- United Kingdom

- /

- Food

- /

- AIM:WYN

3 UK Dividend Stocks Yielding Up To 6.5%

Reviewed by Simply Wall St

In the last week, the United Kingdom market has remained flat, although it has experienced a 7.5% increase over the past year with earnings forecasted to grow by 14% annually. In this context, identifying dividend stocks that offer attractive yields can be a strategic way for investors to potentially benefit from both income and capital appreciation in a steady market environment.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.71% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.13% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.35% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.08% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.97% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.52% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.05% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.88% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.71% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.52% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

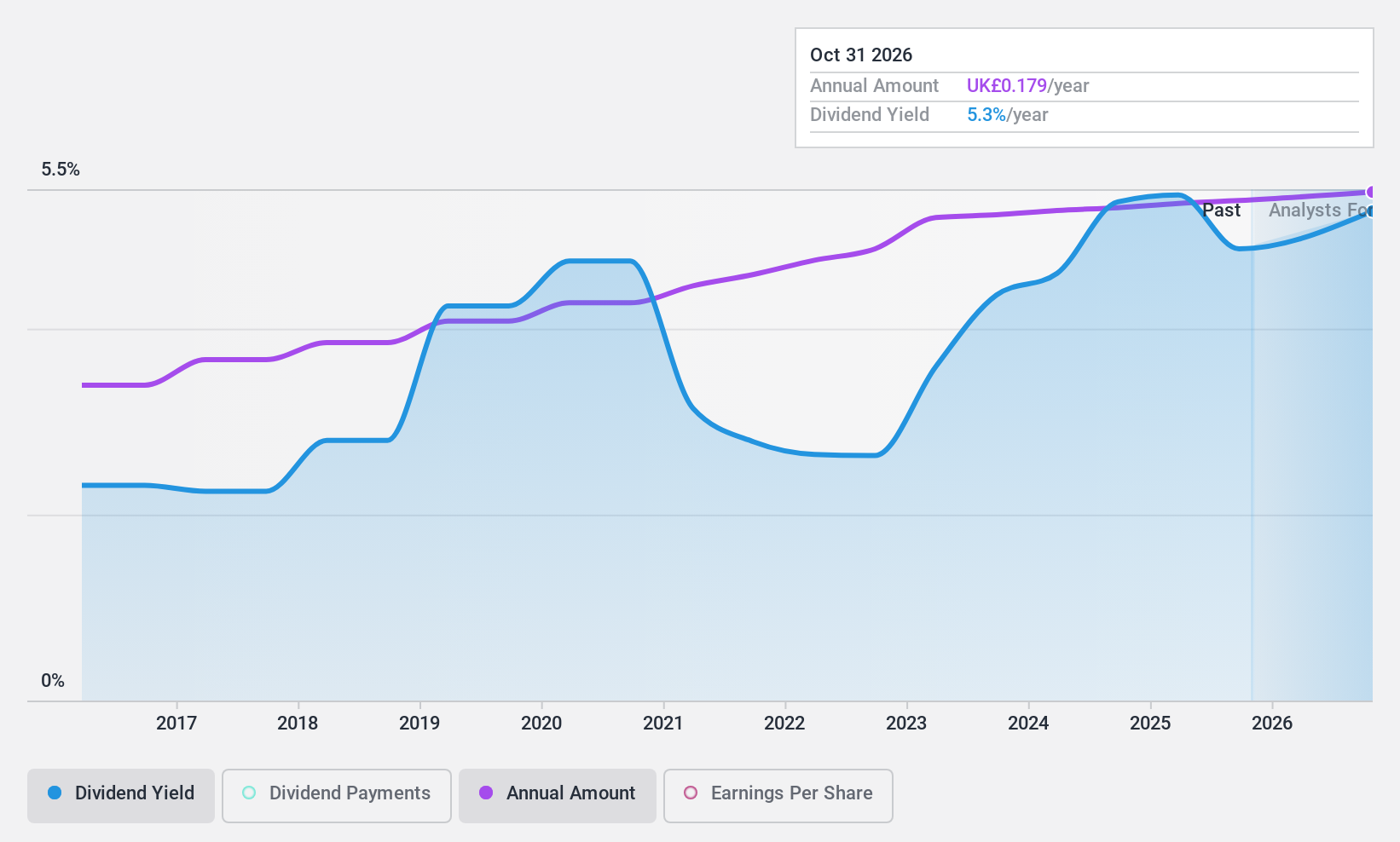

Wynnstay Group (AIM:WYN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wynnstay Group Plc manufactures and supplies agricultural products in the United Kingdom, with a market cap of £77.61 million.

Operations: Wynnstay Group's revenue is primarily derived from its Agriculture segment, generating £507.75 million, and its Specialist Agricultural Merchanting segment, contributing £147.39 million.

Dividend Yield: 5.1%

Wynnstay Group offers a reliable dividend with a 5.14% yield, although this is slightly below the top UK dividend payers. The dividends are well-covered by both earnings (payout ratio of 67.1%) and cash flows (cash payout ratio of 12.3%). Despite recent shareholder dilution, the company has maintained stable and growing dividends over the past decade. Recent executive changes include Alk Brand as CEO and Rob Thomas as CFO, potentially impacting future strategic direction.

- Click here and access our complete dividend analysis report to understand the dynamics of Wynnstay Group.

- The analysis detailed in our Wynnstay Group valuation report hints at an inflated share price compared to its estimated value.

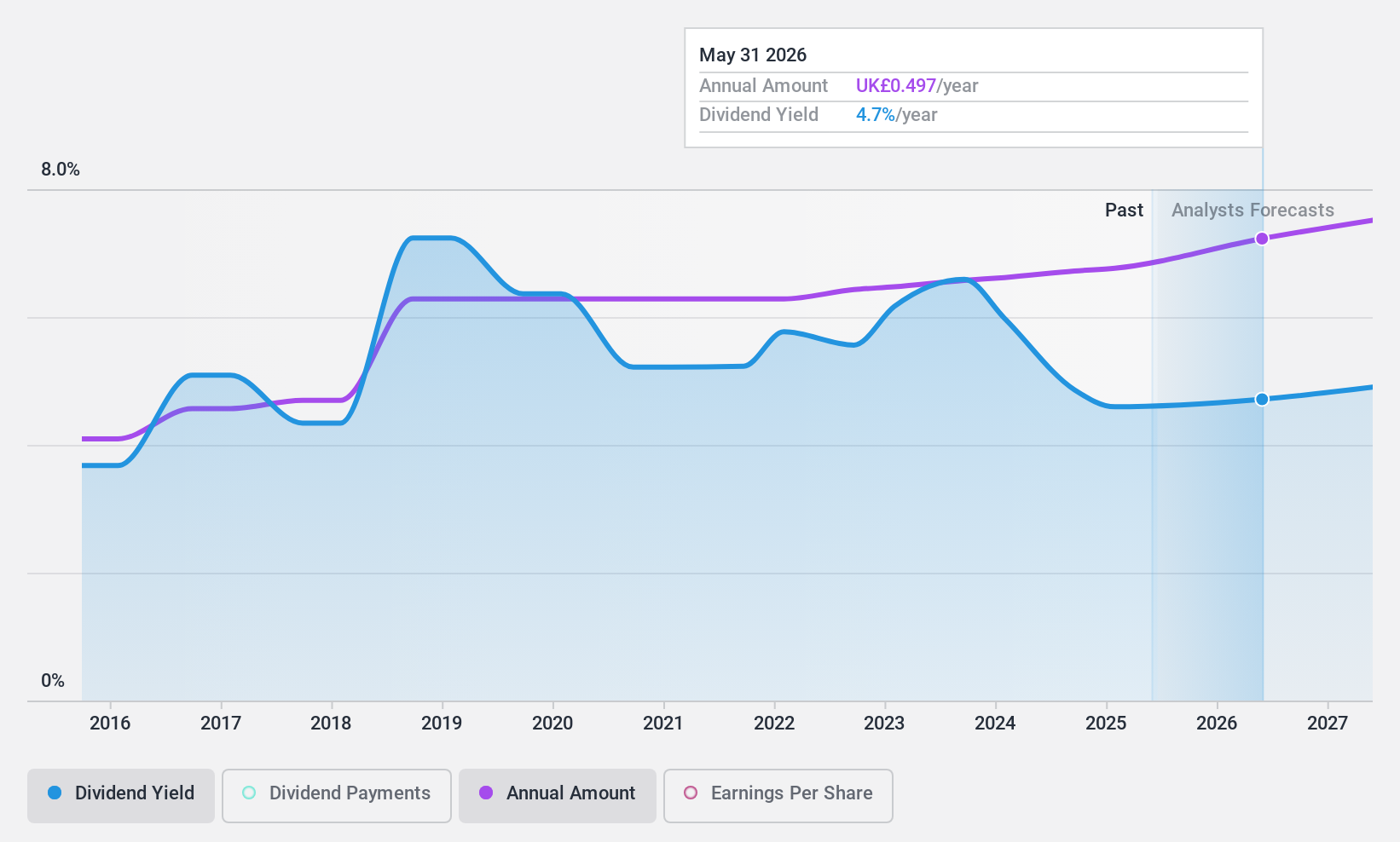

IG Group Holdings (LSE:IGG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IG Group Holdings plc is a fintech company that operates in the online trading sector globally, with a market cap of £3.33 billion.

Operations: IG Group Holdings plc generates its revenue primarily from its brokerage segment, which amounts to £954.50 million.

Dividend Yield: 5%

IG Group Holdings provides a reliable dividend, yielding 4.99%, though slightly below the top UK payers. Dividends are well-covered by earnings (58.2% payout ratio) and cash flows (43.7% cash payout ratio), with stable growth over the past decade. Recent strategic moves include a share buyback program worth £150 million and executive board changes, potentially influencing future performance. The final dividend for 2024 increased to 46.2 pence per share, reflecting sustainable growth despite decreased net income of £307.7 million from last year’s £365 million.

- Navigate through the intricacies of IG Group Holdings with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, IG Group Holdings' share price might be too pessimistic.

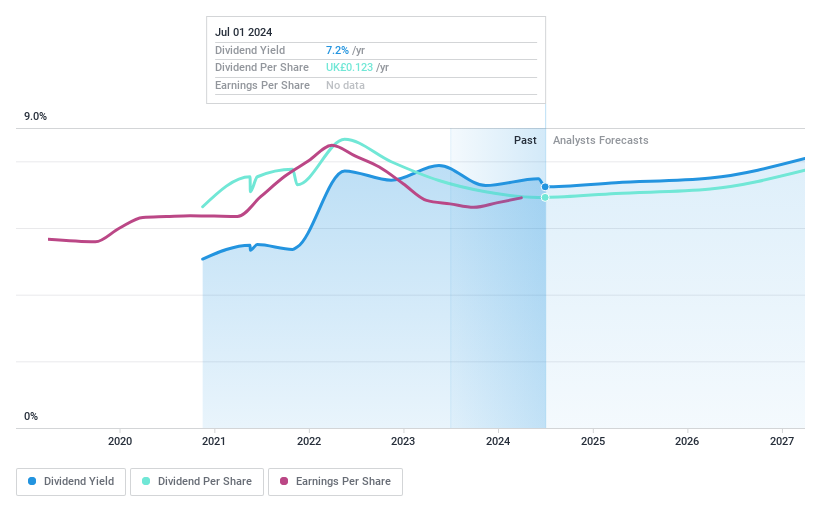

Ninety One Group (LSE:N91)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ninety One Group is an independent global asset manager with operations worldwide and a market cap of £1.71 billion.

Operations: The company's revenue is primarily derived from its Investment Management Business, totaling £588.50 million.

Dividend Yield: 6.5%

Ninety One Group offers a compelling dividend yield of 6.51%, placing it among the top UK payers. Dividends are well-supported by earnings (66.8% payout ratio) and cash flows (65.3% cash payout ratio), although the company has only paid dividends for four years, indicating limited historical stability. Trading at a discount to its estimated fair value, N91 presents good relative value compared to peers, with revenue growth forecasted at 3.71% annually enhancing its investment appeal.

- Dive into the specifics of Ninety One Group here with our thorough dividend report.

- The analysis detailed in our Ninety One Group valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Access the full spectrum of 60 Top UK Dividend Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wynnstay Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:WYN

Wynnstay Group

Manufactures and supplies agricultural products in the United Kingdom.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives