- United Kingdom

- /

- Beverage

- /

- LSE:CCR

Investors in C&C Group (LON:CCR) from a year ago are still down 22%, even after 7.6% gain this past week

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by C&C Group plc (LON:CCR) shareholders over the last year, as the share price declined 22%. That contrasts poorly with the market decline of 2.0%. However, the longer term returns haven't been so bad, with the stock down 16% in the last three years. Furthermore, it's down 12% in about a quarter. That's not much fun for holders.

The recent uptick of 7.6% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for C&C Group

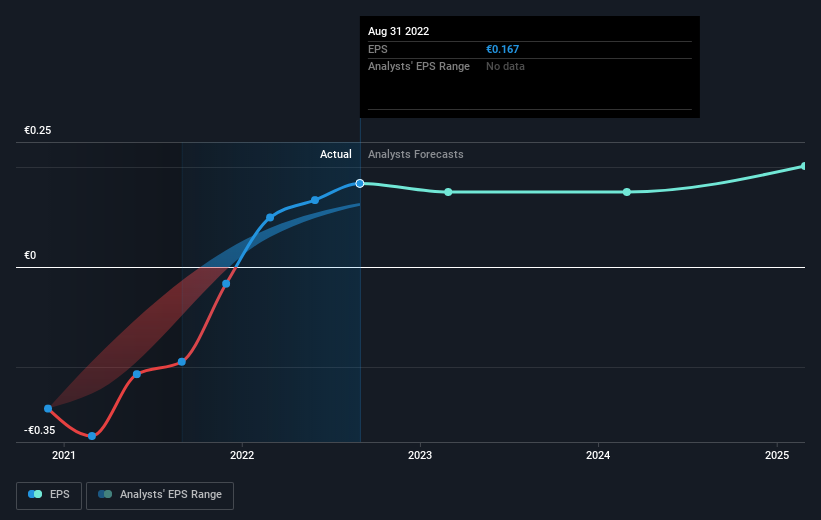

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year C&C Group grew its earnings per share, moving from a loss to a profit.

The result looks like a strong improvement to us, so we're surprised the market has sold down the shares. If the company can sustain the earnings growth, this might be an inflection point for the business, which would make right now a really interesting time to study it more closely.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that C&C Group has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

C&C Group shareholders are down 22% for the year, falling short of the market return. The market shed around 2.0%, no doubt weighing on the stock price. The three-year loss of 3% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: C&C Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CCR

C&C Group

Manufactures, markets, and distributes beer, cider, wine, spirits, and soft drinks in the Republic of Ireland, Great Britain, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives