

Market Volatility Affecting Diageo's Position

Despite its strategic initiatives, Diageo faces threats from intensifying competition and economic pressures. The volatile political environment and regulatory challenges pose risks to its operations and consumer sentiment. Additionally, market volatility in Latin America remains a concern, as highlighted by CEO Debra Crew in the earnings call. While the company navigates these challenges, the departure of Alan Stewart from the board and the termination of Lavanya Chandrashekar as a director may lead to transitional uncertainties. These factors could impact Diageo's ability to maintain its market position and achieve long-term growth objectives.

To gain deeper insights into Diageo's historical performance, explore our detailed analysis of past performance. To dive deeper into how Diageo's valuation metrics are shaping its market position, check out our detailed analysis of Diageo's Valuation.Conclusion

Diageo's strategic growth in diverse regions and its focus on premiumization have fortified its market position, yet the company faces challenges that could impede its full potential. The high debt-to-equity ratio and inventory management issues, particularly in the Tequila and Scotch segments, highlight operational risks that need addressing. Despite these challenges, Diageo's trading price of £25.88, well below its estimated fair value of £48.37, suggests a potential opportunity for investors who believe in its long-term growth strategies and market expansion efforts. However, the company's ability to navigate market volatility, regulatory challenges, and transitional uncertainties will be crucial in determining its future performance and ability to close the gap between its current trading price and estimated fair value.

Turning Ideas Into Actions

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:DGE

Diageo

Engages in the production, marketing, and sale of alcoholic beverages.

Established dividend payer and fair value.

Market Insights

Community Narratives