- United Kingdom

- /

- Oil and Gas

- /

- AIM:SEA

3 UK Penny Stocks With Market Caps At Least £20M

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, impacting companies closely tied to its economy. Despite these broader market fluctuations, there remain investment opportunities in smaller or newer companies often referred to as penny stocks. While the term may seem outdated, these stocks can still offer growth potential and value when they possess strong financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.345 | £432.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.95 | £188.38M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.175 | £100.28M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.265 | £72.16M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.99 | £74.98M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.36 | £173.2M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.29 | £198.96M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4205 | $244.45M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Anpario (AIM:ANP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anpario plc, with a market cap of £69.06 million, is involved in the production and distribution of natural feed additives aimed at enhancing animal health, hygiene, and nutrition.

Operations: The company's revenue is derived from its Vitamins & Nutrition Products segment, totaling £32.72 million.

Market Cap: £69.06M

Anpario plc, with a market cap of £69.06 million, has demonstrated stable financial health by maintaining no debt and covering both short and long-term liabilities with its assets. Despite a 7.4% annual decline in earnings over the past five years, recent performance shows improvement with a 25.3% earnings growth in the last year, alongside increased net profit margins from 7.6% to 9.2%. Revenue is forecasted to grow at 17.25% annually, supported by experienced management and board teams. The company reported H1 sales of £16.99 million and increased its interim dividend to 3.25 pence per share.

- Click to explore a detailed breakdown of our findings in Anpario's financial health report.

- Gain insights into Anpario's outlook and expected performance with our report on the company's earnings estimates.

Eleco (AIM:ELCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eleco Plc is a company that offers software and related services across the United Kingdom, Scandinavia, Germany, Europe, the United States, and internationally with a market cap of £115.30 million.

Operations: The company generates revenue of £30.77 million from its software segment.

Market Cap: £115.3M

Eleco Plc, with a market cap of £115.30 million, has shown a robust financial position by eliminating debt and covering liabilities with assets. Despite a 2.1% annual decline in earnings over five years, recent performance is strong with earnings growing 40.3% last year, surpassing industry growth rates. The company's net profit margins have improved to 9.5%, and it reported half-year sales of £16.25 million and net income of £1.28 million for June 2024, reflecting solid operational results. Additionally, Eleco increased its interim dividend to 0.30 pence per share, indicating confidence in future cash flows.

- Unlock comprehensive insights into our analysis of Eleco stock in this financial health report.

- Understand Eleco's earnings outlook by examining our growth report.

Seascape Energy Asia (AIM:SEA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Seascape Energy Asia plc is a full-cycle exploration and production company that acquires oil and gas assets in Norway, Malaysia, South-East Asia, and the United Kingdom, with a market cap of £22.27 million.

Operations: Seascape Energy Asia plc has not reported any specific revenue segments.

Market Cap: £22.27M

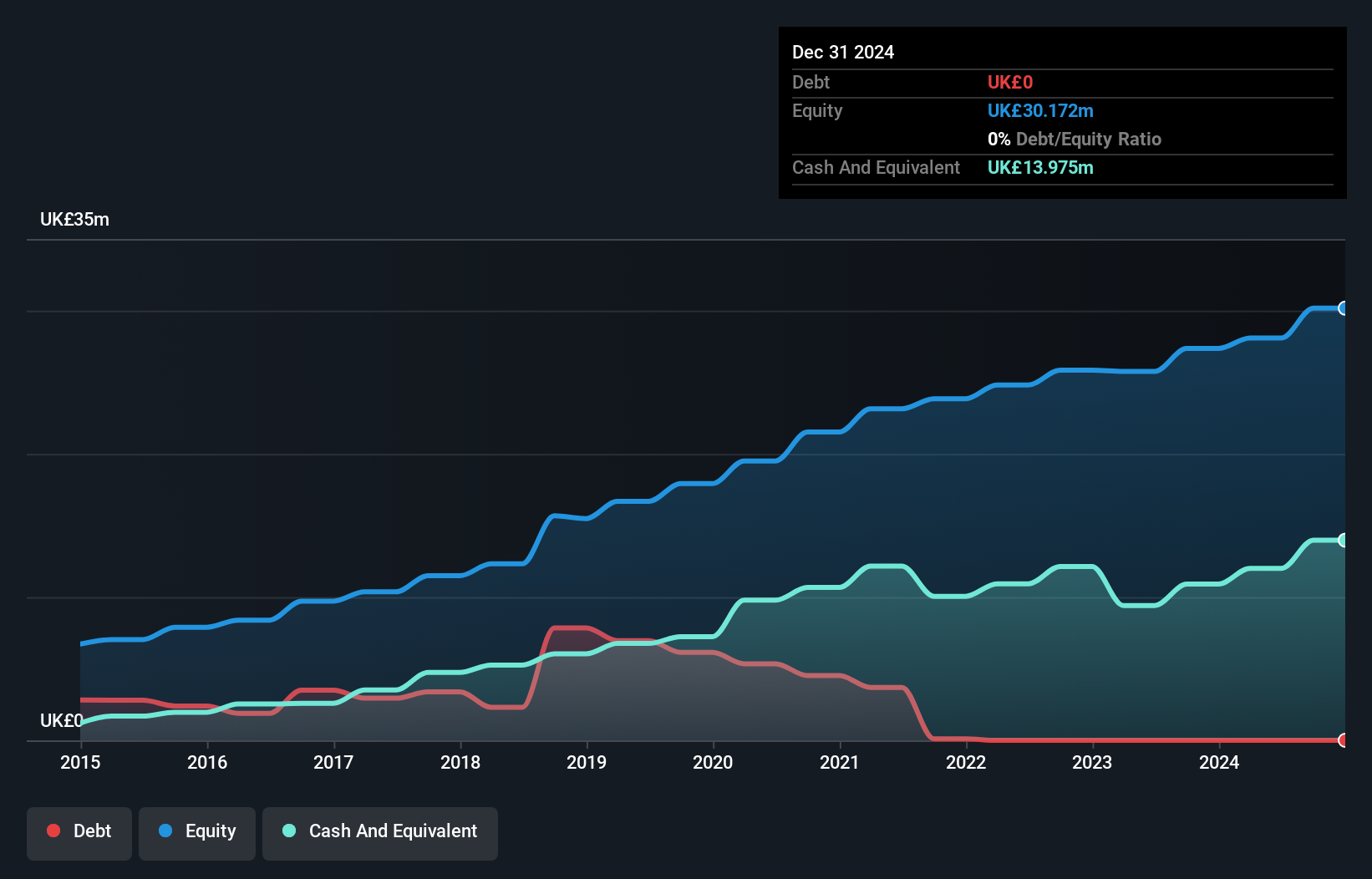

Seascape Energy Asia plc, with a market cap of £22.27 million, is currently pre-revenue and unprofitable, reporting a net loss of £12.53 million for the half year ending June 2024. Despite this, the company has successfully raised approximately £2 million through a follow-on equity offering and completed a farm-out deal for Block 2A. The absence of debt and sufficient short-term assets to cover liabilities highlight its financial flexibility. However, volatility in share price remains high and both management and board have limited tenure experience, indicating potential operational challenges ahead as they navigate growth strategies in oil and gas exploration.

- Click here and access our complete financial health analysis report to understand the dynamics of Seascape Energy Asia.

- Gain insights into Seascape Energy Asia's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Embark on your investment journey to our 470 UK Penny Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SEA

Seascape Energy Asia

A full-cycle E&P company, focuses on acquiring oil and gas assets in Norway, Malaysia, South-East Asia, and the United Kingdom.

Adequate balance sheet slight.

Market Insights

Community Narratives