- United Kingdom

- /

- Oil and Gas

- /

- LSE:GKP

Revenues Tell The Story For Gulf Keystone Petroleum Limited (LON:GKP) As Its Stock Soars 26%

Gulf Keystone Petroleum Limited (LON:GKP) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 60%.

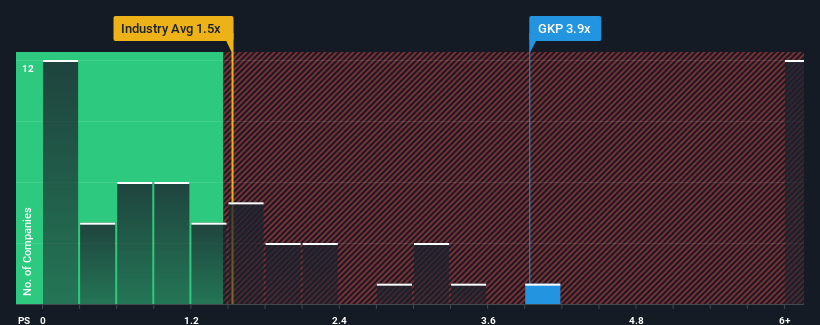

Following the firm bounce in price, given around half the companies in the United Kingdom's Oil and Gas industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Gulf Keystone Petroleum as a stock to avoid entirely with its 3.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Gulf Keystone Petroleum

What Does Gulf Keystone Petroleum's P/S Mean For Shareholders?

Recent times haven't been great for Gulf Keystone Petroleum as its revenue has been falling quicker than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Gulf Keystone Petroleum.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Gulf Keystone Petroleum's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 58% decrease to the company's top line. As a result, revenue from three years ago have also fallen 39% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 79% as estimated by the five analysts watching the company. Meanwhile, the broader industry is forecast to contract by 1.5%, which would indicate the company is doing very well.

In light of this, it's understandable that Gulf Keystone Petroleum's P/S sits above the majority of other companies. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Key Takeaway

The strong share price surge has lead to Gulf Keystone Petroleum's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we anticipated, our review of Gulf Keystone Petroleum's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Gulf Keystone Petroleum, and understanding should be part of your investment process.

If you're unsure about the strength of Gulf Keystone Petroleum's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:GKP

Gulf Keystone Petroleum

Engages in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives