- United Kingdom

- /

- Oil and Gas

- /

- AIM:SENX

Cautious Investors Not Rewarding Serinus Energy plc's (LON:SENX) Performance Completely

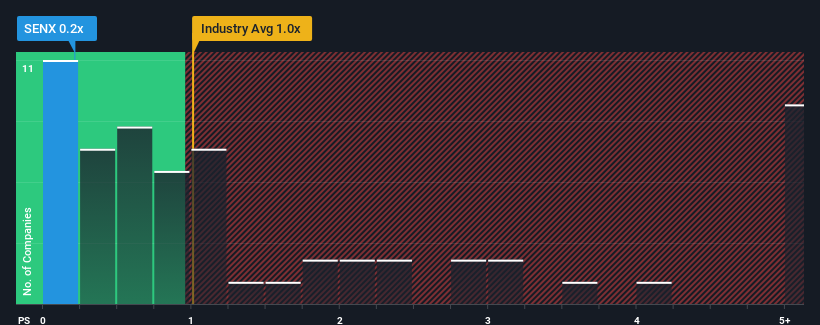

When you see that almost half of the companies in the Oil and Gas industry in the United Kingdom have price-to-sales ratios (or "P/S") above 1x, Serinus Energy plc (LON:SENX) looks to be giving off some buy signals with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Serinus Energy

How Has Serinus Energy Performed Recently?

Serinus Energy could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Serinus Energy will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Serinus Energy?

In order to justify its P/S ratio, Serinus Energy would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 63%. This means it has also seen a slide in revenue over the longer-term as revenue is down 23% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 17% during the coming year according to the two analysts following the company. With the rest of the industry predicted to shrink by 1.0%, that would be a fantastic result.

With this in mind, we find it intriguing that Serinus Energy's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Serinus Energy's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Serinus Energy that you need to be mindful of.

If you're unsure about the strength of Serinus Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SENX

Serinus Energy

Engages in the exploration, appraisal, and development of oil and gas properties in Tunisia and Romania.

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives