- United Kingdom

- /

- Machinery

- /

- LSE:GDWN

Undiscovered Gems 3 UK Stocks To Watch In July 2025

Reviewed by Simply Wall St

The UK market has recently experienced turbulence, with the FTSE 100 and FTSE 250 indices both closing lower due to weak trade data from China, highlighting challenges in global demand and its impact on commodity-linked sectors. In this environment of uncertainty, identifying promising small-cap stocks that are less exposed to international volatility can present unique opportunities for investors seeking growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.15% | 50.88% | 67.63% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Fonix (AIM:FNX)

Simply Wall St Value Rating: ★★★★★★

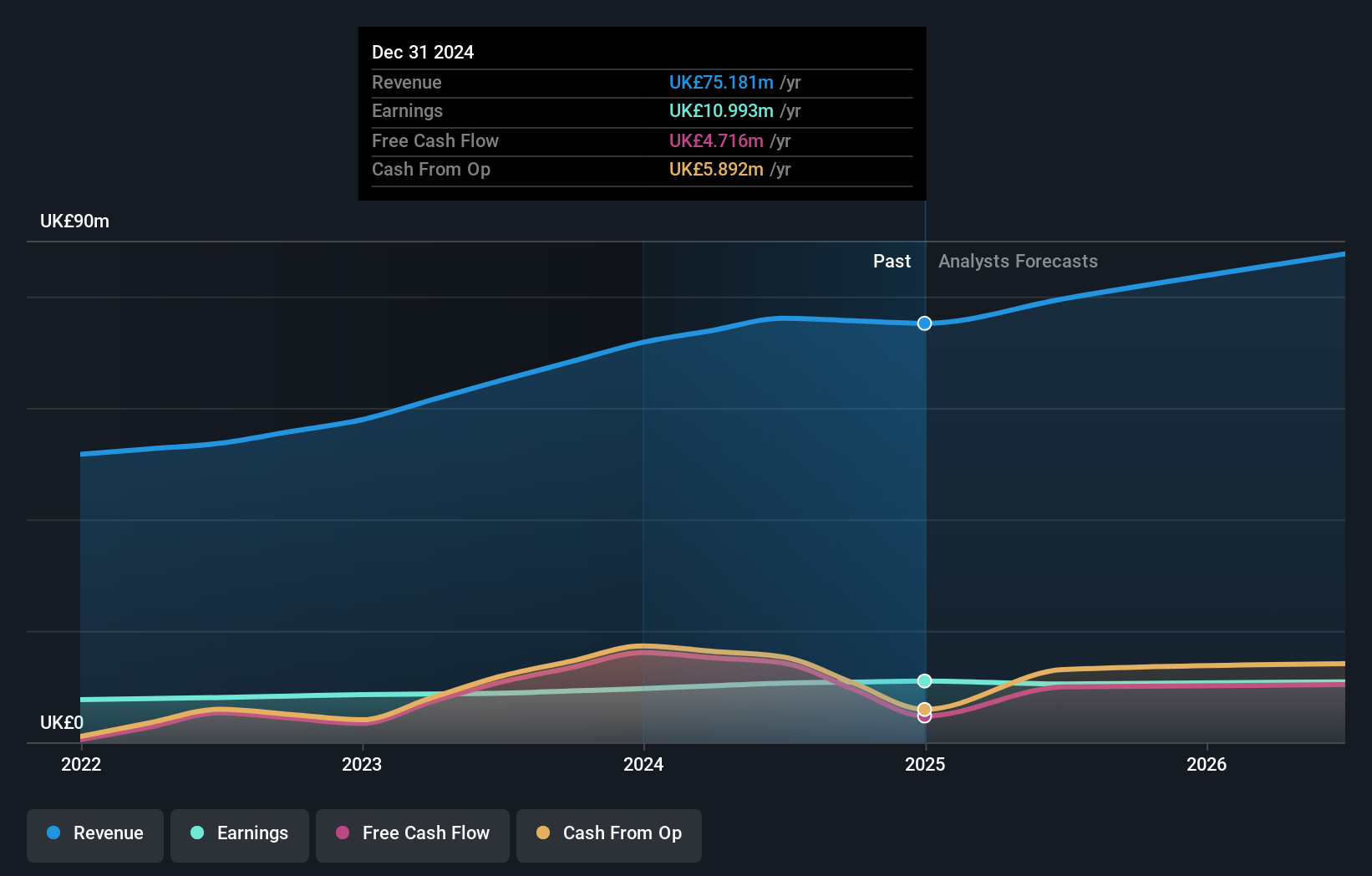

Overview: Fonix Plc operates in the United Kingdom, offering mobile payments and messaging services along with managed services for sectors such as media, charity, gaming, and e-mobility, with a market cap of £209.54 million.

Operations: Revenue from facilitating mobile payments and messaging stands at £75.18 million.

Fonix, a nimble player in the UK market, showcases its strength with high-quality earnings and no debt for five years. The company has consistently generated positive free cash flow, reaching £14.24 million as of June 2024. Earnings growth at 14.1% outpaces the diversified financial industry average, indicating robust performance. With revenue projected to grow by 6.1% annually, Fonix seems well-positioned for steady expansion without the burden of interest payments due to its debt-free status. This financial health likely supports its strategic initiatives and potential future growth within a competitive landscape.

- Click here and access our complete health analysis report to understand the dynamics of Fonix.

Explore historical data to track Fonix's performance over time in our Past section.

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★☆

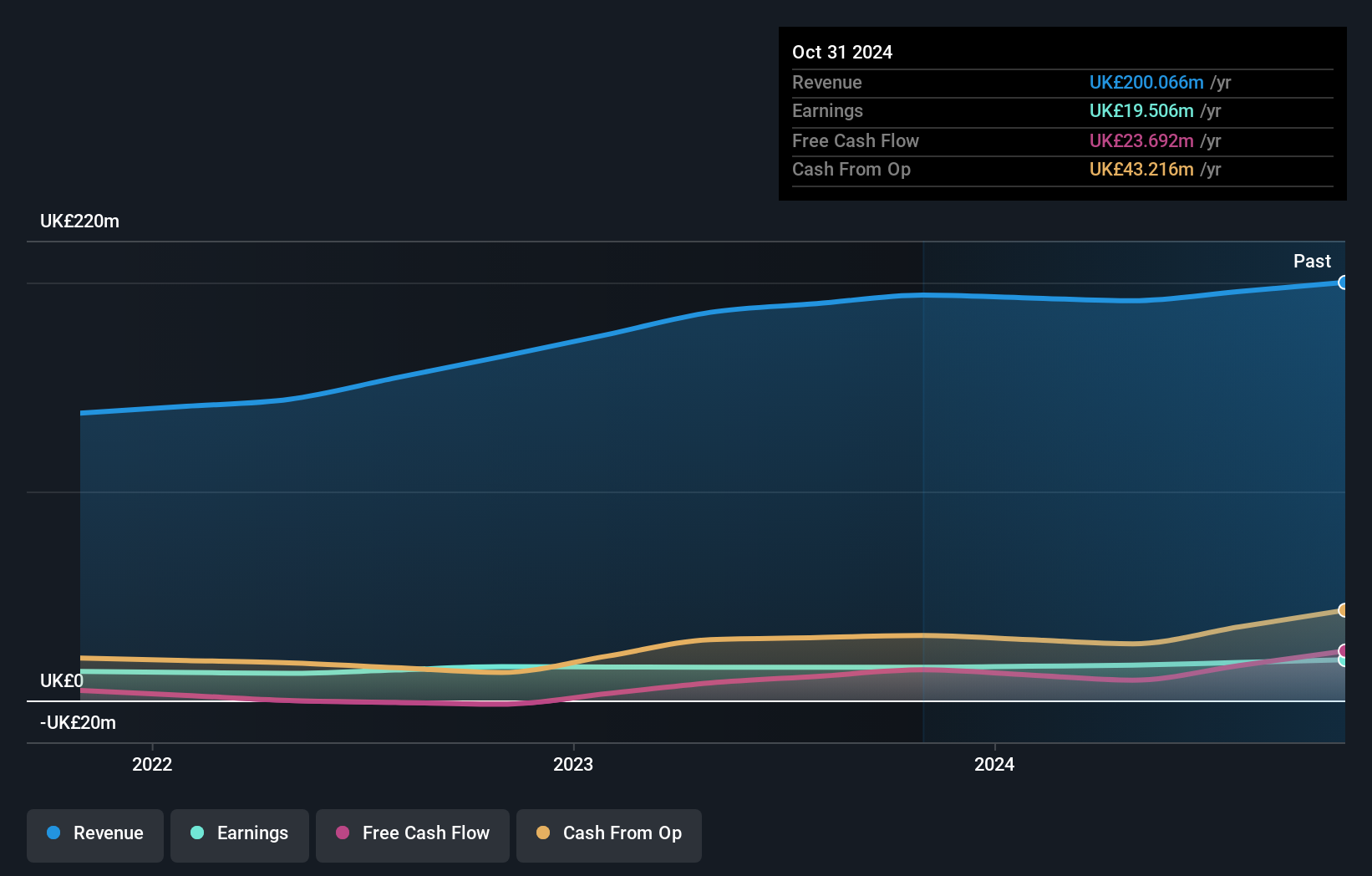

Overview: Goodwin PLC, along with its subsidiaries, offers mechanical and refractory engineering solutions across the UK, Europe, the US, the Pacific Basin, and other international markets with a market cap of £569.23 million.

Operations: With a market cap of £569.23 million, Goodwin PLC generates revenue from two primary segments: Mechanical (£168.02 million) and Refractory (£75.58 million). The company's financial performance is influenced by its net profit margin, which reflects the efficiency of its operations after accounting for expenses.

Goodwin, a notable player in the machinery sector, has demonstrated robust financial health with its net debt to equity ratio at 25.3%, deemed satisfactory. The company is trading significantly below its estimated fair value by 52.5%, presenting potential investment appeal. Impressively, Goodwin's earnings growth of 22.9% outpaced the industry average of -7.7%. Despite an increase in its debt to equity ratio from 27.2% to 37% over five years, interest payments are well-covered by EBIT at a multiple of 8.4x, indicating strong earnings quality and effective debt management strategies amidst recent executive board changes.

- Unlock comprehensive insights into our analysis of Goodwin stock in this health report.

Gain insights into Goodwin's historical performance by reviewing our past performance report.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is an independent energy company involved in oil and gas exploration, production, and gas processing across Nigeria, Bahamas, Italy, Switzerland, England, and Singapore with a market cap of £1.41 billion.

Operations: Seplat Energy generates revenue primarily from oil, contributing $1.60 billion, and gas sales amounting to $140.44 million, with a minor segment adjustment of $4.95 million.

Seplat Energy, a notable player in the UK market, has demonstrated impressive growth with earnings surging by 563% over the past year, significantly outpacing the industry. Trading at 18.8% below estimated fair value suggests potential upside for investors. The company’s debt-to-equity ratio has increased from 46.7% to 57.8% over five years, yet its net debt-to-equity remains satisfactory at 39.9%. Recent production results show a substantial increase to an average of 131,561 boepd for Q1 2025, surpassing guidance and reflecting strong performance from gas plants like Oben and Sapele.

Turning Ideas Into Actions

- Dive into all 59 of the UK Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GDWN

Goodwin

Provides mechanical and refractory engineering solutions primarily in the United Kingdom, rest of Europe, the United States, the Pacific Basin, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives