- United Kingdom

- /

- Food

- /

- AIM:ANP

Anpario Leads The Charge With 2 Other UK Penny Stocks To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over weak trade data from China, impacting companies tied to its economic performance. In such a climate, investors often look for opportunities in smaller or less-established companies that might offer value and growth potential. While the term "penny stocks" may seem outdated, these stocks can still represent intriguing investment possibilities when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| FRP Advisory Group (AIM:FRP) | £1.47 | £347M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.895 | £476.63M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.18 | £840.18M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.94 | £397.82M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £4.20 | £193.46M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.55 | £191.24M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.334 | £208.83M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.50 | £188.48M | ★★★★★☆ |

| Serabi Gold (AIM:SRB) | £0.91 | £70.81M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.35 | £110.77M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Anpario (AIM:ANP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anpario plc, with a market cap of £65.00 million, produces and distributes natural feed additives focused on animal health, hygiene, and nutrition.

Operations: The company's revenue is primarily generated from its Vitamins & Nutrition Products segment, which accounts for £32.72 million.

Market Cap: £65M

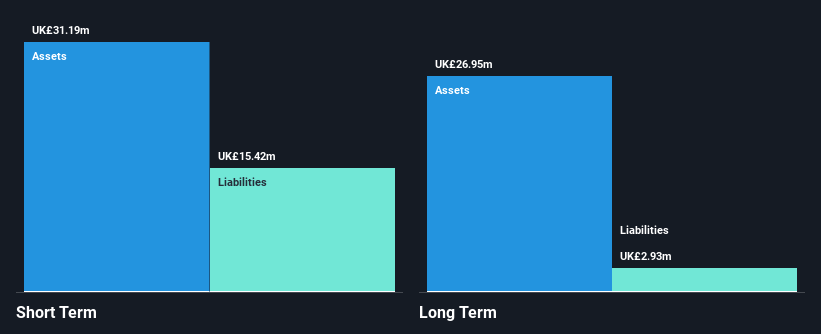

Anpario plc, with a market cap of £65.00 million, has demonstrated steady financial performance in recent periods. The company reported sales of £16.99 million and net income of £1.71 million for H1 2024, reflecting growth from the previous year. Despite a volatile share price recently and earnings growth lagging behind the broader food industry, Anpario's financial stability is supported by its debt-free status and strong asset coverage over liabilities. The seasoned management team adds to its operational strength, although dividend sustainability remains uncertain due to an unstable track record. Revenue is forecasted to grow annually by 17.25%.

- Dive into the specifics of Anpario here with our thorough balance sheet health report.

- Evaluate Anpario's prospects by accessing our earnings growth report.

Synectics (AIM:SNX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Synectics plc designs, integrates, and supports security and surveillance systems both in the United Kingdom and internationally, with a market cap of £47.29 million.

Operations: The company generates revenue from its Systems segment (£35.55 million) and Security segment (£19.30 million).

Market Cap: £47.29M

Synectics plc, with a market cap of £47.29 million, shows strong financial health with no debt and significant earnings growth, outpacing the electronic industry average. The company's short-term assets significantly cover both its short- and long-term liabilities. Recent contract wins include a £2.2 million agreement with National Grid and a US$3.2 million project in South-East Asia, enhancing revenue prospects. However, the recent passing of CEO Paul Webb introduces leadership uncertainty despite interim measures by CFO Amanda Larnder. While trading below estimated fair value suggests potential for appreciation, share price volatility remains high compared to UK peers.

- Take a closer look at Synectics' potential here in our financial health report.

- Understand Synectics' earnings outlook by examining our growth report.

Time Finance (AIM:TIME)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Time Finance plc, along with its subsidiaries, offers financial products and services to consumers and businesses in the United Kingdom, with a market cap of £54.99 million.

Operations: The company generates its revenue through two main segments: Asset Finance, contributing £18.75 million, and Invoice Finance, accounting for £14.32 million.

Market Cap: £54.99M

Time Finance plc, with a market cap of £54.99 million, exhibits mixed financial indicators relevant to penny stock investors. The company reported revenue growth to £33.23 million for the year ended May 31, 2024, up from £26.97 million previously, alongside improved net income of £4.44 million and earnings per share increases. Despite this positive trajectory in earnings growth and a favorable price-to-earnings ratio compared to the UK market average, challenges include low return on equity and negative operating cash flow impacting debt coverage capabilities. Nonetheless, short-term assets comfortably exceed both short- and long-term liabilities while maintaining stable shareholder equity without dilution over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Time Finance.

- Gain insights into Time Finance's outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Take a closer look at our UK Penny Stocks list of 472 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Anpario, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ANP

Anpario

Engages in the production and distribution of natural feed additives for animal health, hygiene, and nutrition.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives