- United Kingdom

- /

- Oil and Gas

- /

- LSE:SEPL

3 Undiscovered Gems in the United Kingdom Market

Reviewed by Simply Wall St

In the current landscape, the United Kingdom's FTSE 100 and FTSE 250 indices have faced downward pressure, largely influenced by weak trade data from China and its ongoing economic struggles. As global markets navigate these challenges, identifying promising opportunities within the UK market requires a keen eye for companies that demonstrate resilience and potential for growth despite broader economic headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Griffin Mining (AIM:GFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the mining, exploration, and development of mineral properties with a market capitalization of £291.47 million.

Operations: Griffin Mining derives its revenue primarily from the Caijiaying Zinc Gold Mine, generating $162.25 million.

Griffin Mining, a nimble player in the mining sector, reported impressive earnings growth of 116.5% over the past year, outpacing the industry's 13%. Trading at a significant discount of 64.2% below its estimated fair value, Griffin shows potential for value-seekers. The company remains debt-free with robust free cash flow generation, evidenced by recent figures like US$25.36 million in levered free cash flow as of December 2023. However, future earnings are projected to decrease by an average of 3.8% annually over the next three years, which may temper enthusiasm slightly despite high-quality past earnings and increased production metrics such as zinc and gold output compared to last year.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company engaged in home and community building in Ireland, with a market capitalization of £1.03 billion.

Operations: Cairn Homes generates revenue primarily from building and property development, amounting to €813.40 million. The company operates within the home and community construction sector in Ireland.

Cairn Homes, a notable player in the UK market, recently reported impressive earnings growth of 49.5%, outpacing the Consumer Durables industry. Their debt to equity ratio rose from 31.3% to 39.1% over five years, while maintaining satisfactory net debt levels at 20.7%. The company repurchased shares worth €70 million this year, reflecting strategic capital management. With a price-to-earnings ratio of 11.1x below the UK average and strong earnings guidance for fiscal year 2025, Cairn seems poised for continued growth in its sector.

- Dive into the specifics of Cairn Homes here with our thorough health report.

Examine Cairn Homes' past performance report to understand how it has performed in the past.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market capitalization of £1.22 billion.

Operations: Seplat Energy generates revenue primarily from oil and gas, with oil contributing $815.03 million and gas $120.87 million.

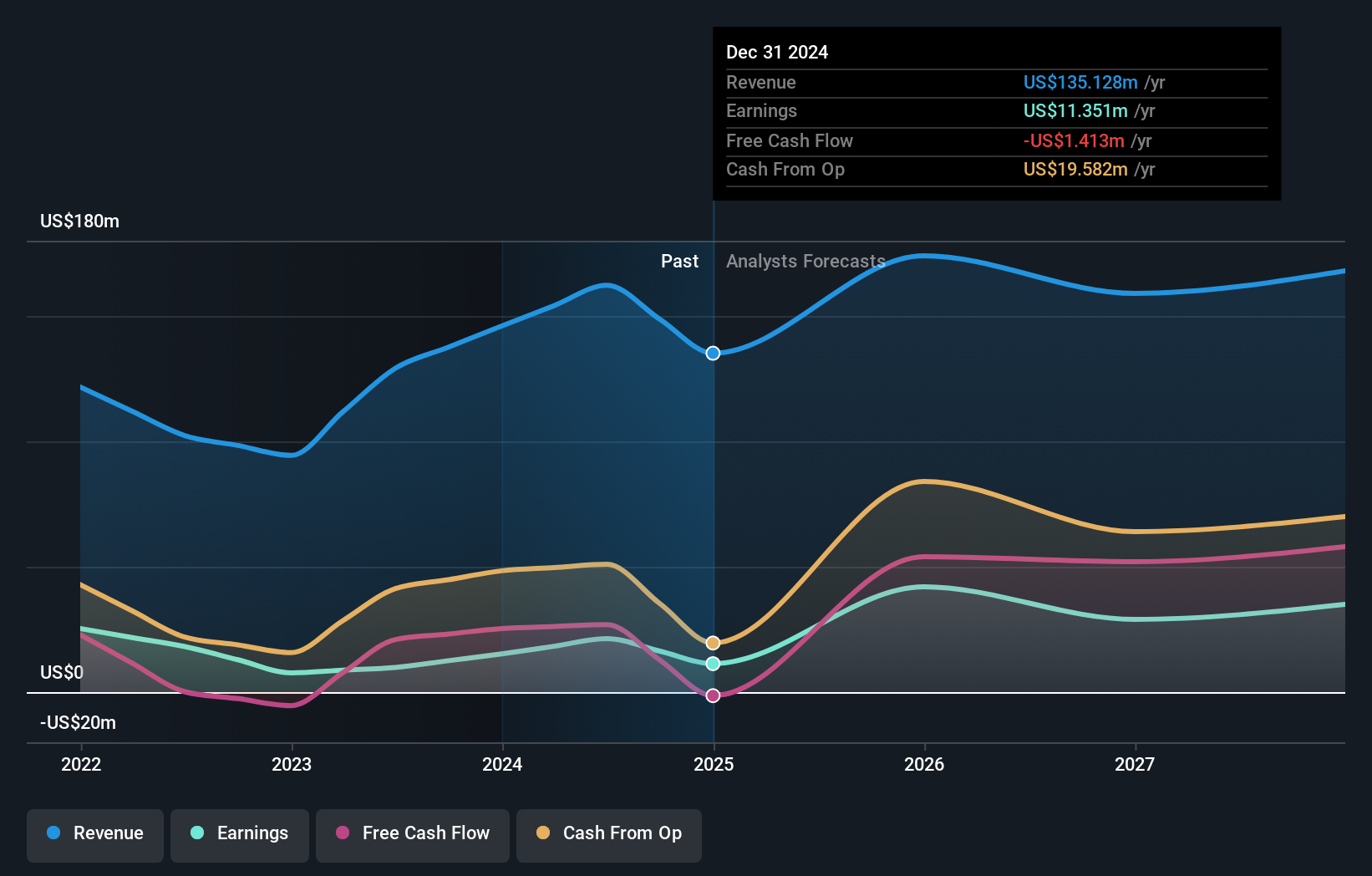

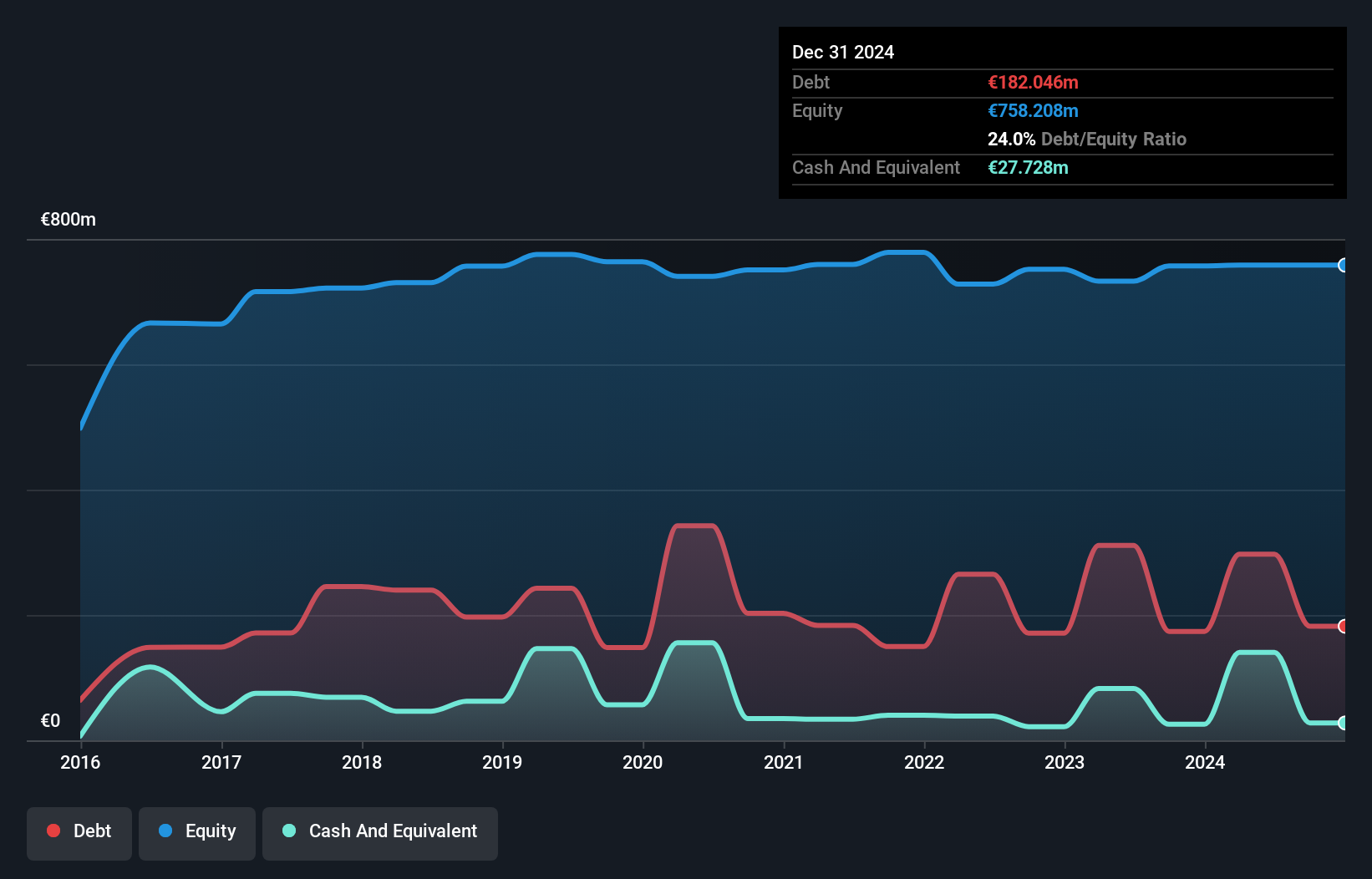

Seplat Energy, a promising player in the UK market, reported Q2 2024 sales of US$241.82 million, up from US$216.03 million last year, with net income at US$39.72 million compared to a net loss previously. The company boasts high-quality earnings and satisfactory debt coverage with EBIT covering interest payments 5.8 times over. Despite an increase in debt to equity from 20.6% to 41.5% over five years, it remains profitable and free cash flow positive.

- Click here and access our complete health analysis report to understand the dynamics of Seplat Energy.

Evaluate Seplat Energy's historical performance by accessing our past performance report.

Make It Happen

- Delve into our full catalog of 80 UK Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SEPL

Seplat Energy

Engages in the oil and gas exploration and production, and gas processing activities in Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England.

Proven track record with adequate balance sheet and pays a dividend.