- United Kingdom

- /

- Hospitality

- /

- LSE:HSW

Undervalued Opportunities UK Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces pressure from weak trade data out of China, investors are closely monitoring market movements to identify potential opportunities. In such conditions, penny stocks—often smaller or newer companies—can present unique growth prospects despite being a somewhat outdated term. When these stocks are supported by strong financials and solid fundamentals, they can offer promising returns without many of the typical risks associated with this segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.725 | £177.65M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.20 | £828.88M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.415 | £439.1M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.13 | £96.44M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.225 | £69.88M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.298 | £200.19M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.365 | £173.84M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.43 | $249.97M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.04 | £78.76M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

OptiBiotix Health (AIM:OPTI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OptiBiotix Health Plc is a life sciences company focused on discovering and developing microbiome modulators, operating in the United Kingdom, the United States, China, and internationally, with a market cap of £19.10 million.

Operations: The company generates revenue of £0.569 million from identifying and developing microbial strains, compounds, and formulations.

Market Cap: £19.1M

OptiBiotix Health, a life sciences company, is navigating the challenges typical of penny stocks with a market cap of £19.10 million and minimal revenue (£569K), indicating it is pre-revenue. The company remains unprofitable and has experienced shareholder dilution recently. Despite this, OptiBiotix's strategic moves include launching SlimBiome® products in India through a partnership with Morepen, supported by a significant £1.5 million marketing investment aimed at capturing the weight management market. Additionally, recent positive study results on SlimBiome® enhance its potential as an appetite suppressant ingredient amidst ongoing financial losses and executive changes.

- Dive into the specifics of OptiBiotix Health here with our thorough balance sheet health report.

- Gain insights into OptiBiotix Health's historical outcomes by reviewing our past performance report.

Hostelworld Group (LSE:HSW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hostelworld Group plc operates as an online travel agent specializing in the hostel market globally, with a market cap of £164.44 million.

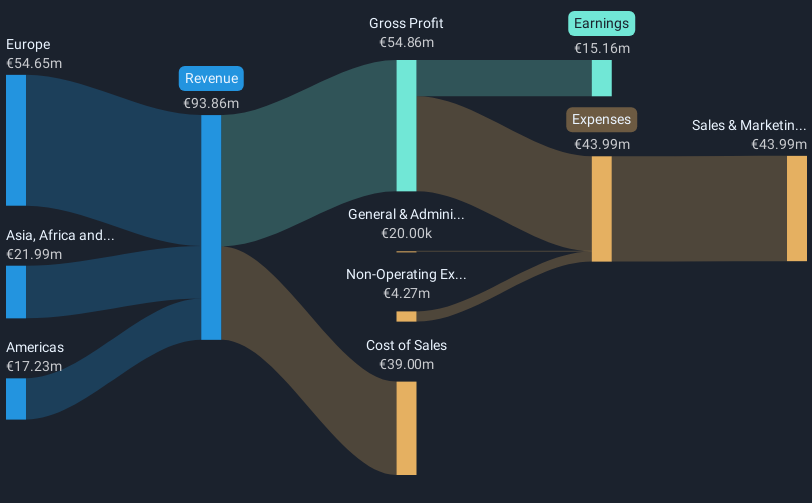

Operations: The company generates revenue of €93.86 million from providing software and data processing services.

Market Cap: £164.44M

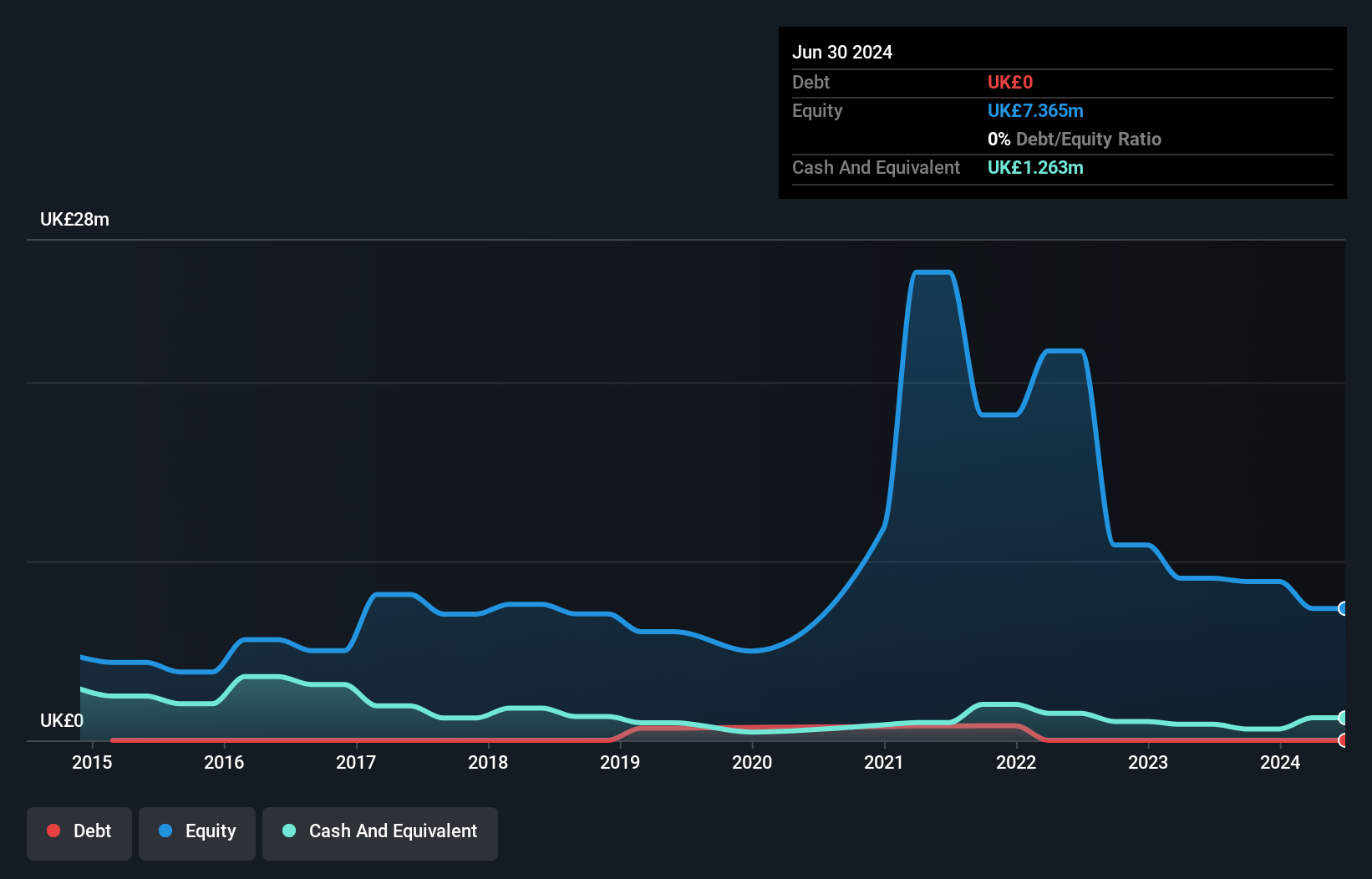

Hostelworld Group, with a market cap of £164.44 million, stands out for its financial stability and growth potential among penny stocks. The company has achieved profitability over the past year and boasts high-quality earnings, supported by a strong return on equity of 24.2%. Its experienced board and management team contribute to effective governance. Despite short-term liabilities exceeding assets (€23.1M vs €10M), Hostelworld is debt-free, reducing financial risk. Trading at 56.9% below estimated fair value suggests it may offer good relative value in the industry, with analysts expecting earnings to grow by 9% annually.

- Unlock comprehensive insights into our analysis of Hostelworld Group stock in this financial health report.

- Explore Hostelworld Group's analyst forecasts in our growth report.

Seplat Energy (LSE:SEPL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.25 billion.

Operations: The company's revenue consists of $846.68 million from oil and $119.56 million from gas operations.

Market Cap: £1.25B

Seplat Energy, with a market cap of £1.25 billion, has shown mixed financial performance. Recent earnings reports indicate a rise in quarterly sales to US$293.7 million, though it recorded a net loss of US$2.09 million for the same period. Despite this, Seplat's earnings grew significantly by 199.5% over the past year and its profit margins improved from 2.4% to 8.4%. The company's debt is well managed with satisfactory coverage by operating cash flow and interest payments are well covered by EBIT at 6.7x coverage, although its dividend sustainability remains questionable due to insufficient earnings coverage.

- Navigate through the intricacies of Seplat Energy with our comprehensive balance sheet health report here.

- Gain insights into Seplat Energy's outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Click this link to deep-dive into the 469 companies within our UK Penny Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hostelworld Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSW

Hostelworld Group

Operates as an online travel agent focused on the hostel market worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives