- United Kingdom

- /

- Oil and Gas

- /

- LSE:BP.

Is There an Opportunity in BP Shares After Major Solar Joint Venture Announcement?

Reviewed by Simply Wall St

If you are wondering whether BP stock is a buy, hold, or sell right now, you are in good company. Even seasoned investors are giving this energy giant a second look, especially after seeing how its share price has moved lately. BP’s price has ticked down by 3.1% over the past week and slid 1.3% in the last 30 days. When you zoom out, the stock is delivering. It is up 3.6% year-to-date, 9.1% over the last year, and 109.5% in the last five years. That kind of long-term outperformance suggests there is a deeper story unfolding behind the headline numbers.

Recent trends in energy prices, ongoing shifts toward renewables, and evolving risk perceptions in the sector have all played a role in shaping BP’s share trajectory. There is a sense that the market is still trying to price in BP’s future, balancing upside from its strategic shifts against the challenges facing the entire oil and gas industry. When you run BP through six key valuation checks, it comes in as undervalued on five of them. That gives it a value score of 5 out of 6, which is rarely seen for a global blue-chip like this.

So, how do those valuation methods stack up, and what do they really tell us about BP’s long-term potential? Let’s break down the numbers, explore the different approaches, and look at a smarter way to understand what BP might be worth today and tomorrow.

Why BP is lagging behind its peersApproach 1: BP Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future free cash flows and then discounting those cash flows back to today’s value. By doing this, investors get an idea of what the business is fundamentally worth, based on the money it is expected to generate in the years ahead.

For BP, the latest reported Free Cash Flow sits at around $10.3 billion. Analysts provide FCF estimates for up to five years, and from there projections are extrapolated further. By the final year in the DCF model, BP's Free Cash Flow is estimated to reach just under $13.3 billion. These projections feed into the model, which then calculates what all these future dollars are worth in today’s terms.

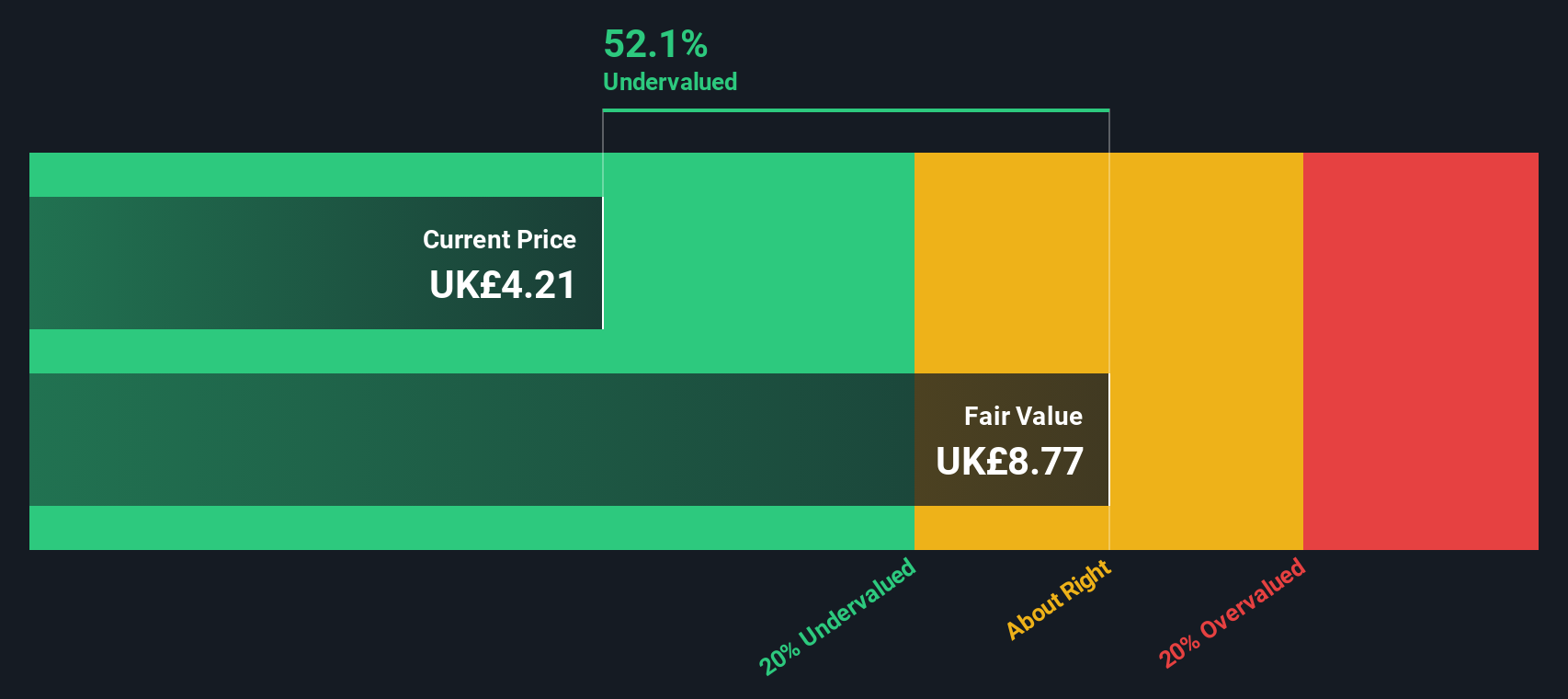

The result is an intrinsic value of $8.78 per share. When you compare that figure with the current share price, the DCF method implies BP is trading at a 52.4% discount to its fundamental worth. This could signal the market is undervaluing the company’s long-term cash generation potential.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for BP.

Approach 2: BP Price vs Sales

The price-to-sales (P/S) ratio is often a go-to measure for valuing large, established companies like BP. It is a simple way to compare a company’s market capitalization with its revenue and is particularly useful when analyzing profitable businesses in mature industries where earnings can be volatile due to commodity cycles.

In BP’s case, growth prospects and risk factors both play roles in how investors perceive its “normal” valuation. When growth expectations are high or risks are low, the market is usually willing to assign a higher P/S ratio. Conversely, increased business risk or weaker growth outlooks will put downward pressure on that multiple.

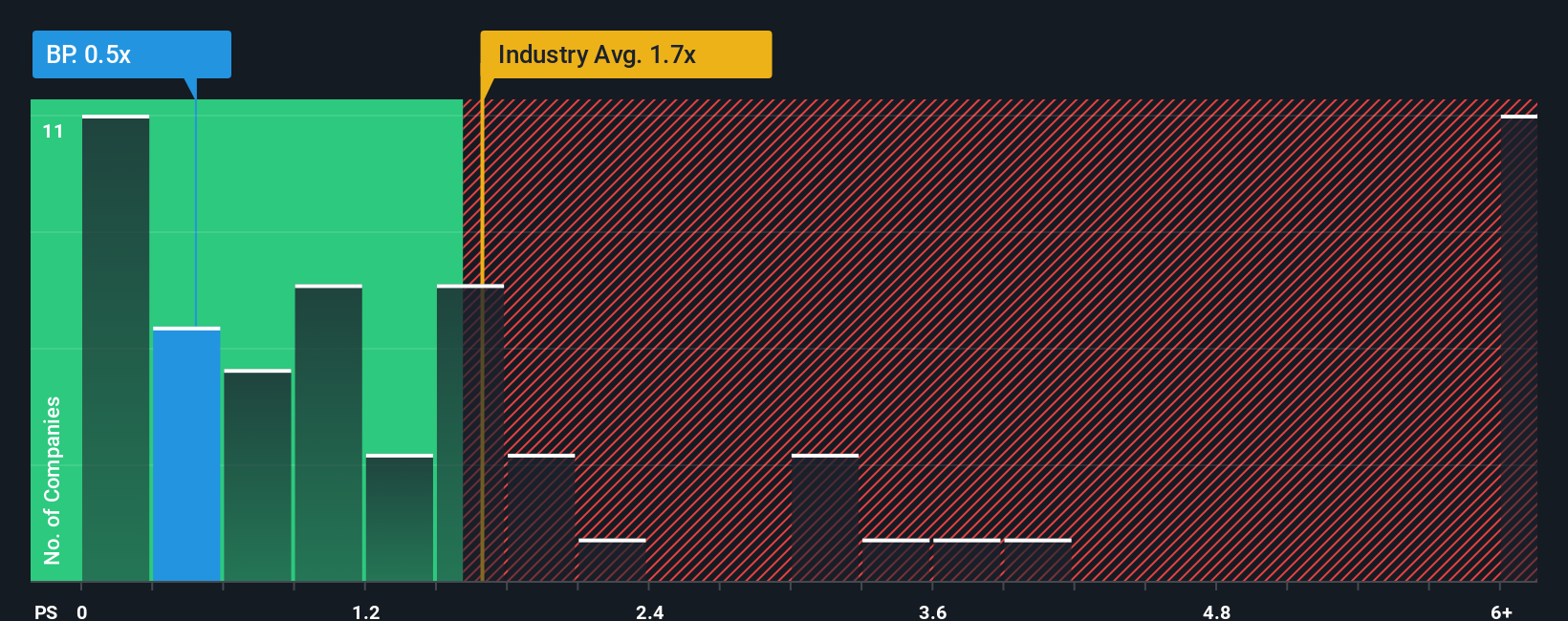

Right now, BP trades at a price-to-sales ratio of 0.47x. That is below both the industry average (1.68x) and the average for its peers (0.59x), indicating that BP is currently priced at a considerable discount to other oil and gas companies.

But instead of just looking at averages, Simply Wall St’s proprietary “Fair Ratio” goes a step further. This metric estimates what an appropriate P/S multiple should be, not just by comparing BP to peers, but by factoring in its specific growth outlook, margins, risk profile, industry, and market cap. For BP, the Fair Ratio is set at 1.13x.

Comparing BP’s current P/S ratio of 0.47x with the Fair Ratio of 1.13x shows that the stock is trading well below the level suggested by a more holistic, forward-looking analysis.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your BP Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own investment story, an explanation of where you think a company like BP is headed, including assumptions around its future revenue, earnings, profit margins, and fair value. Narratives help connect the company’s story and your perspective with a concrete financial forecast, resulting in a view of what BP is really worth today and in the future.

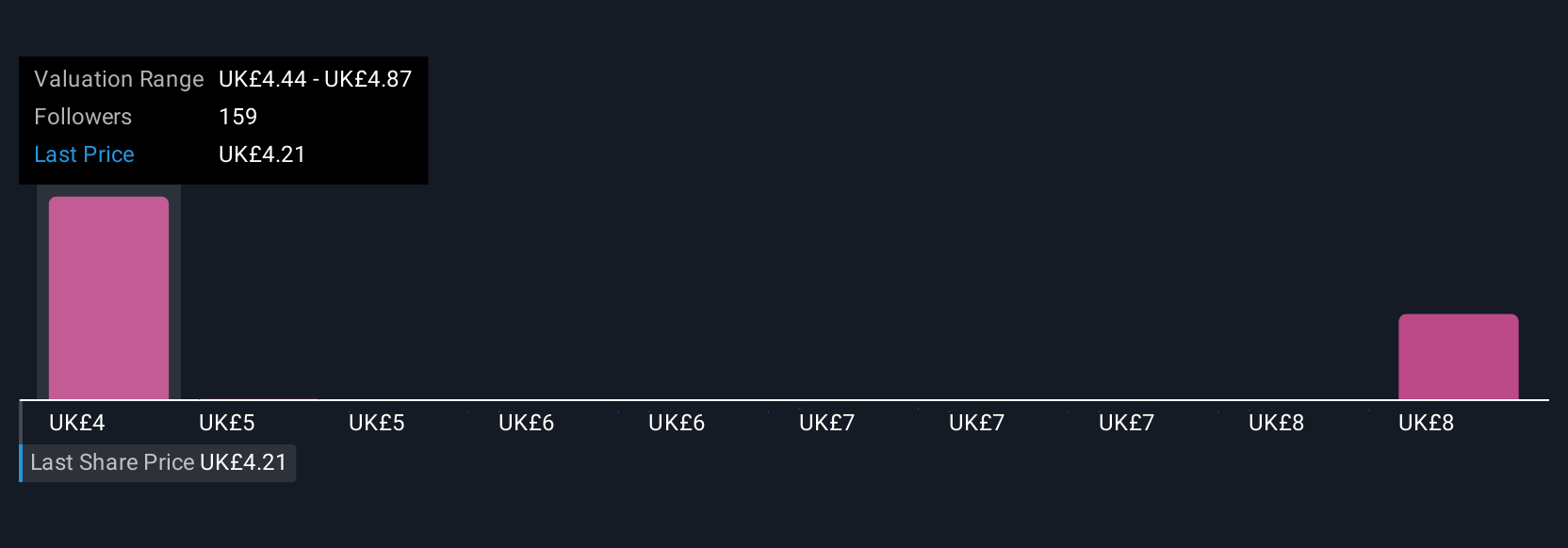

On Simply Wall St’s Community page, Narratives are an accessible tool used by millions of investors. They make it easy to compare your view of BP’s fair value to the current share price, helping you decide when to buy or sell. As new information comes in, whether it’s news, earnings updates, or shifts in the industry, Narratives update dynamically so your decision making stays current.

For example, within the Community, some investors have a bullish view that BP could be worth £5.20 per share if its big upstream projects pay off, while others are more cautious, estimating fair value at just £3.82 due to execution risks and sector headwinds. No matter your view, Narratives empower you to make smarter, more personalized investment decisions.

Do you think there's more to the story for BP? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BP.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives