- United Kingdom

- /

- Oil and Gas

- /

- AIM:PMG

The Parkmead Group plc (LON:PMG) May Have Run Too Fast Too Soon With Recent 34% Price Plummet

To the annoyance of some shareholders, The Parkmead Group plc (LON:PMG) shares are down a considerable 34% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

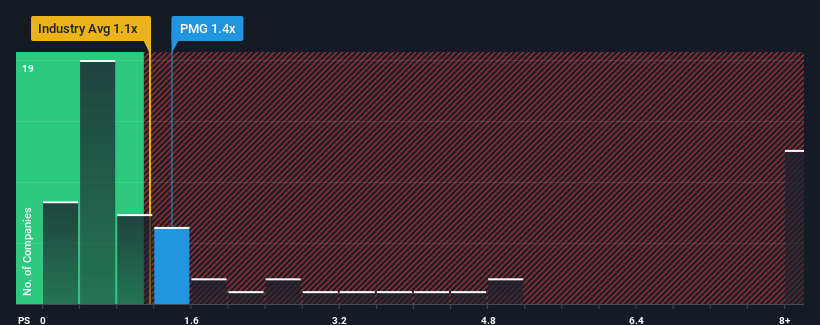

In spite of the heavy fall in price, it's still not a stretch to say that Parkmead Group's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Oil and Gas industry in the United Kingdom, where the median P/S ratio is around 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Parkmead Group

What Does Parkmead Group's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Parkmead Group has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Parkmead Group.Is There Some Revenue Growth Forecasted For Parkmead Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Parkmead Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 178%. The latest three year period has also seen an excellent 265% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 15% as estimated by the sole analyst watching the company. The industry is also set to see revenue decline 4.3% but the stock is shaping up to perform materially worse.

In light of this, it's somewhat peculiar that Parkmead Group's P/S sits in line with the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

What We Can Learn From Parkmead Group's P/S?

Following Parkmead Group's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Parkmead Group's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. Even though the company's P/S is on par with the rest of the industry, the fact that it's revenue outlook is poorer than an already struggling industry suggests that the P/S isn't justified. We also have our reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 3 warning signs for Parkmead Group you should be aware of.

If these risks are making you reconsider your opinion on Parkmead Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:PMG

Parkmead Group

An independent oil and gas company, engages in the exploration and production of oil and gas properties in Europe.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives