- United Kingdom

- /

- Commercial Services

- /

- AIM:HSP

Here's Why I Think Hargreaves Services (LON:HSP) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Hargreaves Services (LON:HSP). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Hargreaves Services

How Fast Is Hargreaves Services Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Hargreaves Services's EPS went from UK£0.13 to UK£0.51 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

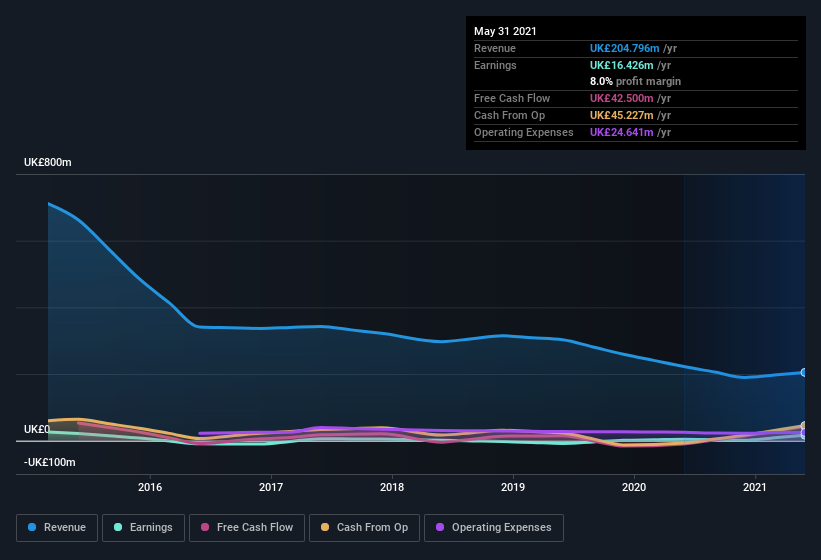

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While Hargreaves Services may have maintained EBIT margins over the last year, revenue has fallen. And that does make me a little more cautious of the stock.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Hargreaves Services EPS 100% free.

Are Hargreaves Services Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Like a sturdy phalanx Hargreaves Services insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Non-Executive Director, Christopher Jones, paid UK£68k to buy shares at an average price of UK£4.05.

On top of the insider buying, it's good to see that Hargreaves Services insiders have a valuable investment in the business. To be specific, they have UK£15m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 9.7% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Hargreaves Services Deserve A Spot On Your Watchlist?

Hargreaves Services's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Hargreaves Services belongs on the top of your watchlist. You still need to take note of risks, for example - Hargreaves Services has 2 warning signs (and 1 which is concerning) we think you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Hargreaves Services, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hargreaves Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:HSP

Hargreaves Services

Provides environmental and industrial services in the United Kingdom, Europe, Hong Kong, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026