- United Kingdom

- /

- Hospitality

- /

- LSE:PTEC

UK Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

The United Kingdom market has shown stability with a flat performance over the last week, complemented by an 8.5% increase over the past year and expectations of annual earnings growth of 13%. In this context, stocks with high insider ownership can be particularly compelling, as they often signal strong confidence from those most familiar with the company's potential and operations.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 34.7% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 12% | 44.4% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.1% | 14.7% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 27.9% |

| Velocity Composites (AIM:VEL) | 27.8% | 173.3% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Mothercare (AIM:MTC) | 15.1% | 41.2% |

| Hochschild Mining (LSE:HOC) | 38.4% | 42.6% |

Let's review some notable picks from our screened stocks.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is an oil and gas company focused on the exploration, production, and development of energy resources, with a market capitalization of approximately £1.96 billion.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling approximately $1.42 billion.

Insider Ownership: 10.6%

Earnings Growth Forecast: 15.6% p.a.

Energean, a UK-based energy company, is trading at 61.5% below its estimated fair value, presenting a potential opportunity for investors. The company's earnings are expected to grow by 15.6% annually, outpacing the UK market forecast of 12.5%. However, it faces challenges such as high debt levels and recent shareholder dilution. Despite these issues, Energean's revenue growth is projected to exceed the market average significantly, with robust production increases reported in early 2024.

- Dive into the specifics of Energean here with our thorough growth forecast report.

- Our valuation report here indicates Energean may be undervalued.

Playtech (LSE:PTEC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtech plc is a global technology company specializing in gambling software, services, content, and platform technologies with a market capitalization of approximately £1.58 billion.

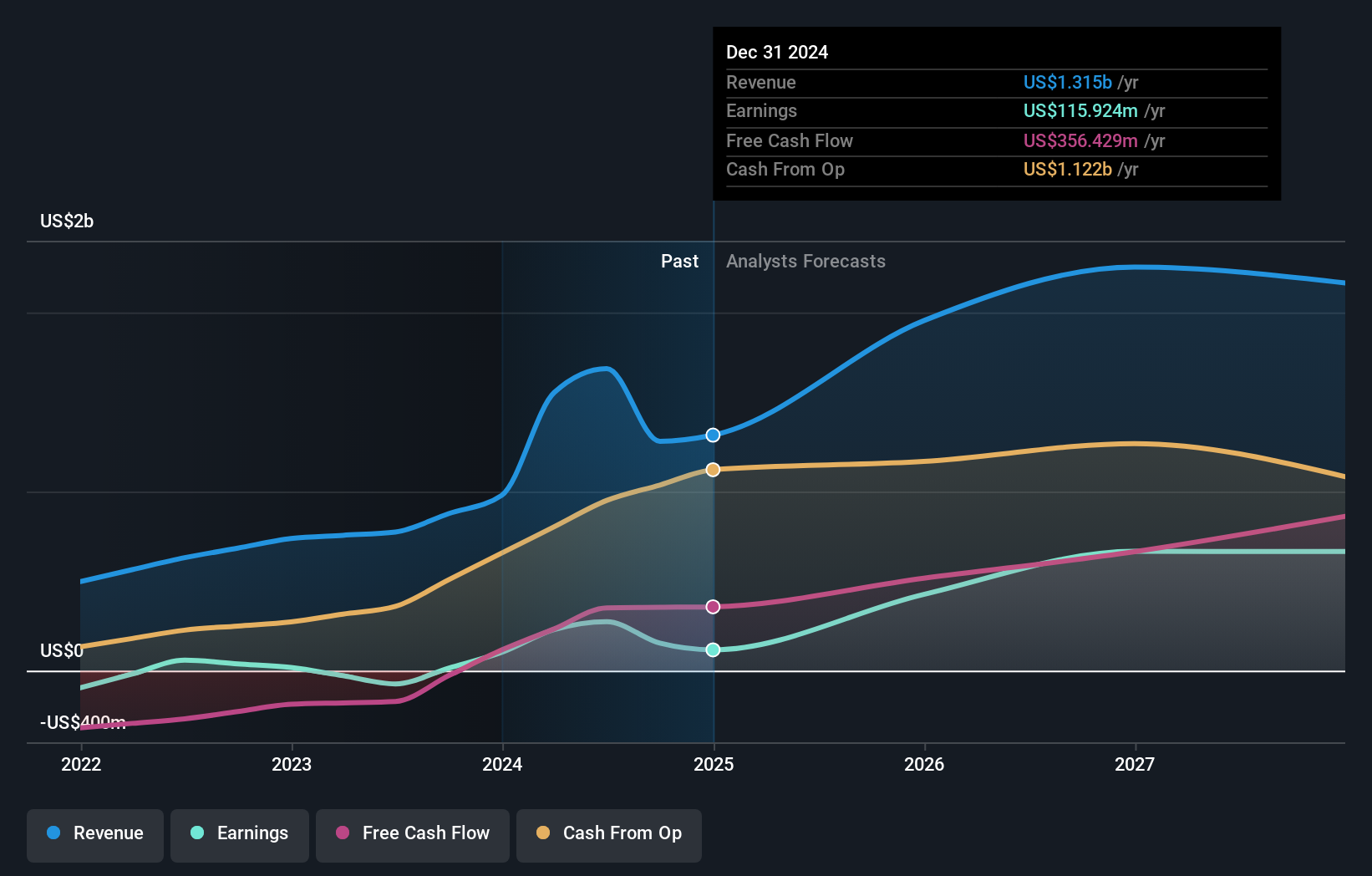

Operations: Playtech's revenue is divided into several segments, with €684.10 million from Gaming B2B and €946.60 million from Gaming B2C, supplemented by smaller contributions of €18.20 million from HAPPYBET and €73.40 million from Sun Bingo and other B2C activities.

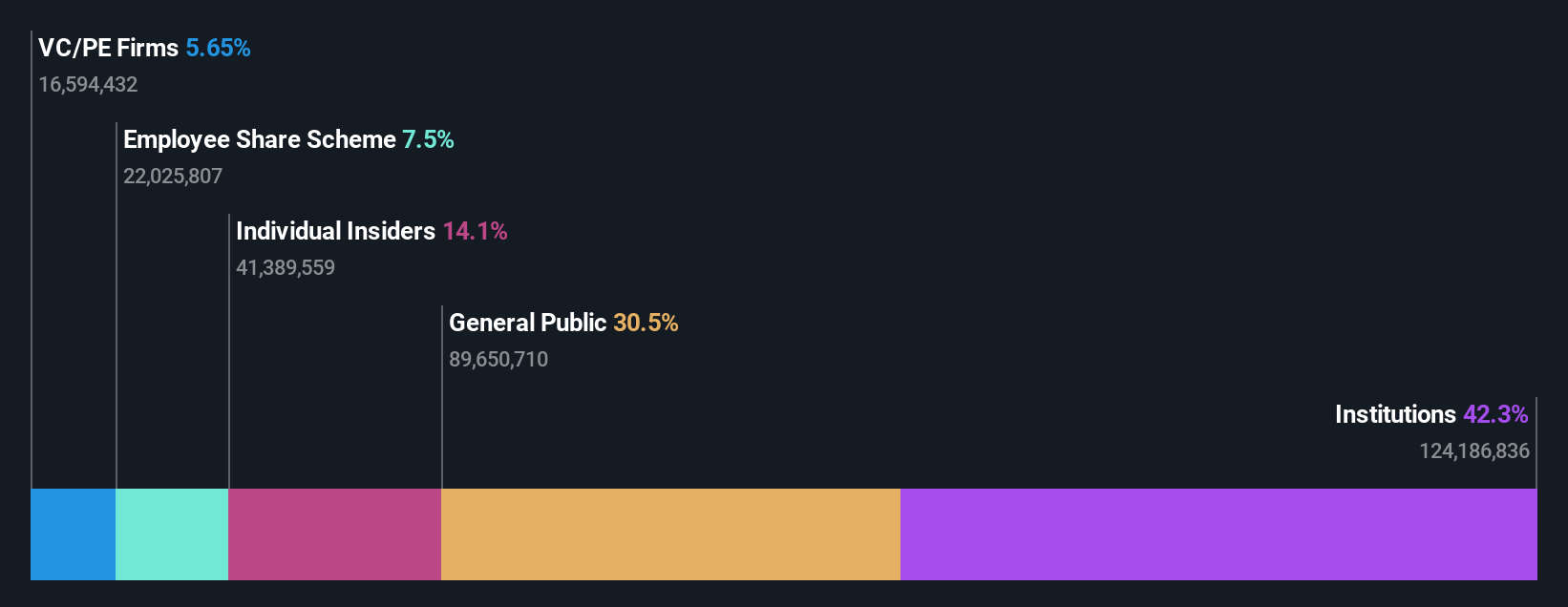

Insider Ownership: 13.5%

Earnings Growth Forecast: 20.6% p.a.

Playtech, a UK-based technology firm, is gaining traction with its recent strategic partnership with MGM Resorts, enhancing its live casino offerings directly from Las Vegas. Despite trading at 52.6% below its estimated fair value and experiencing substantial earnings growth of 158.9% last year, concerns linger due to one-off items affecting financial results and a forecasted low return on equity of 8.9%. Nevertheless, Playtech's revenue and earnings growth are expected to surpass the UK market averages at 4% and 20.6% per year respectively.

- Navigate through the intricacies of Playtech with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Playtech is trading behind its estimated value.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

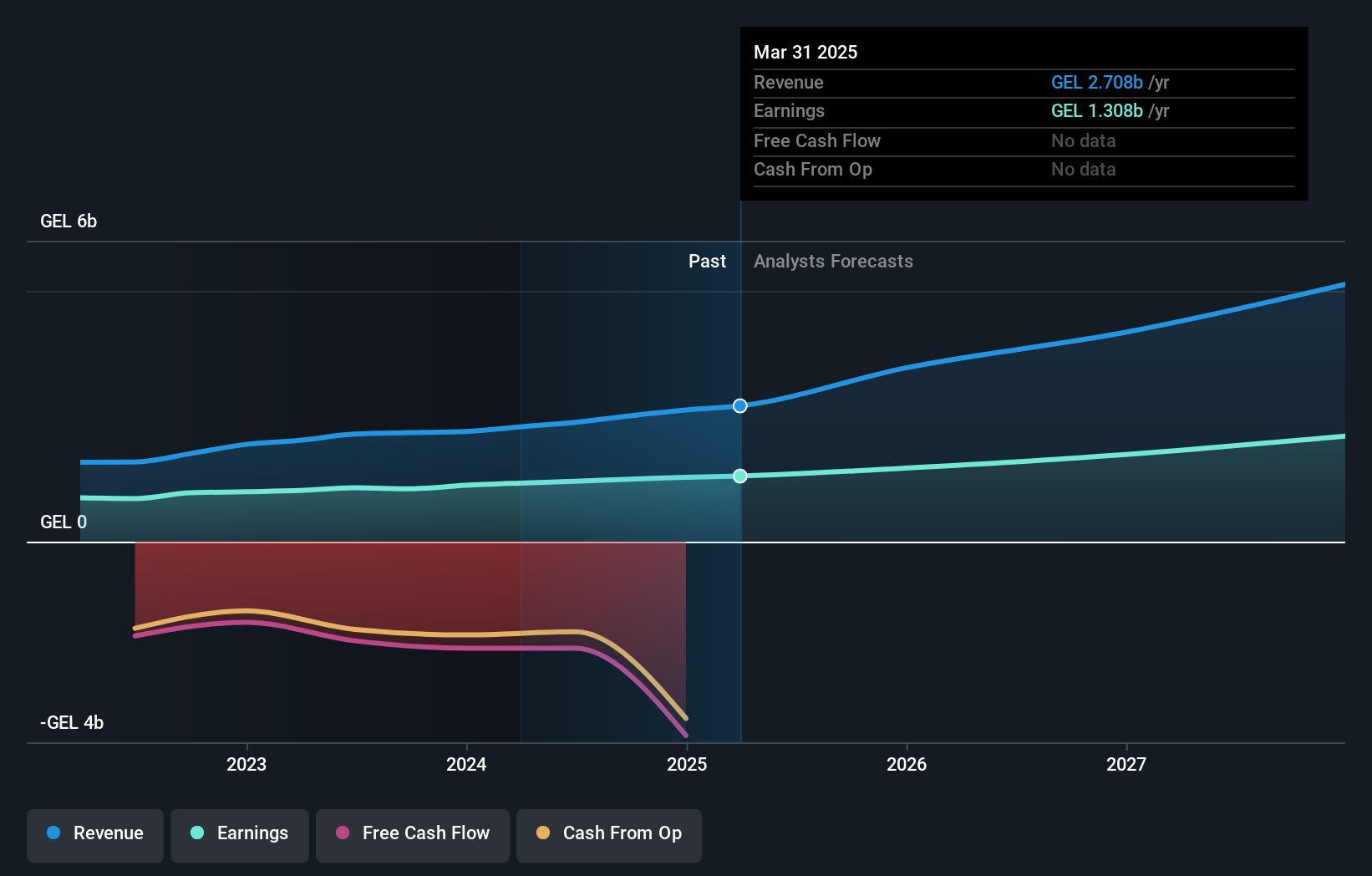

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of services including banking, leasing, insurance, brokerage, and card processing with a market cap of approximately £1.58 billion.

Operations: The company generates revenue from various services such as banking, leasing, insurance, brokerage, and card processing across Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 18%

Earnings Growth Forecast: 15.2% p.a.

TBC Bank Group, with significant insider investment in recent private placements, shows robust growth potential in the UK market. The bank's revenue and earnings are forecasted to grow at 18.3% and 15.2% annually, outpacing the UK average significantly. Despite a highly volatile share price and an unstable dividend track record, TBC Bank's strategic buybacks and consistent profit growth over five years highlight its resilience. However, a high bad loans ratio at 2.1% poses some risk to financial stability.

- Click here and access our complete growth analysis report to understand the dynamics of TBC Bank Group.

- Our valuation report unveils the possibility TBC Bank Group's shares may be trading at a discount.

Where To Now?

- Discover the full array of 62 Fast Growing UK Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PTEC

Playtech

A technology company, operates as a gambling software, services, content, and platform technologies provider worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives