- United Kingdom

- /

- Tobacco

- /

- LSE:BATS

Investors Still Waiting For A Pull Back In British American Tobacco p.l.c. (LON:BATS)

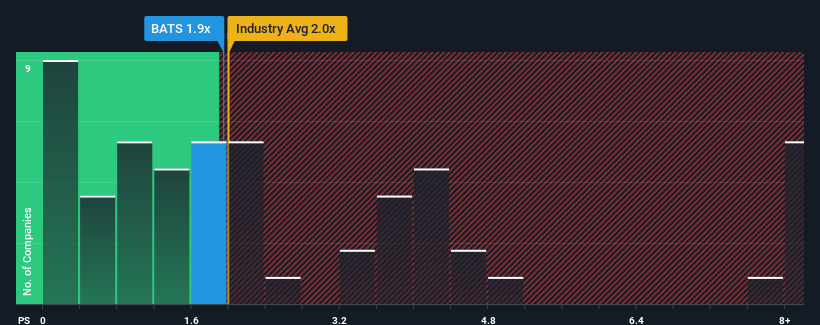

British American Tobacco p.l.c.'s (LON:BATS) price-to-sales (or "P/S") ratio of 1.9x may not look like an appealing investment opportunity when you consider close to half the companies in the Tobacco industry in the United Kingdom have P/S ratios below 0.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for British American Tobacco

What Does British American Tobacco's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, British American Tobacco's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on British American Tobacco.How Is British American Tobacco's Revenue Growth Trending?

In order to justify its P/S ratio, British American Tobacco would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.3%. Regardless, revenue has managed to lift by a handy 5.8% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 1.7% per annum during the coming three years according to the analysts following the company. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 2.1% each year, that would be a solid result.

With this in mind, we see why British American Tobacco's P/S is a cut above its industry peers. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of British American Tobacco's analyst forecasts revealed that its superior revenue outlook against a shaky industry is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with British American Tobacco, and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if British American Tobacco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BATS

British American Tobacco

Engages in the provision of tobacco and nicotine products to consumers worldwide.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives