- United Kingdom

- /

- Medical Equipment

- /

- AIM:SUN

3 UK Penny Stocks With Market Caps Over £4M To Consider

Reviewed by Simply Wall St

The UK market has been experiencing fluctuations, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic interdependencies. For investors seeking opportunities in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant investment area. These stocks can offer affordability and growth potential when they are backed by strong financials, presenting a unique opportunity for those willing to explore beyond traditional blue-chip investments.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.21M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.00 | £322.74M | ★★★★★★ |

| RTC Group (AIM:RTC) | £0.975 | £13.27M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.225 | £838.41M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.26 | £161.24M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.2075 | £319M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.52 | £86.2M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.878 | £74.65M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.415 | £180.2M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Block Energy (AIM:BLOE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Block Energy Plc is involved in the exploration, development, and production of oil and gas in the Republic of Georgia with a market cap of £4.55 million.

Operations: The company's revenue comes entirely from its operations in Georgia, amounting to $8.13 million.

Market Cap: £4.55M

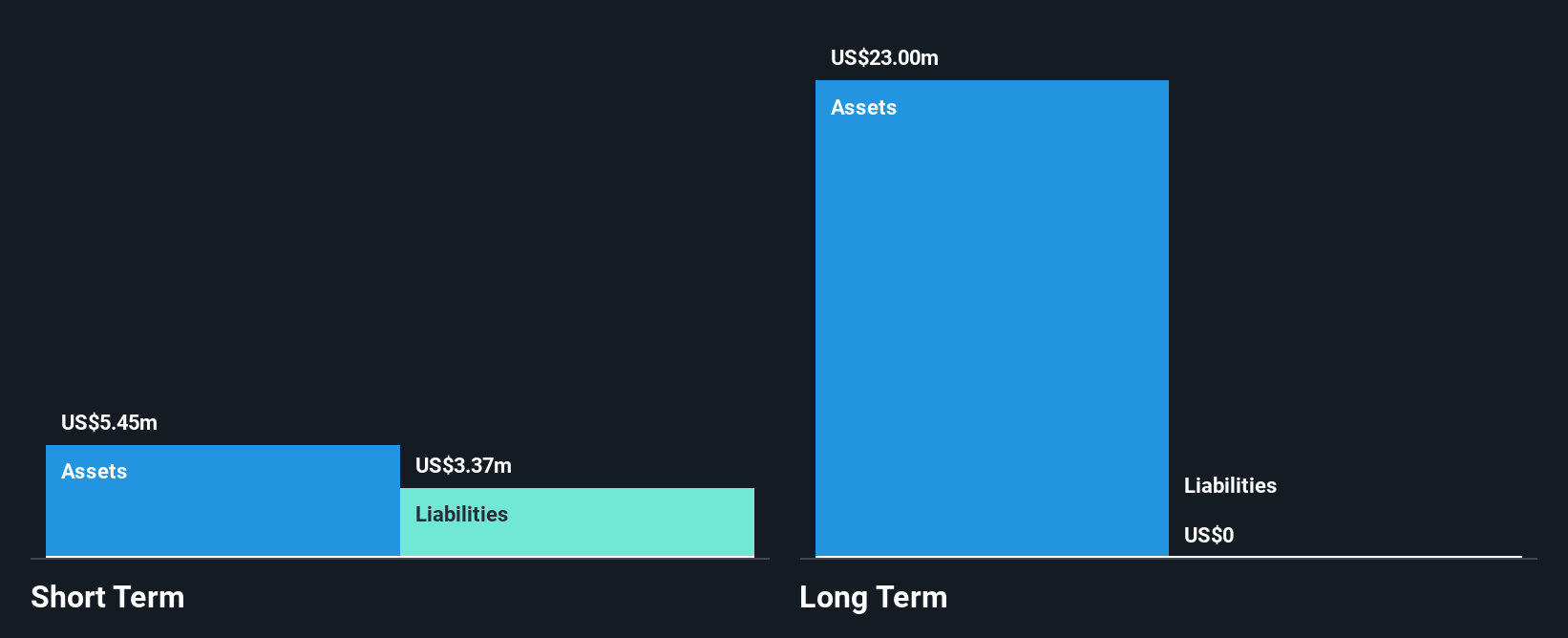

Block Energy Plc, with a market cap of £4.55 million and annual revenue of US$8.13 million from its Georgian operations, is navigating the challenges typical of penny stocks. Despite being unprofitable, Block Energy has managed to reduce its losses by 18.8% annually over five years and maintains a satisfactory net debt to equity ratio of 5.2%. The company possesses sufficient cash runway for over three years due to positive free cash flow growth. Recent strategic alliances have advanced their Carbon Capture and Storage project in Georgia, potentially enhancing future commercial viability through innovative carbon sequestration techniques.

- Click to explore a detailed breakdown of our findings in Block Energy's financial health report.

- Assess Block Energy's previous results with our detailed historical performance reports.

Surgical Innovations Group (AIM:SUN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Surgical Innovations Group plc designs, manufactures, and exports medical products for laparoscopic and robotic minimally invasive surgery across the UK, Europe, Asia Pacific, the US, and other international markets with a market cap of £5.13 million.

Operations: The company's revenue is derived from three segments: SI Brand (£6.39 million), Distribution (£3.88 million), and OEM including Precision Engineering (£2.26 million).

Market Cap: £5.13M

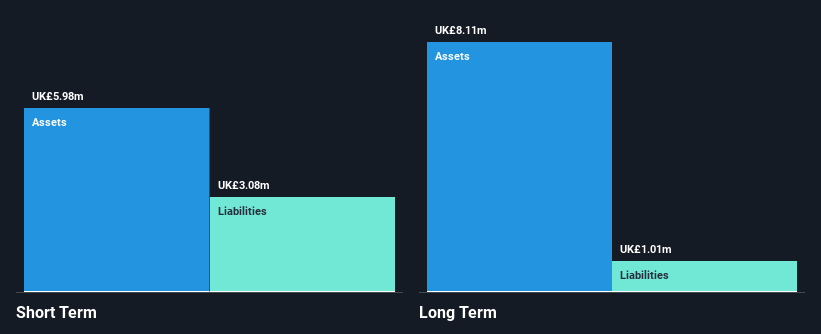

Surgical Innovations Group plc, with a market cap of £5.13 million, operates in the medical equipment sector but remains unprofitable. The company has reduced its losses by 43.1% annually over the past five years and maintains a satisfactory net debt to equity ratio of 4.8%. While its short-term assets (£6 million) cover both short and long-term liabilities, it faces less than a year of cash runway under current free cash flow conditions. The management team is experienced, though the board is relatively new, suggesting recent changes in governance structure.

- Take a closer look at Surgical Innovations Group's potential here in our financial health report.

- Examine Surgical Innovations Group's past performance report to understand how it has performed in prior years.

Union Jack Oil (AIM:UJO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Union Jack Oil plc is an onshore oil and gas company operating in the United Kingdom and the United States with a market cap of £12.26 million.

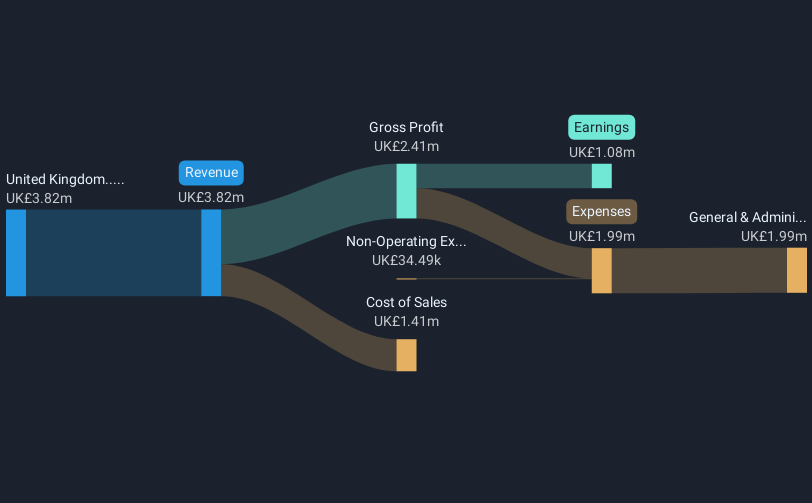

Operations: The company's revenue comes entirely from its operations in the United Kingdom, amounting to £3.82 million.

Market Cap: £12.26M

Union Jack Oil plc, with a market cap of £12.26 million, operates without debt and has short-term assets (£5.2M) comfortably covering liabilities (£489.2K). Despite negative earnings growth last year, the company is forecasted to grow earnings by 31.09% annually and has become profitable over the past five years with a net profit margin improvement to 28.2%. Recent updates highlight positive developments in its US operations, particularly at the Moccasin and Taylor wells in Oklahoma, suggesting potential for future revenue enhancement. However, high volatility remains a concern with shares trading significantly below estimated fair value.

- Click here and access our complete financial health analysis report to understand the dynamics of Union Jack Oil.

- Review our growth performance report to gain insights into Union Jack Oil's future.

Next Steps

- Get an in-depth perspective on all 446 UK Penny Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SUN

Surgical Innovations Group

Engages in the design, manufacture, and export of medical products for use in laparoscopic and robotic minimally invasive surgery in the United Kingdom, Europe, the Asia Pacific, the United States, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives