- United Kingdom

- /

- Tobacco

- /

- LSE:BATS

British American Tobacco (LSE:BATS) Appoints New Chief Corporate Officer, Affirms Dividend Amid Growth

British American Tobacco (LSE:BATS) is navigating a complex environment marked by both significant growth in new categories and substantial challenges in its traditional markets. Recent developments include a 1.4 million increase in smokeless consumers and a 6.9% decline in combustible volumes, alongside macroeconomic and regulatory pressures. In the discussion that follows, we will delve into British American Tobacco's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Take a closer look at British American Tobacco's potential here.

Strengths: Core Advantages Driving Sustained Success For British American Tobacco

British American Tobacco (BAT) has shown significant growth in its new categories, adding 1.4 million smokeless consumers, reaching a total of 26.4 million. This segment now accounts for 18% of group revenue, an increase of 1.4 percentage points compared to the previous year, as highlighted by CEO Tadeu Marroco in the latest earnings call. The company's commitment to rewarding shareholders with strong cash returns further underscores its financial health. CFO Soraya Benchikh noted that new category revenue growth in the first half was driven by an excellent performance from Velo across all regions. Additionally, BAT delivered a 4.3% combustible price mix, with pricing up 7.2%, which showcases operational efficiency. Despite being expensive based on its Price-To-Sales Ratio (2.4x) compared to the Global Tobacco industry average (2.2x), BAT is trading below the estimated fair value of £67.25, indicating potential undervaluation. To dive deeper into how British American Tobacco's valuation metrics are shaping its market position, check out our detailed analysis of British American Tobacco's Valuation.

Weaknesses: Critical Issues Affecting British American Tobacco's Performance and Areas For Growth

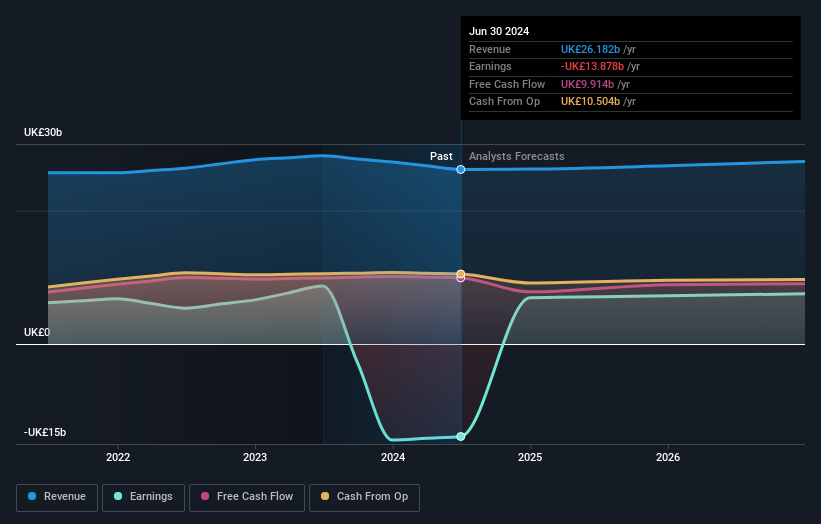

BAT faces several critical challenges, including declining combustible volumes, which fell by 6.9% on an organic basis, as noted by Soraya Benchikh. The company's exit from the Russian and Belarusian markets has also negatively impacted reported results. Additionally, macroeconomic headwinds in the U.S. have further strained the group's performance. Regulatory challenges persist, with the proliferation of illicit products in the U.S. eroding market share. The company's unprofitability, with losses increasing at a rate of 41.4% per year over the past five years, and a negative Return on Equity of -25.09%, further highlight its financial struggles.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

BAT has several strategic opportunities to enhance its market position. The company is investing heavily in 2024, as stated by CEO Tadeu Marroco, with expectations of accelerating new category performance in the second half. The innovation pipeline is robust, with revenue in the APMEA region growing by 48%, indicating significant market expansion potential. Regulatory advocacy remains a focus, with efforts to promote appropriate regulation and enforcement of new categories. These strategic investments and market expansions can potentially offset the financial challenges and position BAT for sustained growth. The company's forecasted annual profit growth of 46.45% per year and expected profitability over the next three years, which is considered above average market growth, further underscore its growth potential.

Threats: Key Risks and Challenges That Could Impact British American Tobacco's Success

BAT faces significant threats from external factors, including competition from illicit products, particularly in the U.S. market. Soraya Benchikh highlighted the growing proliferation of illegal single-use vapor products, which continues to erode market share. Economic factors such as high inflation and interest rates have also impacted consumer behavior, as noted by Tadeu Marroco. Regulatory risks remain a concern, with the success of legal products heavily dependent on FDA actions to tackle illicit vapor. Market volatility, with net finance costs expected to be around £1.7 billion, subject to FX and interest rate fluctuations, further adds to the company's challenges. These external factors, combined with the company's financial weaknesses, could significantly impact its competitive positioning and market share.

Conclusion

British American Tobacco (BAT) demonstrates significant strengths, particularly in its growing new categories and operational efficiency, which contribute to its financial health and shareholder returns. However, the company faces critical weaknesses, including declining combustible volumes and financial challenges, such as increasing losses and a negative Return on Equity. Strategic opportunities, such as heavy investments in 2024 and a strong innovation pipeline, offer potential for market expansion and profit growth, which may counterbalance these weaknesses. Nevertheless, external threats like competition from illicit products and economic volatility pose significant risks. Despite being considered expensive based on its Price-To-Sales Ratio of 2.4x compared to the industry average of 2.2x, BAT is trading below its estimated fair value of £67.25, suggesting potential for future growth if it can effectively navigate these challenges.

Already own BAT? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Valuation is complex, but we're here to simplify it.

Discover if British American Tobacco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:BATS

British American Tobacco

Provides tobacco and nicotine products to consumers in the Americas, Europe, the Asia-Pacific, the Middle East, Africa, and the United States.

Average dividend payer and fair value.