- United Kingdom

- /

- Consumer Durables

- /

- LSE:SRAD

3 UK Stocks Estimated To Be Undervalued By Up To 48%

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 closing lower due to weak trade data from China, highlighting concerns over global economic recovery. In this environment of uncertainty and fluctuating indices, identifying undervalued stocks can offer potential opportunities for investors seeking value in a market impacted by external economic pressures.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| GlobalData (AIM:DATA) | £1.89 | £3.73 | 49.3% |

| AstraZeneca (LSE:AZN) | £116.96 | £220.52 | 47% |

| Watches of Switzerland Group (LSE:WOSG) | £4.358 | £8.48 | 48.6% |

| S&U (LSE:SUS) | £19.15 | £36.55 | 47.6% |

| Informa (LSE:INF) | £8.206 | £15.42 | 46.8% |

| Gulf Keystone Petroleum (LSE:GKP) | £1.283 | £2.47 | 48% |

| St. James's Place (LSE:STJ) | £8.61 | £16.69 | 48.4% |

| Foxtons Group (LSE:FOXT) | £0.616 | £1.19 | 48.2% |

| Auction Technology Group (LSE:ATG) | £4.465 | £8.40 | 46.9% |

| Genel Energy (LSE:GENL) | £0.765 | £1.51 | 49.4% |

Let's dive into some prime choices out of the screener.

Gulf Keystone Petroleum (LSE:GKP)

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £279.46 million.

Operations: The company's revenue is primarily derived from its exploration and production activities in the oil and gas sector, amounting to $115.15 million.

Estimated Discount To Fair Value: 48%

Gulf Keystone Petroleum appears undervalued based on cash flows, trading at £1.28, significantly below its estimated fair value of £2.47. The company is expected to see revenue growth of 39.8% per year, outpacing the UK market's 3.6%. However, its dividend yield of 11.07% is not well covered by earnings or free cash flows, raising sustainability concerns despite recent dividend declarations totaling $20 million for interim payments in October 2024.

- Insights from our recent growth report point to a promising forecast for Gulf Keystone Petroleum's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Gulf Keystone Petroleum.

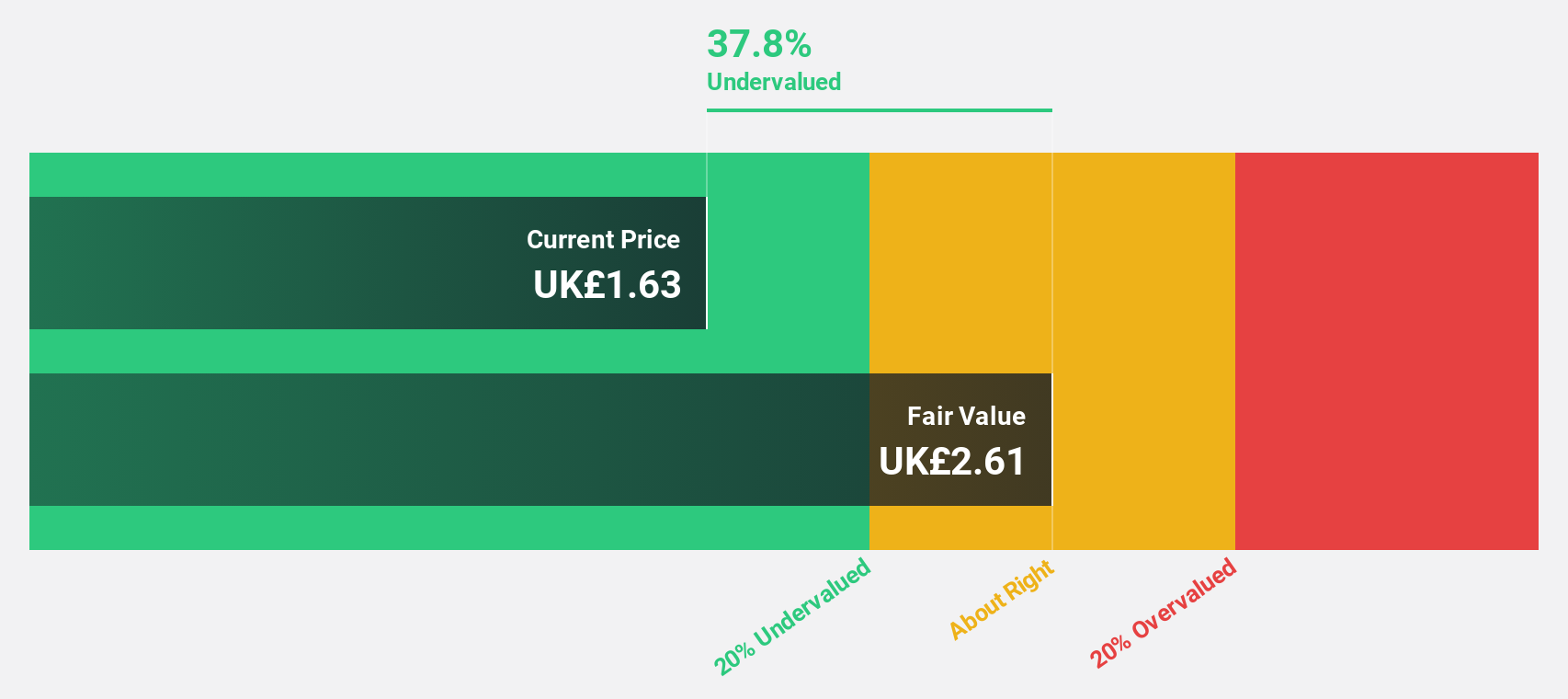

Stelrad Group (LSE:SRAD)

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £196.12 million.

Operations: The company's revenue from the manufacture and distribution of radiators is £294.27 million.

Estimated Discount To Fair Value: 41.8%

Stelrad Group is trading at £1.53, significantly below its estimated fair value of £2.63, indicating it may be undervalued based on cash flows. Despite a high debt level, earnings are expected to grow 14.52% annually, surpassing the UK market's growth rate of 13.9%. Recent executive changes include Leigh Wilcox as CFO and board member, enhancing financial leadership stability amid a modest dividend increase to 2.98 pence per share.

- Upon reviewing our latest growth report, Stelrad Group's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Stelrad Group's balance sheet health report.

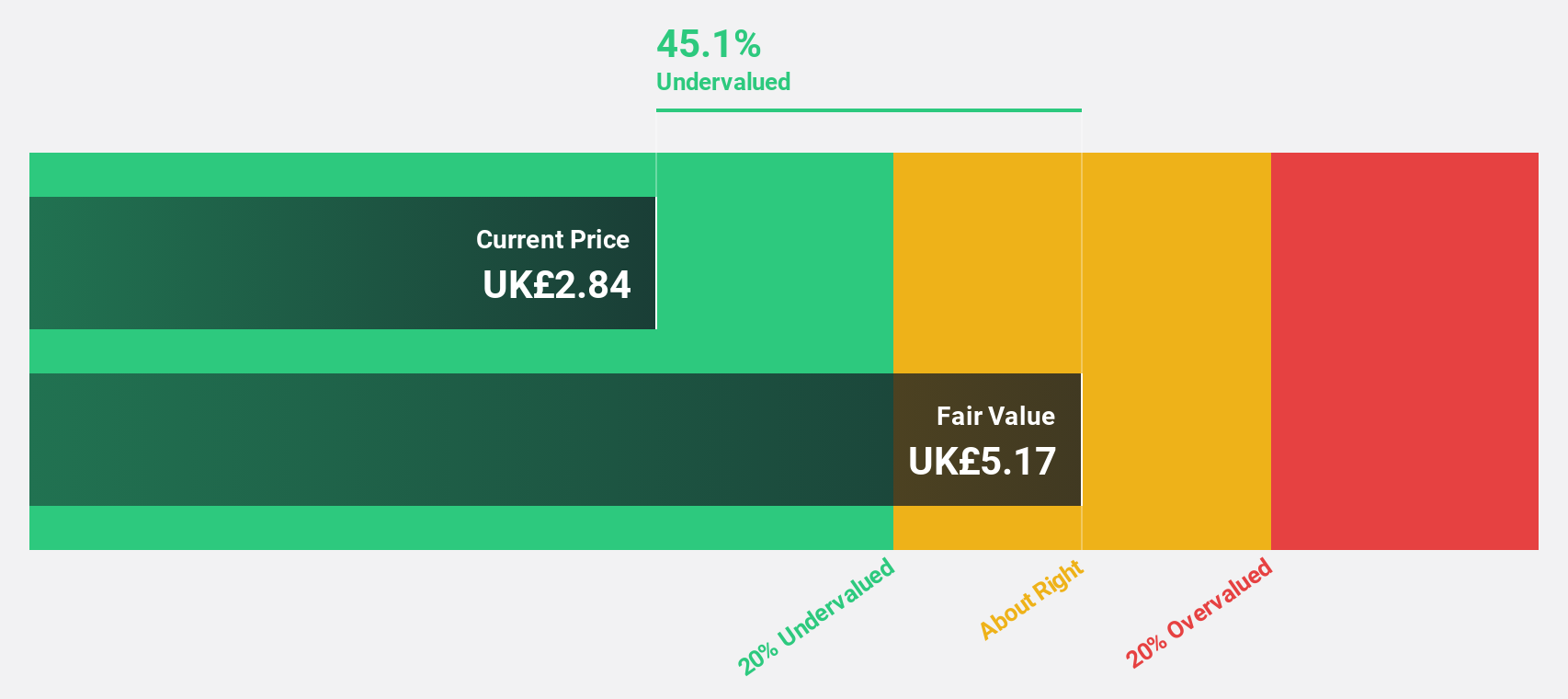

Trainline (LSE:TRN)

Overview: Trainline Plc operates an independent rail and coach travel platform that sells tickets in the United Kingdom and internationally, with a market cap of £1.49 billion.

Operations: The company's revenue segments consist of £134.76 million from Trainline Solutions, £53.16 million from International Consumer, and £208.80 million from United Kingdom Consumer.

Estimated Discount To Fair Value: 35.9%

Trainline is trading at £3.39, significantly below its estimated fair value of £5.29, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 22.51% annually, outpacing the UK market's 13.9% growth rate, while revenue is expected to increase by 5.8% per year, faster than the market average of 3.6%. A sales/trading statement for the first half of 2025 will be released on September 12, 2024.

- Our expertly prepared growth report on Trainline implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Trainline's balance sheet by reading our health report here.

Seize The Opportunity

- Embark on your investment journey to our 61 Undervalued UK Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SRAD

Stelrad Group

Manufactures and distributes radiators in the United Kingdom, Ireland, Europe, Turkey, and internationally.

Undervalued with solid track record.