- United Kingdom

- /

- Oil and Gas

- /

- LSE:BP.

BP (LSE:BP.) Valuation Check as Shares Pause After Strong 1-Year Return

Reviewed by Simply Wall St

Why BP (LSE:BP.) is back on income investors radar

BP (LSE:BP.) has quietly outpaced the broader market over the past year, and that steady climb is catching income focused investors attention as they weigh the shares current valuation against long term energy trends.

See our latest analysis for BP.

Recent trading tells a mixed story, with a 30 day share price return of minus 8.2 percent but a solid 1 year total shareholder return of 17.6 percent. This suggests momentum is pausing rather than broken as investors reassess energy demand and transition risks.

If BP has you rethinking your energy exposure, it might also be worth exploring other opportunities across aerospace and defense stocks as a different way to tap into global spending trends.

Yet with BP trading below analyst targets and screening as modestly valued despite rising profits, investors face a key question: is this a genuine value opportunity, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 9.6% Undervalued

With the narrative fair value sitting modestly above BP’s last close, the story tilts toward upside potential if its long term plan delivers.

The ramp up of major upstream projects, breakthrough exploration successes in Brazil, West Africa, and other regions, and an ongoing focus on high return organic growth provide BP with the ability to capture persistent global energy demand growth particularly from emerging markets supporting visible revenue and earnings expansion.

Want to see what kind of revenue reset and margin rebuild this scenario bakes in, and how aggressively future earnings are being rerated? The full narrative unpacks the specific growth, profitability, and valuation assumptions driving that fair value call, plus how a higher discount rate still leaves room for upside.

Result: Fair Value of $4.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing impairments in new energy projects and possible missteps around major divestments like Castrol could quickly undermine those margin and valuation assumptions.

Find out about the key risks to this BP narrative.

Another Angle on Value

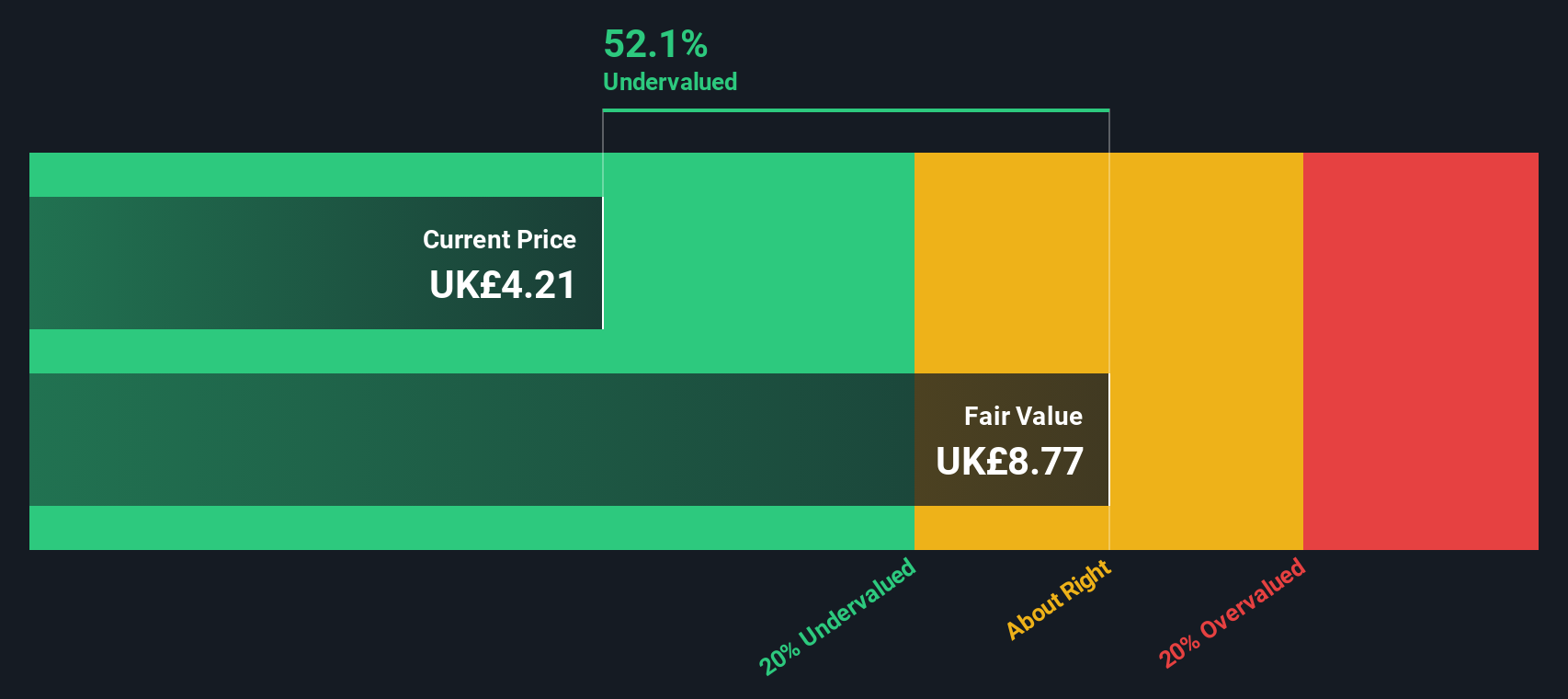

While the narrative sees modest upside, the SWS DCF model is far more upbeat, suggesting BP is trading about 56.7 percent below its £9.84 fair value estimate. If that gap is even partly right, are markets overreacting to near term noise and underpricing long term cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BP Narrative

If you see the story differently or want to stress test your own assumptions directly against the numbers, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your BP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

BP might be a strong contender, but you will stack the odds further in your favor by scanning other opportunities on Simply Wall St before you act.

- Capture powerful price swings with these 3636 penny stocks with strong financials that already show financial strength rather than pure speculation.

- Position ahead of the next technology wave by targeting these 26 AI penny stocks shaping real world AI adoption, not just hype.

- Lock in potential mispricings using these 910 undervalued stocks based on cash flows that trade below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BP.

BP

An integrated energy company, engages in the oil and gas business worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)