- United Kingdom

- /

- Oil and Gas

- /

- LSE:PRD

We Think Predator Oil & Gas Holdings (LON:PRD) Can Easily Afford To Drive Business Growth

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Predator Oil & Gas Holdings (LON:PRD) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Predator Oil & Gas Holdings

How Long Is Predator Oil & Gas Holdings' Cash Runway?

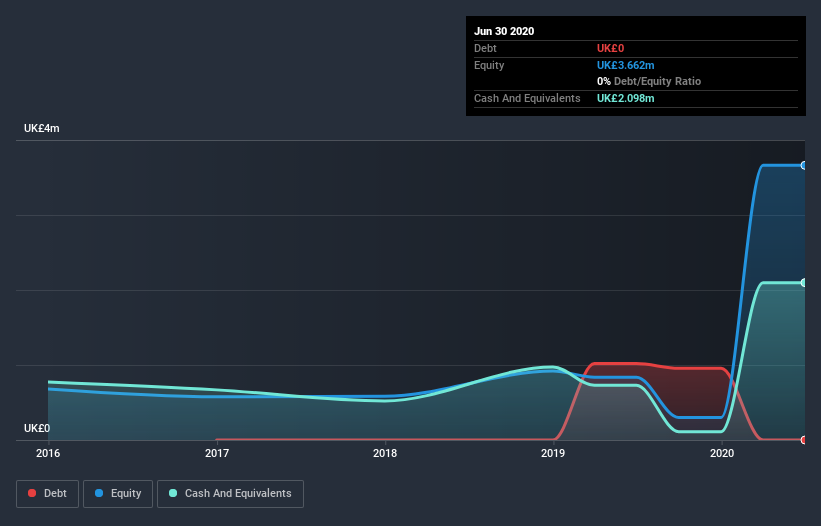

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In June 2020, Predator Oil & Gas Holdings had UK£2.1m in cash, and was debt-free. Looking at the last year, the company burnt through UK£417k. So it had a cash runway of about 5.0 years from June 2020. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. The image below shows how its cash balance has been changing over the last few years.

How Is Predator Oil & Gas Holdings' Cash Burn Changing Over Time?

Because Predator Oil & Gas Holdings isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. Notably, its cash burn was actually down by 79% in the last year, which is a real positive in terms of resilience, but uninspiring when it comes to investment for growth. Predator Oil & Gas Holdings makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Easily Can Predator Oil & Gas Holdings Raise Cash?

There's no doubt Predator Oil & Gas Holdings' rapidly reducing cash burn brings comfort, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund further growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Predator Oil & Gas Holdings has a market capitalisation of UK£15m and burnt through UK£417k last year, which is 2.7% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

So, Should We Worry About Predator Oil & Gas Holdings' Cash Burn?

As you can probably tell by now, we're not too worried about Predator Oil & Gas Holdings' cash burn. For example, we think its cash runway suggests that the company is on a good path. And even its cash burn relative to its market cap was very encouraging. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash. Taking a deeper dive, we've spotted 4 warning signs for Predator Oil & Gas Holdings you should be aware of, and 2 of them don't sit too well with us.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading Predator Oil & Gas Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:PRD

Predator Oil & Gas Holdings

Engages in the exploration, appraisal, and development of oil and gas assets in Africa, Europe, and the Caribbean.

Moderate with adequate balance sheet.

Market Insights

Community Narratives