- United Kingdom

- /

- Oil and Gas

- /

- LSE:PHAR

There's No Escaping Pharos Energy plc's (LON:PHAR) Muted Revenues

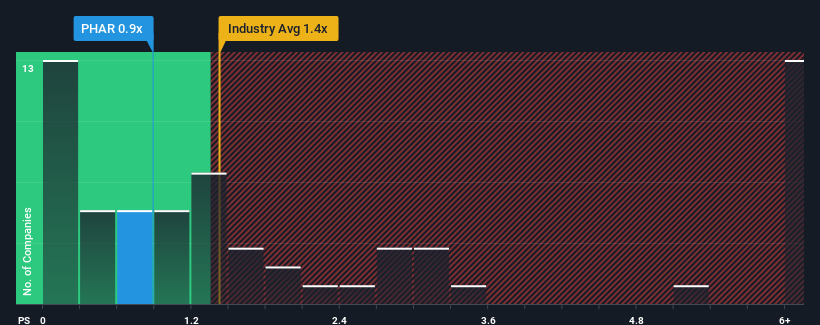

Pharos Energy plc's (LON:PHAR) price-to-sales (or "P/S") ratio of 0.9x might make it look like a buy right now compared to the Oil and Gas industry in the United Kingdom, where around half of the companies have P/S ratios above 1.4x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Pharos Energy

How Pharos Energy Has Been Performing

There hasn't been much to differentiate Pharos Energy's and the industry's retreating revenue lately. One possibility is that the P/S ratio is low because investors think the company's revenue may begin to slide even faster. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's revenue continues tracking the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pharos Energy.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Pharos Energy would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 23% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the five analysts covering the company are not good at all, suggesting revenue should decline by 6.2% per annum over the next three years. The industry is also set to see revenue decline 0.7% per year but the stock is shaping up to perform materially worse.

With this information, it's not too hard to see why Pharos Energy is trading at a lower P/S in comparison. Nonetheless, with revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

What We Can Learn From Pharos Energy's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Pharos Energy's P/S is about what we expect, seeing as the P/S and revenue growth forecasts are lower than that of an already struggling industry. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Although, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. Given the current circumstances, it's difficult to envision any significant increase in the share price in the near term.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Pharos Energy that you should be aware of.

If you're unsure about the strength of Pharos Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:PHAR

Pharos Energy

An independent energy company, explores, develops, and produces oil and gas properties in Vietnam and Egypt.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives