- United Kingdom

- /

- Oil and Gas

- /

- LSE:SEPL

3 UK Penny Stocks With Market Caps Under £2B

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, certain investment opportunities remain appealing. Penny stocks, though a somewhat outdated term, continue to offer potential growth prospects for investors seeking exposure to smaller or newer companies with strong financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.96M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

| Union Jack Oil (AIM:UJO) | £0.09 | £9.59M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £452.53M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.288 | £198.65M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.685 | £366.5M | ★★★★☆☆ |

| Impax Asset Management Group (AIM:IPX) | £2.515 | £321.35M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.1125 | £95.05M | ★★★★★★ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Henry Boot (LSE:BOOT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Henry Boot PLC operates in the United Kingdom, focusing on property investment and development, land promotion, and construction activities, with a market cap of £308.71 million.

Operations: The company's revenue is derived from three primary segments: Property Investment and Development (£170.56 million), Construction (£87.90 million), and Land Promotion (£28.37 million).

Market Cap: £308.71M

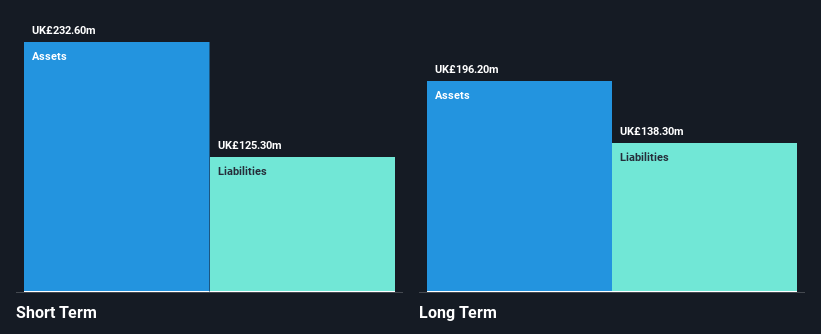

Henry Boot PLC, with a market cap of £308.71 million, operates across property investment and development, construction, and land promotion. Despite its diverse revenue streams (£170.56M from Property Investment and Development), the company has faced challenges with declining earnings over the past five years at 6.7% annually. Debt levels have risen but remain satisfactory with short-term assets comfortably covering liabilities. However, negative operating cash flow raises concerns about debt coverage. While trading below estimated fair value suggests potential upside, profit margins have decreased recently and dividend sustainability is questionable due to insufficient free cash flows to cover payouts.

- Unlock comprehensive insights into our analysis of Henry Boot stock in this financial health report.

- Evaluate Henry Boot's prospects by accessing our earnings growth report.

Ricardo (LSE:RCDO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ricardo plc offers environmental, technical, and strategic consultancy services across the United Kingdom, Europe, North America, China, the rest of Asia, Australia, and internationally with a market cap of £273.11 million.

Operations: The company's revenue is primarily derived from its Defense segment (£123.4 million), followed by Energy & Environment (£104 million), Performance Products (£83.5 million), Rail (£78 million), Automotive and Industrial - emerging markets (£58.6 million), and Automotive and Industrial - established markets (£28.6 million).

Market Cap: £273.11M

Ricardo plc, with a market cap of £273.11 million, has recently become profitable despite a significant one-off loss of £21 million impacting its last 12 months' results. The company is trading at a substantial discount to estimated fair value, suggesting potential undervaluation. Its short-term assets exceed both short and long-term liabilities, indicating strong liquidity. However, the dividend yield of 2.89% is not well covered by earnings, raising sustainability concerns. Recent product innovations like the Element range highlight Ricardo's focus on modular and adaptable solutions for evolving industries such as motorsport and defence amidst rapid technological changes.

- Get an in-depth perspective on Ricardo's performance by reading our balance sheet health report here.

- Gain insights into Ricardo's future direction by reviewing our growth report.

Seplat Energy (LSE:SEPL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.19 billion.

Operations: The company's revenue is derived from its oil segment, which generated $846.68 million, and its gas segment, contributing $119.56 million.

Market Cap: £1.19B

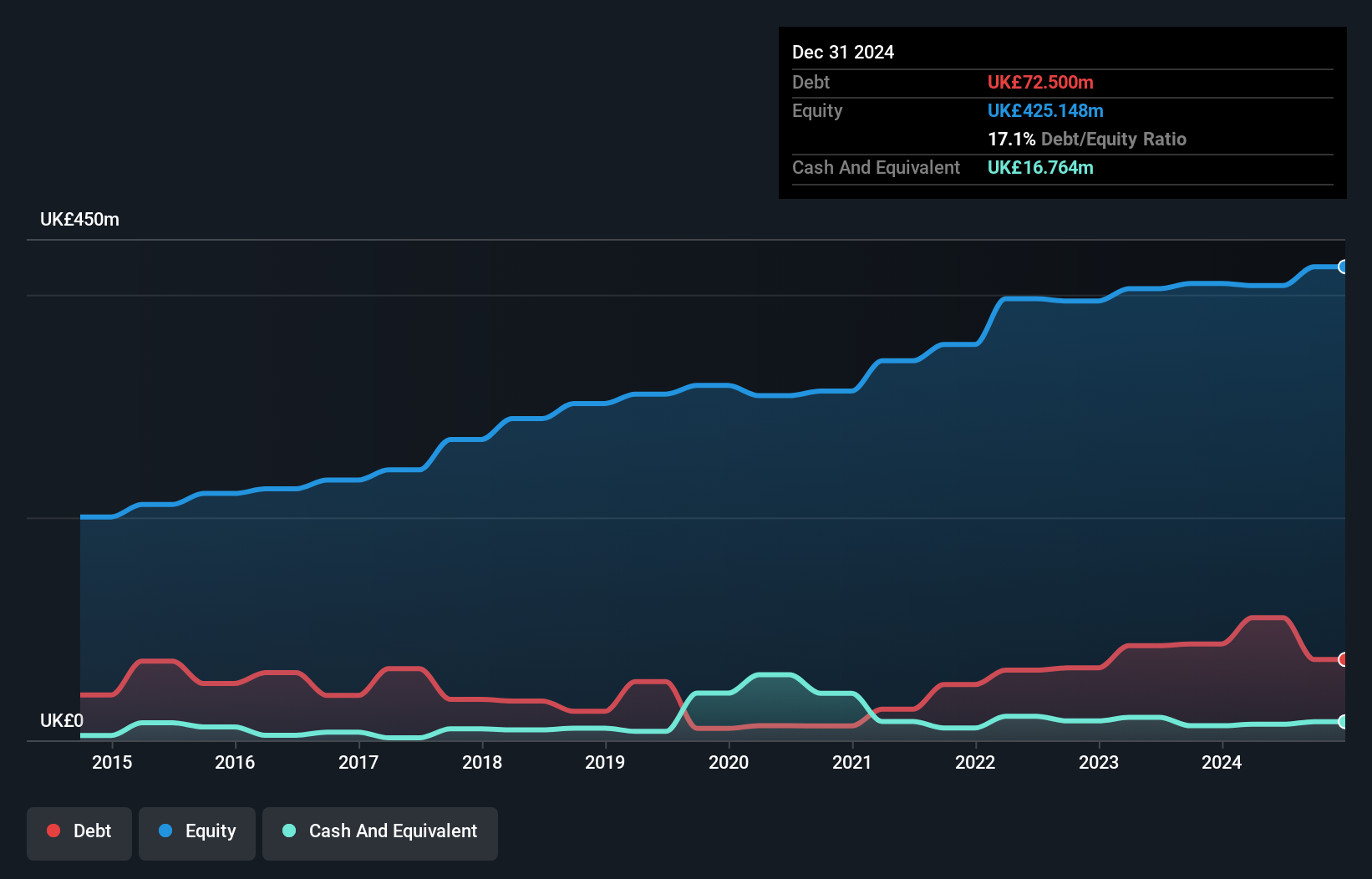

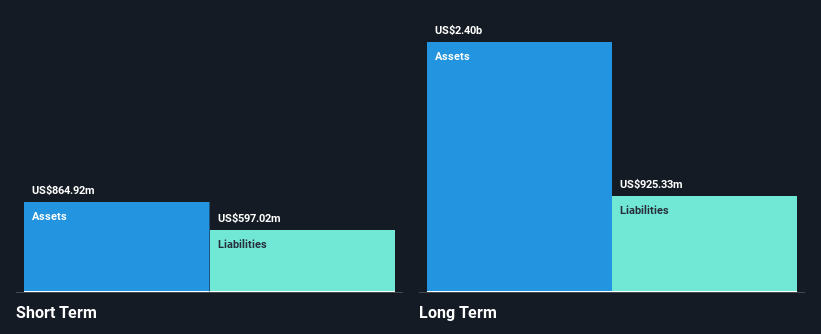

Seplat Energy, with a market cap of £1.19 billion, is navigating challenges in the oil and gas sector. Despite a recent net loss of US$2.09 million for Q3 2024, earnings have shown improvement over the past year with significant growth compared to its 5-year average decline. The company's short-term assets exceed its liabilities, yet long-term liabilities remain uncovered by short-term assets. Seplat's dividend yield of 6.9% raises sustainability concerns due to inadequate earnings coverage. Recent M&A discussions regarding Mobil Producing Nigeria Unlimited could impact future strategic positioning and operational scale if pursued further.

- Jump into the full analysis health report here for a deeper understanding of Seplat Energy.

- Explore Seplat Energy's analyst forecasts in our growth report.

Make It Happen

- Click through to start exploring the rest of the 464 UK Penny Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SEPL

Seplat Energy

An independent energy company, engages in the oil and gas exploration and production, and gas processing activities in Nigeria, Bahamas, Italy, Switzerland, England, and Singapore.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives