- United Kingdom

- /

- Diversified Financial

- /

- AIM:EQLS

Undiscovered Gems In The United Kingdom To Watch This September 2024

Reviewed by Simply Wall St

In the last week, the United Kingdom market has stayed flat, yet it is up 5.3% over the past year with earnings expected to grow by 14% per annum over the next few years. In this promising environment, identifying lesser-known stocks with strong growth potential can be particularly rewarding for investors looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Equals Group (AIM:EQLS)

Simply Wall St Value Rating: ★★★★★★

Overview: Equals Group plc, with a market cap of £219.51 million, develops and sells payment platforms to private clients and corporations in the United Kingdom through prepaid currency cards, international money transfers, and current accounts.

Operations: Equals Group generates revenue primarily from Solutions (£42.15 million), International Payments (£40.71 million), Currency Cards (£15.46 million), and Banking (£8.26 million). Travel Cash contributes minimally at £0.02 million, while Segment Adjustment adds £4.05 million to the total revenue stream.

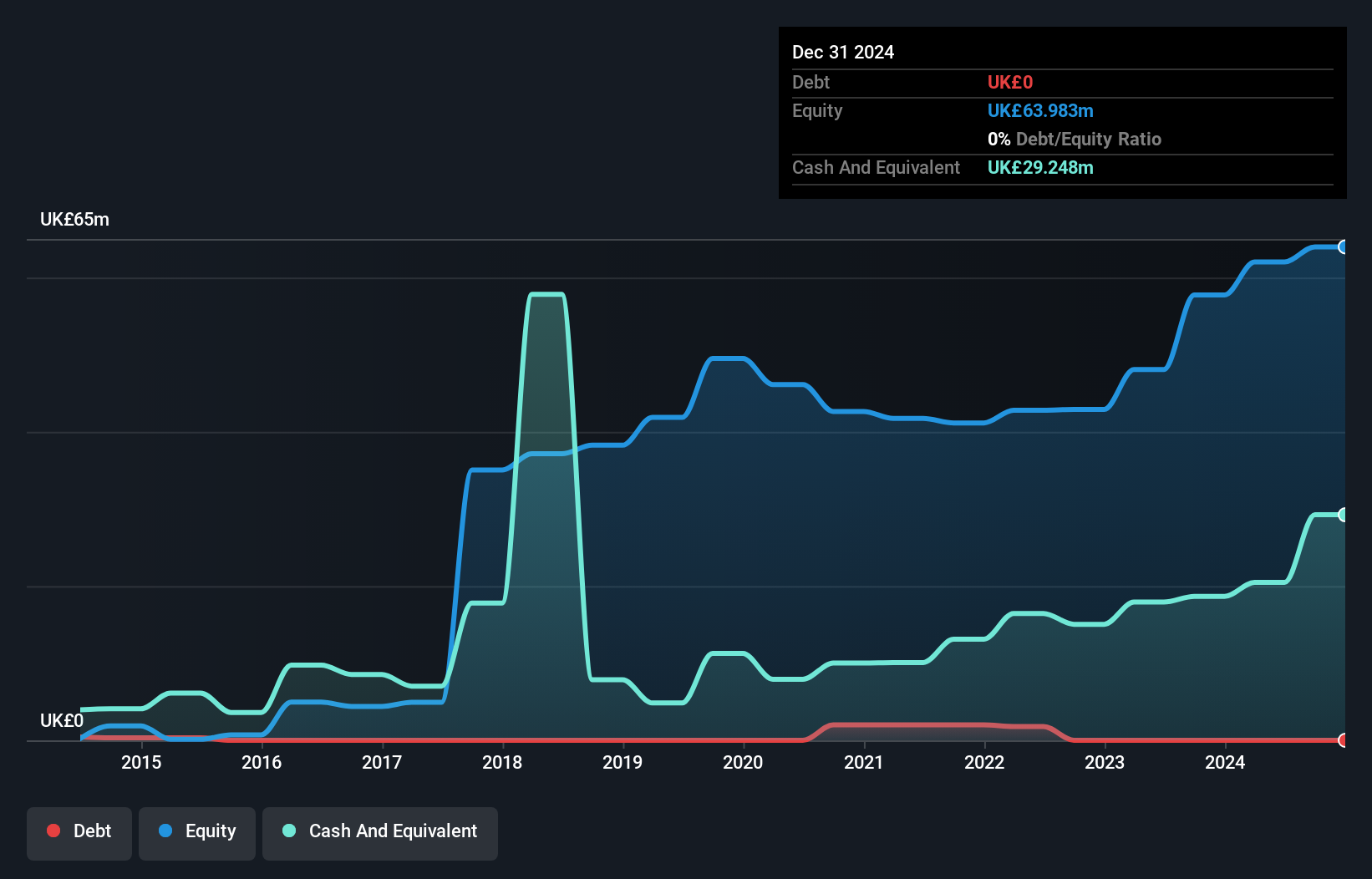

Equals Group has shown robust performance with earnings growth of 10.8% over the past year, outpacing the Diversified Financial industry’s 6.4%. The company reported sales of £55.92 million for H1 2024, up from £40.98 million a year ago, and net income rose to £5.18 million from £4.79 million in the same period. Despite significant insider selling recently, Equals remains debt-free and forecasts suggest an annual earnings growth rate of 31.92%.

- Take a closer look at Equals Group's potential here in our health report.

Assess Equals Group's past performance with our detailed historical performance reports.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group International plc offers foreign exchange risk management and alternative banking solutions across the United Kingdom, Europe, Canada, and internationally, with a market cap of £930.50 million.

Operations: Alpha Group International plc generates revenue primarily from Alpha Pay (£72.30 million), Institutional (£67.47 million), and Corporate segments in Toronto, Amsterdam, and London (£60.21 million combined).

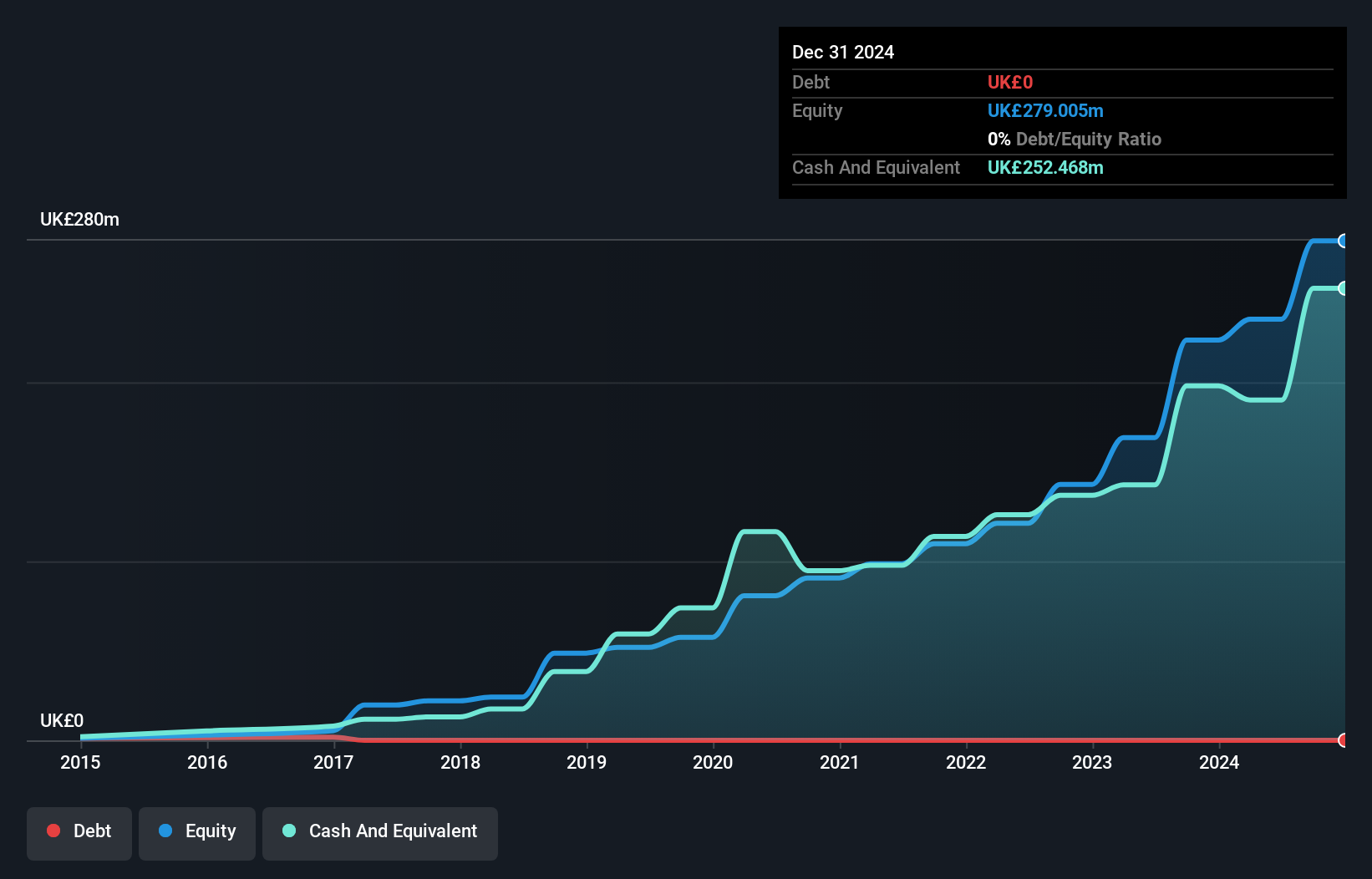

Alpha Group International has shown impressive earnings growth of 46.3% over the past year, significantly outpacing the Capital Markets industry’s 4%. The company remains debt-free, eliminating concerns about interest coverage. Trading at a price-to-earnings ratio of 9.9x, it offers good value compared to the UK market average of 16.7x. Recent executive changes include Morgan Tillbrook stepping down as CEO by year-end and Clive Kahn taking over in January 2025, reflecting strong leadership continuity.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc engages in oil and gas exploration, production, and gas processing activities across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.14 billion.

Operations: Seplat Energy generates revenue primarily from oil ($815.03 million) and gas ($120.87 million).

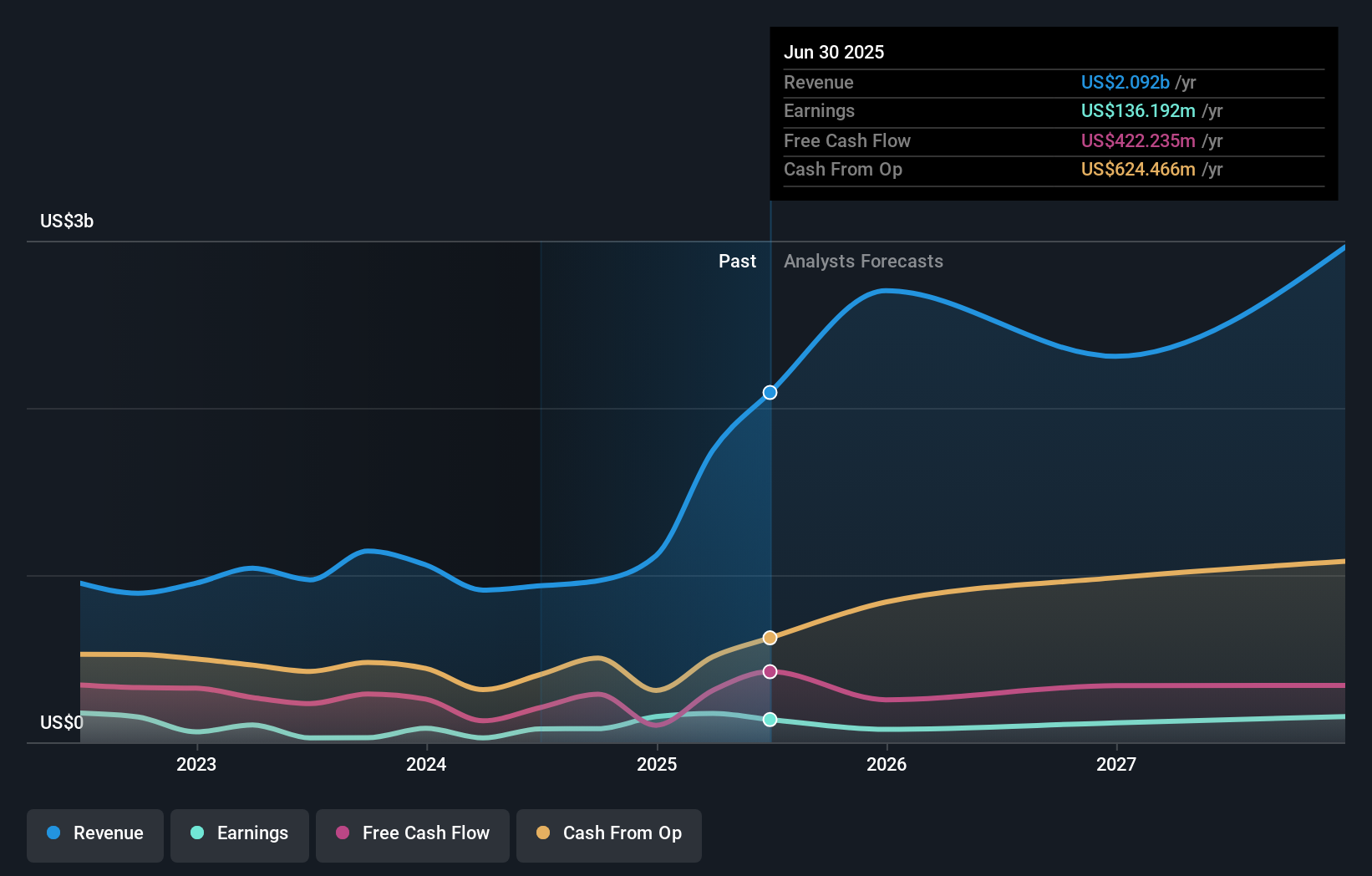

Seplat Energy has shown impressive financial performance, with earnings growing 207.6% over the past year and forecasted to grow 13.59% annually. The company’s debt to equity ratio increased from 20.6% to 41.5% over five years, yet its interest payments are well covered by EBIT at a ratio of 5.8x. Recent results highlight a net income of US$39.72 million for Q2, reversing a net loss of US$14.63 million from the previous year, indicating robust profitability trends.

- Navigate through the intricacies of Seplat Energy with our comprehensive health report here.

Gain insights into Seplat Energy's past trends and performance with our Past report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 79 UK Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equals Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EQLS

Equals Group

Through its subsidiaries, develops and sells payment platforms to private clients and corporations through prepaid currency cards, international money transfers, and current accounts in the United Kingdom.

Flawless balance sheet with reasonable growth potential.